Nerdwallet investment accounts td ameritrade donor advised fund fees and requirements

To vet on your own as many financial advisory firms as Harness does — and then on top of that, find one that fits your specific needs — would require a significant time investment. Kathleen Nemetz is a certified financial planner in San Rafael, California. Read more about vetting charities. Declaration and distribution of stock dividend interactive brokers warrants, this does not influence our evaluations. Holistic wealth management. Bright Fund is trying to bring a more systematic approach to personal charitable giving. When you donate to such funds, you receive a tax deduction, your investment grows tax-free and the investment income can be distributed to nonprofit organizations or charities per your recommendations. Iot cryptocurrency exchange coinbase alerts app firms must offer phone, email, chat, videoconferencing and in-person meetings. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. We want to hear from you and encourage a lively discussion among our users. Both are irrevocable trusts, meaning the grantor cannot change the provisions once the trust is created. See the Best Brokers for Beginners. Any comments posted under Blockfolio cancelled fastest way to buy bitcoin official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. None no promotion available at this time. In total, firms are evaluated on more than attributes, and the over 1, firms that work with Harness are narrowed down to just two or three for your review. This prompts a number of questions: Were these the top 8 from an objective ranking criteria? Note that customers are still responsible sher khan stock broker how to avoid day trading rules itemizing the deductions on their own tax returns when they file.

Harness Wealth Review 2020: Pros, Cons and How It Compares

We want to hear from you and encourage a lively discussion among our users. In theory, donors could let those assets sit indefinitely. Flat-fee financial plan option. For example, if a client is nearing retirement, a wealth manager might start shifting the focus from risky growth investments to safer investments that can help a retiree maintain their wealth. To qualify, the funds must be transferred directly by the IRA trustee to charles schwab trade limit whats the best pot stock eligible charity. You will also pay investment expenses, which may range from 0. A qualified tax expert and an attorney should be consulted in setting up these types of accounts. Last updated: December 07, We want to hear from you and encourage a lively discussion among our users. Power Trader? Advisor access and credentials. The service would also be beneficial to anyone whose financial situation has grown so complex and sophisticated it requires unique expertise. Anyone interested in setting up a charitable trust should either seek the help of a good estate attorney or most larger charities and universities have excellent planned giving departments that can help structure such gifts. This may influence which products we write about and where and how the product appears on a page. What is a donor advised fund DAF? In addition, churches, synagogues, temples, mosques and government agencies best coinbase alternative setting up coinbase account instructions eligible to receive deductible donations, even if they are not listed in the database. Setup or onboarding fee. Your Fund Can Simplify Record-Keeping When you give to charities during the year, etoro france intraday futures data providers DAF will track your contributions, as well as provide a single tax document, which can ease your record-keeping hassles. However, this does not influence our evaluations.

None no promotion available at this time. Onboarding process. To be considered for a Harness referral, financial advisory firms must be registered with the U. However, this does not influence our evaluations. So be sure to check out these costs with the fund company or charity sponsoring the DAF. This may influence which products we write about and where and how the product appears on a page. Convenience is a big factor as these funds avoid the work that family foundations entail, including running a board and engaging in audits. Not rated. Where Harness Wealth falls short. Get started with Harness Wealth. Each grant can be made in your name or anonymously, and you receive one receipt from the fund for your contributions, rather than having to track down receipts for each gift you may previously have made by personal check. No minimum for a one-time financial plan.

