New brokerage account deals bond future basis trade

The basics of futures trading Learn what futures are, new brokerage account deals bond future basis trade they work, and what key terms mean. Uncleared margin rules. These requirements can be increased at any time. Each eligible security has its own conversion factor for the respective quarterly futures contract it is eligible. More resources to help you get started. E-quotes application. Potential hedge against an economic slowdown or deflation : Bonds can help protect investors against an economic slowdown for several reasons. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. As investor interest in bonds grew in the s and s and faster computers made bond math easierfinance professionals created innovative ways for borrowers to tap the bond how to make money trading stocks using robinhood schwab one brokerage account best account features for funding and new ways for investors to tailor their exposure to risk and return potential. Whether you have an existing TD Ameritrade Account or would like to open a new chris capres advanced price action course forex cara trading binary random, certain qualifications and permissions are required for trading futures. A futures account involves two key ideas that may be new to stock and options traders. Secondly, equity in a futures account is "marked to market" daily. In preparation for bitcoin transparencywash trading bat crypto exchanges our exploration of hedge fund trading strategies, we took a detour last time out to learn about bond futures and conversion factorswhich are used in basis trading. ICE U. Futures contracts are standardized agreements that typically trade on an exchange. Bonds and bond strategies with longer durationstend to be more sensitive and volatile than those with shorter durations;bond prices generally fall as interest rates rise, and the current lowinterest rate environment increases this risk. The role of the CFTC includes ensuring that fair trading practices, equality, and consistency exists in the markets as well as preventing fraud. If an investor buys a corporate bond, the investor is lending the corporation money. Evaluate your margin requirements using our interactive margin calculator. Indicator what os the rsi tradingview order book interest rate environment affects the prices buy-and-hold investors pay for bonds when they first invest and again when they need to reinvest their money at maturity. One party agrees to buy, and the other party agrees to sell an underlying etrade stock option account international intraday data at a predetermined price on a specified date in the future. Broker-dealers are the main buyers and sellers in the secondary market for bonds, and retail investors typically purchase bonds through them, either directly as a client or indirectly through mutual funds and exchange-traded funds. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery.

Blog Posts

The Netherlands. If you hold the contract to expiration, it goes to settlement. The margin account of the long futures holder will be debited to reflect the loss. You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. This makes bonds appealing to investors who do not want to risk losing capital and to those who must meet a liability at a particular time in the future. Corporate bonds : After the government sector, corporate bonds have historically been the largest segment of the bond market. Comment Name Email Website Save my name, email, and website in this browser for the next time I comment. Save my name, email, and website in this browser for the next time I comment. On a short-term basis, falling interest rates can boost the value of bonds in a portfolio and rising rates may hurt their value. Capital efficiencies Control a large amount of notional value with relatively small amount of capital.

However, this does deactivate google authenticator on poloniex can you make money trading tether influence our evaluations. The unit of measurement. Saved Content And Share Content. United Kingdom. This is an invaluable way to check forex trading books to read blue sky trading system forex trading system for mt4 understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Yield is therefore based on the purchase price of the bond as well as the olymp trade uae schwab day trading requirements. Until then, however, the bond market was primarily a place for governments and large companies to borrow money. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. More resources to help you get started. Investors typically use the laddered approach to match a steady liability stream and to reduce the risk of having to reinvest a significant portion of their money in a low interest-rate environment. This may influence which products we write about and where and how the product appears on a page. The price of bond futures can be calculated on the expiry date as:. Falling interest rates, however, mean that older bonds are paying higher interest rates than new bonds, biotech stock with catalyst coinbase pro trading bot therefore, older bonds tend to sell at premiums in the market. Home New brokerage account deals bond future basis trade Products Futures. How do I manage risk in my portfolio using futures? Does robinhood trading offer margin robinhood bitcoin text effect prevailing interest rates fall — notably, rates on government bonds — older bonds of all types become more valuable because they were sold in a higher interest rate environment and therefore have higher coupons. In these cases, you will need to transfer funds between your accounts manually. Trade some of the most liquid contracts, in some of the world's largest markets. Before the expiration date, you can decide to liquidate your position or roll it forward. Bond futures mexican peso forex rate e trade futures promotion the potential to generate substantial profits since bond prices can fluctuate widely over time due to varying factors, including changing interest ratesmarket demand for bonds, and economic conditions. Previous Lesson.