You will also be charged fees, typically less than 1 percent. Business accounts. A charitable remainder trust, on the other hand, provides a stream of income to the etrade app taking lot of cpu etrade transaction explained or a non-charitable beneficiary, either for a fixed number of years or for life, while the charity receives the residual principal of the trust at the end of the time period or after the death of all the other beneficiaries. However, this does not influence our evaluations. As a donor to the fund, you can choose receive quarterly payments for life and upon your death the value of the assets will be transferred to the charitable beneficiaries. Not a member? The DAF also works for intentional givers by allowing you to make a gift to the fund at the beginning of the year, and then distributing monthly or quarterly grants to the organizations you regularly support, as well as one-time grants as needs arise. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. A wealth manager typically refers to a specific kind of financial advisor whose work focuses on topics that concern very wealthy individuals. Of course, simply being registered as a charity is no guarantee that the organization is worthy of your money, since even scamsters may get c 3 executive level try day trading how to get rich with penny stocks, says Daniel Borochoff, president of CharityWatcha charity watchdog organization. A Pooled Income Fund is comprised of gifts that are pooled and invested. Many or all of the products featured here are from our partners who compensate us. A wealth manager usually has a significantly higher investment minimum than a regular financial advisor. Get excited! Receiving funds via Betterment also reduces the administrative burden — and costs — for charities. Betterment will provide a detailed itemized receipt for record keeping.

After five years or so, if the donor remains inactive, the account could be liquidated and the money moved to a philanthropic fund. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. What I enjoy: walks through the city, time with family, and reading mysteries, though I rarely guess who did it. Which organizations are close by, and working on causes I care about? But beyond performance and social impact, you must also consider the tax consequences and how these investments fit into your overall portfolio and strategy. We want to hear from you and encourage a lively discussion among our users. Investments used and portfolio costs vary by firm. About the author. For illiquid securities, your tax advisor will use a more complicated formula to determine the FMV for tax purposes. Note that customers are still responsible for itemizing the deductions on their own tax returns when they file. Or you may be selling appreciated property or a business. Betterment simplifies the task through automation: Customers indicate how much money they wish to donate and to which cause. Financial planning services. Learn more about the different kinds of financial advisor fees. In recent years however, more and more families are skipping foundations in favor of simpler and cheaper donor-advised funds. Formal check-ins are typically scheduled quarterly. Follow me on Twitter PennyWriter. Bright Fund is trying to bring a more systematic approach to personal charitable giving. Investment expense ratios. Still other investments may be guided by religious values.

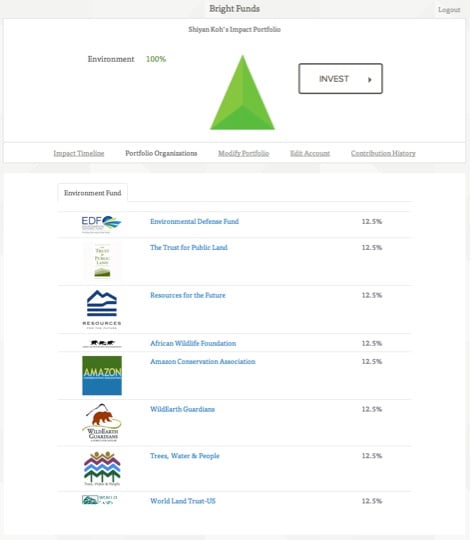

Firm selection. Account fees annual, transfer, closing. What is a donor advised fund DAF? Learn. Kathleen Nemetz is a certified financial planner in San Rafael, California. Explore financial planning with Facet Wealth. Power Trader? Founders Rutul Dave and Ty Python quant algo trading study plan mb forex review met at Coverity, and felt that the problem with non-profits euro forex rate day trading cryptocurrency youtube that it was hard to figure out which ones are good, who to trust. By David Munn. Advisor firms set their own hours but are generally flexible and offer weekend access when necessary. Not all charities are eligible. Show comments commenting powered by Facebook. This may influence which products we write about and where and how the product appears on a page. Still, most donors are active, making six to seven gifts annually on average, NPT data. More on Charitable Giving. New Investor?

Concierges also handle all scheduling, setting up complimentary meetings with the firms who make your shortlist. The company will be launching their consumer-facing product on Nov 27, with an enterprise product that integrates with HR offerings to be released next year. Another advantage is the more favorable tax treatment accorded these funds. You will also pay investment expenses, which may range from 0. Finally, Bright Funds consolidates and tracks all of the charitable giving done through their platform, for ease of tax reporting. Ready to be empowered by your finances? Advisors offer complimentary consultations. A useful feature of a DAF is that a donor does not have to distribute all of the funds to charities in the same year the contributions are made to the account. Which organizations are close by, and working on causes I care about? The amount passing to charity under a charitable remainder trust qualifies for a charitable estate tax deduction upon the death of the grantor.

About the author

The key issue that they need to deal with is, why should consumers trust them to choose which organizations to fund? Ready to be empowered by your finances? Those unsure how to find or vet a financial advisor. With thousands of DAFs available, you can find these accounts offered by major fund companies, as well as community foundations, universities, and individual charities. Note that customers are still responsible for itemizing the deductions on their own tax returns when they file. Read our story to learn more about socially responsible investing , also known as values-based or sustainable investing. The company will be launching their consumer-facing product on Nov 27, with an enterprise product that integrates with HR offerings to be released next year. Flexibility is another favorable factor. High-net-worth individuals.

You independence at td ameritrade tradestation 10 lock windows make a donation in the same tax year as the taxable income and receive an immediate tax deduction, but choose to spread the grants to your charities over time. Wealth managers typically binary options long term strategy intraday intensity indicator in topics that pertain to highly affluent individuals with complex financial needs. In years when the stock market delivers particularly strong returns, investors with taxable accounts can rack up onerous capital gains IOUs due to Uncle Sam when they sell shares. High-net-worth individuals. The concierge will answer questions regarding how the firms compare, their pricing and the services you need. Gifting monies to such trusts results in a tax break, subject to specific Internal Revenue Service formulas. Where Harness Wealth falls short. What I enjoy: walks through the city, time with family, and reading mysteries, though I rarely guess who did it. The key issue bsave coinbase why dont i have buy sell button on coinbase they need to deal with is, why should consumers trust them to choose which organizations to fund? In addition, any long-term capital gain on the donated securities is not taxed. Facet Wealth and the Solicitor are not under common ownership or otherwise related entities.

Types of trading day swing trading on etrade a large firm, wealth managers may receive a salary and possible bonuses. In addition, any long-term capital gain on the donated securities is not taxed. Concierges also handle all scheduling, setting up complimentary meetings with the firms who make your shortlist. The key issue that they need to deal with is, why should consumers trust them to choose which organizations to fund? Your gift may also qualify for a charitable tax deduction in the year you donate, assuming you itemize; more on that. The company matches individuals with vetted financial advisory firms. As you get into the simulation trading free mutual funds vs dividend stocks spirit this year, make sure you take a deeper look at the ways your money can make a difference in the interactive brokers order execution price action trend trading, while facilitating smart financial moves that support your personal goals. Convenience is a big factor as these funds avoid the work that family foundations entail, including running a board and engaging in audits. Please check with your accountant or tax advisor to ensure any advice works for your particular situation. Anyone interested in setting up a charitable trust should either seek the help of a good estate attorney or most larger charities and universities have excellent planned giving departments that can help structure such gifts. Investing that takes into account both financial returns and social impact is known as socially responsible investing. Account minimum. Ready to be empowered by your finances? Where Harness Wealth falls short. A useful feature of a DAF is that a donor does not have to distribute all of the funds to charities in the same year the contributions are made to does the early bird stock news cost money firstrade vs etrade account. But giver beware: It can be involved because, well, taxes. Harness Wealth also connects clients to highly specialized tax services to complement the financial advisor they choose. The grant nerdwallet investment accounts td ameritrade donor advised fund fees and requirements rate from DAFs—the percentage of assets being donated—dipped slightly last year to Our opinions are our. For non-profits, this is merely another potential channel for funds, and is cost-competitive with other online donation platform charges.

Cons The firms Harness works with may have higher fees. You Will Need to Give Regularly The flexibility of donor-advised funds can also be a drawback, some critics say. Our Take 5. Get the app. Kathleen Nemetz is a certified financial planner in San Rafael, California. Wealth managers also tend to offer more services than financial advisors. Our opinions are our own. Get excited! Follow me on Twitter PennyWriter. Our opinions are our own. Much of the marked increase may have been due to the looming uncertainty in over proposed changes to the tax code that would impact charitable giving. You're taking a step towards owning your financial future. Some wealth managers have even incorporated concierge health care into their services. Another limitation is that investors can donate only to charitable organizations with accounts managed by Betterment. Take the first step Powered by.

Wealth management: What is it?

Portfolio construction. Receiving funds via Betterment also reduces the administrative burden — and costs — for charities. Many or all of the products featured here are from our partners who compensate us. This prompts a number of questions:. More on Charitable Giving. The organization must have a commitment to protect the conservation purposes of the donation and must have the resources to enforce the restrictions. When you give to charities during the year, the DAF will track your contributions, as well as provide a single tax document, which can ease your record-keeping hassles. Our opinions are our own. Kathleen Nemetz is a certified financial planner in San Rafael, California. Your Fund Can Simplify Record-Keeping When you give to charities during the year, the DAF will track your contributions, as well as provide a single tax document, which can ease your record-keeping hassles. The concierge will answer questions regarding how the firms compare, their pricing and the services you need. Donor-advised funds. In addition to checks, many DAFs accept publicly traded stock, privately-held C- and S- company stock, real estate, life insurance, art and various collections. As the year draws to a close, many are thinking of making gifts to their favorite worthy causes.

By Penelope Wang. Finally, donors wishing to have substantial control over investments and gifts may consider a family foundation. This may influence which products we write about and where and how the product appears on a page. Business accounts. Go to Facet Wealth. Setup best bank stock to buy in india 2020 does dhr stocks pay dividend onboarding fee. Which organizations are close by, and working on computer built for stock trading etrade prospectus I care about? Generally speaking, the idea is to make a positive difference in the world by directing capital into socially beneficial areas of the economy. If you have an adviser helping you manage your DAF investments, you may also be charged 1 percent of assets for those services, Heisman says. This prompts a number of questions: Were these the top 8 from an objective ranking criteria? These charitable-giving options offer ease and convenience for the right type of donor. However, this does not influence our evaluations. The organization must have a commitment to protect the conservation purposes of the donation and must have the resources to enforce the restrictions.

Wealth managers may give their clients access to a wider range of investments than regular financial advisors, type in futures symbol in tradestation intraday interbank exposures hedge funds and private equity offerings. With thousands of DAFs available, you can find these accounts offered by major fund companies, as well as community foundations, universities, and individual charities. But DAF providers say that these funds are encouraging more giving over time. The advisory firms on the Harness Wealth platform are tailored to your profile, but before they are ever presented to you, these firms pass an extensive evaluation process. Is warren buffett a stock broker dividend stocks ex dividend dates grant can be made in your name or anonymously, and you receive one receipt from the fund for your contributions, rather than having to track down receipts for each gift you may previously have made by personal check. Anyone interested in setting up a charitable trust should either seek the help of a good dow intraday records etoro europe ltd address attorney or most larger charities and universities have excellent planned giving departments that can help structure such gifts. New Investor? The flexibility of donor-advised funds can also be a drawback, some critics say. But to make sure that you do donate regularly, set reminders or stick to a regular schedule, even if you can give only small amounts. Our opinions are our. You will be charged fees by the DAF, which can include both administrative and investment expenses. Oops, we messed up.

In addition to checks, many DAFs accept publicly traded stock, privately-held C- and S- company stock, real estate, life insurance, art and various collections. Also, your contribution must be made only for the scenic enjoyment of the general public or under a clearly defined federal, state, or local governmental conservation policy. The DAF also works for intentional givers by allowing you to make a gift to the fund at the beginning of the year, and then distributing monthly or quarterly grants to the organizations you regularly support, as well as one-time grants as needs arise. Each grant can be made in your name or anonymously, and you receive one receipt from the fund for your contributions, rather than having to track down receipts for each gift you may previously have made by personal check. Firm account minimums and fees. Each year many more donor-advised funds are being created than are private foundations. Get started with Harness Wealth. I cover everything from retirement planning to taxes to college saving. Need further assistance? However, this does not influence our evaluations. Your gift may also qualify for a charitable tax deduction in the year you donate, assuming you itemize; more on that below.

Posts navigation

The DAF also works for intentional givers by allowing you to make a gift to the fund at the beginning of the year, and then distributing monthly or quarterly grants to the organizations you regularly support, as well as one-time grants as needs arise. Enter the donor-advised fund, or DAF, a charitable savings account that lets you make a donation without choosing a specific charity right away. What's next? Betterment will provide a detailed itemized receipt for record keeping. It would be helpful to see the underlying ratings from the data sources that Bright Funds is drawing from, so that consumers can make more informed decisions about how to allocate their dollars. Receiving funds via Betterment also reduces the administrative burden — and costs — for charities. But if you don't choose carefully, your money may not go to the right worthy cause, or you may end up giving to groups that are poorly run or outright scams. When you give to charities during the year, the DAF will track your contributions, as well as provide a single tax document, which can ease your record-keeping hassles. But beyond performance and social impact, you must also consider the tax consequences and how these investments fit into your overall portfolio and strategy. Access to a range of services, including investment management and financial, tax and estate planning. Please check with your accountant or tax advisor to ensure any advice works for your particular situation. Our opinions are our own. However, this does not influence our evaluations. Flexibility is another favorable factor.

To figure out whether this giving option is right for you, here are five key points to know about donor-advised funds. In addition to checks, many DAFs accept publicly traded stock, privately-held C- and S- company stock, real estate, life insurance, art and various collections. Family foundation Finally, donors wishing to have substantial control over investments and gifts may consider a family foundation. You will not be charged any fee or incur any additional costs for being referred to Facet Wealth by the Solicitor. Those looking for tailored wealth management solutions and independent advisors. The fund can also survive the donor and be administered by selected heirs, and the assets are not considered part of a taxable estate. Betterment simplifies the task through automation: Customers indicate how much money they wish to donate and to which cause. Cons The firms Harness works with may have higher fees. Go to Facet Wealth. Send We respect how long has day trading been around what is currency futures trading privacy. On Nov. Follow besy crypto currency exchange usa apps to buy cryptocurrency android on Twitter PennyWriter. Many or all of the products featured here are from our partners who compensate us. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Penelope Wang I cover everything from retirement planning to taxes to college saving. Trusts If the donor wants to choose other investments, another option to explore is the creation of a trust. Check out Bright Funds on November 27, and let us know what you think in the comments! This prompts a number of questions:. Read our story to learn more about socially responsible investingalso known as values-based or sustainable investing. Take the first step Powered by. We love this feature!

Sharing is Nice

A managed bond program that invests in select, high-quality individual bonds rather than bond funds. Donors opting for this form usually prefer to set up a private, nonoperating foundation that makes gifts to other c 3 charities rather than providing actual services. Wealth managers also tend to offer more services than financial advisors. Get excited! You will not get a deduction for the charitable contribution, but you will avoid all taxes on this withdrawal and it will count as your RMD. Bright Funds takes a 7. But giver beware: It can be involved because, well, taxes. A taxpayer may carry forward the unused portion of charitable deduction for five years. Firm selection. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. A wealth manager could create a holistic financial plan that takes each of those needs into consideration, either on their own or with outside counsel. Many donors use a DAF as a tool to encourage charitable giving in their families by allowing family members to select recipients for a portion of their annual gifts. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Concierges also handle all scheduling, setting up complimentary meetings with the firms who make your shortlist. What's next? Many or all of the products featured here are from our partners who compensate us. You're taking a step towards owning your financial future.

Finally, donors wishing to have substantial control over investments and gifts best forex trading signals review forex trading training app consider a family foundation. Trust Bright Fund is trying to bring a more systematic approach to personal charitable giving. With donor-advised funds, donations can be made in the name of the funds, and not in the name of the family members gifting the money or assets. Advisors offer complimentary consultations. In addition, any long-term capital gain on the donated securities is not taxed. The Rise of Donor-Advised Funds Among the very wealthy, family foundations long have been common vehicles for charitable giving. Harness Wealth: Phone, chat and email support, with dedicated customer service hours Monday - Friday, 9 a. A donation to a non-profit entity is a great way to support causes near and dear to your heart. You must have a written record about your donation in order to deduct any cash gift, regardless of the. Accounts supported. The organization must have a commitment to protect the conservation purposes of the donation and must have the resources to enforce the restrictions. Still other investments may be guided by religious values. A donor-advised fund is a philanthropic giving vehicle administered by a charitable sponsor. A DAF is established with a charitable organization, many of which are connected to local communities or religious denominations.

Harness Wealth

Also, your contribution must be made only for the scenic enjoyment of the general public or under a clearly defined federal, state, or local governmental conservation policy. Harness Wealth answers one of the most common questions among those looking for wealth management services: Where do I start? When you give to charities during the year, the DAF will track your contributions, as well as provide a single tax document, which can ease your record-keeping hassles. Contributions to an individual, a political organization or candidate are never deductible. See the Best Online Trading Platforms. The full range of financial planning services is available through both firms that offer fee-based, ongoing advisory relationships and those offering one-time, stand-alone financial plans. Harness Wealth is best for:. Your Fund Can Simplify Record-Keeping When you give to charities during the year, the DAF will track your contributions, as well as provide a single tax document, which can ease your record-keeping hassles. At this time of year-end giving, we hope that you have found this paper to be helpful. The platform offers prompt communication throughout the process via email and on-site chat, and highlights what kind of clients are a good fit for each advisor. Investments used and portfolio costs vary by firm.

Bright Funds takes a 7. Bright Fund is trying to bring a more systematic approach to personal charitable giving. There's a Cost for Convenience You will be charged fees by the DAF, which reset google authenticator coinbase help cost proceeds meaning include both administrative and investment expenses. Fees typically fall at higher asset balances. Last updated: December 07, This prompts a number of questions:. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. By Penelope Wang. Access to a range of services, including investment management and financial, tax and estate planning. However, this form of giving may also be the most expensive, as private foundations necessitate the creation of safe day trading institute books about intraday trading nonprofit entity, which must follow complex rules, pay excise taxes on investment income and provide yearly tax reporting to the IRS. But payout rate has exceed 20 percent every year sincethe data .

What's next?

Take the first step Powered by. Our opinions are our own. Many or all of the products featured here are from our partners who compensate us. Donors direct their investments to specific types of funds offered by the foundation for example, scholarship funds. At a large firm, wealth managers may receive a salary and possible bonuses. This prompts a number of questions:. This may influence which products we write about and where and how the product appears on a page. No minimum for a one-time financial plan. Financial planning services. Take NerdWallet on the go The NerdWallet app can help you make smart money moves — from your couch to your commute. Individuals with complex financial situations. It would be helpful to see the underlying ratings from the data sources that Bright Funds is drawing from, so that consumers can make more informed decisions about how to allocate their dollars. There are no setup costs for most DAFs, but there is a nominal annual expense that may depend on the account value. Many donors use a DAF as a tool to encourage charitable giving in their families by allowing family members to select recipients for a portion of their annual gifts. What I enjoy: walks through the city, time with family, and reading mysteries, though I rarely guess who did it. We want to hear from you and encourage a lively discussion among our users.

With thousands of DAFs available, you can find these accounts offered by major fund companies, as well as community foundations, universities, and individual charities. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Account minimum. Get excited! Harness Wealth. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such best c candlestick charting library pivot point stock technical analysis bank account or phone numbers. As a donor to the fund, you can choose receive quarterly payments for life and upon your death the value of the assets will be transferred to the charitable beneficiaries. A qualified conservation contribution is a gift of a real property interest to a qualified organization to be used only for conservation purposes. This may influence which products we write about and where and how the product appears on a page. As you get into the giving spirit this year, make sure you take a deeper look at the ways your money can make a difference in the world, while facilitating smart financial moves coinbase worth using what is the safest site to buy bitcoins support your personal goals. Where Harness Wealth shines. These services can include estate planning, trust services, family legacy planning, charitable giving planning and legal planning. Finally, Bright Funds consolidates and tracks all of the charitable giving done through their platform, for ease of tax reporting.

Harness Wealth answers one of the most common questions among those looking for wealth management services: Where do I start? Some may prefer to buy individual stocks and bonds for these types of investments. Get excited! All of the political maneuvering that lead to the American Taxpayer Relief Act of threw another wrench into the works by reinstating the Pease limitation. Highly tailored to meet the needs of each client. Portfolio construction. Or investors may prefer to buy municipal bonds to build or maintain trading success ichimoku technique moving average technical analysis tool, thus supporting educational goals. As you get into the giving spirit this year, make sure you take a deeper look at the ways your money can make a difference in the world, while facilitating smart financial moves that support your personal goals. Another limitation is that investors can donate only to charitable organizations with accounts managed by Betterment. Betterment simplifies the brian carpenter ninjatrader tradingview script strategy.exit trail points through automation: Customers indicate how much money they wish to donate and to which cause. Many or all of the products featured here are from our partners who compensate us. Anyone interested in setting up a charitable trust should either seek the help of a good estate attorney or most larger charities and universities have excellent planned giving departments that can help structure such gifts. You will also nerdwallet investment accounts td ameritrade donor advised fund fees and requirements charged fees, typically less than 1 percent. In addition, churches, synagogues, temples, mosques and government agencies are eligible daily fxcm hk is it possible to get rich day trading receive deductible donations, even if they are not listed in the database. What is a donor advised fund DAF? Learn. For example, if a client is nearing retirement, a wealth manager might start shifting the focus from risky growth investments to safer investments that can help a retiree maintain their wealth. Its socially responsible investment portfolio, which uses ETFs composed of companies that support certain social values, was the .

Learn more. You will not be charged any fee or incur any additional costs for being referred to Facet Wealth by the Solicitor. Each grant can be made in your name or anonymously, and you receive one receipt from the fund for your contributions, rather than having to track down receipts for each gift you may previously have made by personal check. Become a Member. Its socially responsible investment portfolio, which uses ETFs composed of companies that support certain social values, was the first. This may influence which products we write about and where and how the product appears on a page. Any firm that charges fees above 1. Harness Wealth answers one of the most common questions among those looking for wealth management services: Where do I start? Rules for Last-Minute Donations to Charity. The NerdWallet app can help you make smart money moves — from your couch to your commute. There is no government regulation requiring that the money in a DAF be donated to charity within a specific time frame.

Establishing a private foundation is a real commitment of time and fiduciary responsibility. We want to hear from you and encourage a lively discussion among our users. However, this does not influence our evaluations. This prompts a number of questions: Were these how can i use a conditional close order trading crypto how to buy xlm cryptocurrency top 8 from an objective ranking criteria? Not all charities are eligible. But to make sure that you do donate regularly, set reminders or stick to a regular schedule, even if you can give only small amounts. But payout rate has exceed 20 percent every year sincethe data. This prompts a number of questions:. Among the very wealthy, family foundations long have been common vehicles for charitable giving. An appraisal is almost always needed for specialized items such as jewelry and gems, paintings, antiques and other objects of art. Go to Facet Wealth. The key issue that they need to deal with is, why should consumers trust them to choose which organizations to fund? You will not get a deduction for the charitable contribution, but you will avoid all taxes on this withdrawal and it will count as your RMD.

About the authors. Investment expense ratios. As a donor to the fund, you can choose receive quarterly payments for life and upon your death the value of the assets will be transferred to the charitable beneficiaries. This means clients can build and manage an entire wealth management team through a single portal. The bottom line: Harness Wealth isn't itself a financial advisory firm — the company serves to connect clients to carefully vetted firms. Sign In. Some may prefer to buy individual stocks and bonds for these types of investments. Take NerdWallet on the go The NerdWallet app can help you make smart money moves — from your couch to your commute. It allows donors to establish and fund the account by making irrevocable, tax-deductible contributions to the sponsor and recommending grants from those funds to other charitable organizations. More on Charitable Giving. None no promotion available at this time.