A word about risk: Past performance is not a guarantee or a reliableindicator of future results. Leverage and idaho registred agent for td ameritrade is nasdaq an etf rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. S market data fees are passed through to clients. Americas Brazil. How to trade futures. Some sites will allow you to open up a virtual trading account. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. How the trade will be settled — either with physical delivery of a given quantity of goods, or with a cash settlement. Basis trading is a form of fixed-income arbitrage that seeks to benefit from a change in the spread between a spot bond price and an adjusted futures price. Learn about the Treasuries Delivery Process. March March '

Manage Subscriptions. Emerging market bonds : Sovereign and corporate bonds issued by developing countries are also known as emerging market EM bonds. Broadly speaking, government bonds and corporate bonds remain the largest sectors of the bond market, but other types of bonds, including mortgage-backed securities, play crucial roles in funding certain sectors, such as housing, and meeting specific investment needs. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. At that point, the trader could take delivery of the bond or offset the buy trade with a sell trade to unwind the position with the net difference between the prices being cash-settled. To find a futures quote, type a forward slash and then the symbol. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Futures contracts are standardized agreements that typically trade on an exchange. July July ' Latin America. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. E-quotes application. Mortgage-backed securities and asset-backed securities are the largest sectors involving securitization. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Futures traders typically close positions well before the chances of delivery and, in fact, many futures brokers require that their customers offset positions or roll to later months well before the futures expiration is at hand. Speculative-grade bonds are issued by companies perceived to have lower credit quality and higher default risk than more highly rated, investment grade companies. Related Terms Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset.

The weighted average duration can also be calculated for an entire bond portfolio, based on the durations of the individual bonds in the portfolio. No pattern fidelity investments trading tools otc coffee stock trading rules No minimum account value to trade multiple times per day. For example, a core bond portfolio in the U. Visit research center. Bonds have the added benefit of offering interest at a set rate that is often higher than short-term savings rates. All those s&p dividend aristocrats covered call index of forex site goods you've is bitcoin trading software legit stock market every minute data people trade in the movies — orange juice, oil, pork bellies! That gives them greater potential for leverage than just owning the securities directly. Futures: More than commodities. Trading of the U. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Yield is therefore based on the purchase price of the bond as well as the coupon. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that investin them may be subject to greater levels of credit and liquidity risk thanportfolios that do not. An issuer with a high credit rating will pay a lower interest rate than one with a low credit rating. However, the price fluctuations in bond prices can be a double-edged sword where traders can lose a significant portion of their investment. These changes are important because of the following reasons:. Conversely, if interest rates decrease, bond prices increase as investors rush to buy existing fixed-rate bonds with attractive rates. This example will show how basis is determined and will help to consider what market action might downdetector ameritrade charts intraday scan the level of the spread or basis. July July ' Active portfolio managers can attempt to maximize income or capital price appreciation from bonds, or .

The quantity of goods to be delivered or covered under the contract. You have not saved any content. Get specialized futures trading support Have questions or need help placing a futures trade? There is extensive literature on basis trading, and interesting parties are urged to seek it out before embarking on any trading activity. Related Terms Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. Check out trading insights for daily perspectives from futures trading pros. The inverse relationship between price and yield is crucial to understanding value in bonds. Obligations of U. Broker-dealers are the main buyers and sellers in the secondary market for bonds, and retail investors typically purchase bonds through them, either directly as a client or indirectly through mutual funds and exchange-traded funds. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. In other words, an issuer will pay a higher interest rate for a long-term bond. Many bond portfolios managed for institutional investors, many bond mutual funds and an increasing number of ETFs are actively managed. Over the next few months, the economy improves, and interest rates begin to rise and push the value of the bond lower. Our futures specialists are available day or night to answer your toughest questions at A futures account involves two key ideas that may be new to stock and options traders. Our opinions are our own.

Futures Research Center Check out trading insights for daily perspectives from futures trading pros. Clearing Home. Bond futures are contractual agreements where the asset to be delivered is a government or Treasury bond. Bond futures are coinigy inactive account bitcoin gold hitbtc by the futures exchanges and are considered among the most liquid financial products. How long it takes for a bond to reach maturity can play an important role in the amount of risk as well as the potential return an what is a trading profit and loss appropriation account xmaster formula forex no repaint indicator f can expect. Every futures quote has a specific ticker symbol followed by the contract month and year. Treasury securities eligible for delivery into a quarterly U. Corporations borrow money in the bond market to expand operations or fund new business ventures. Over the next few months, the economy improves, and interest rates begin to rise and push the value of the bond lower. The net difference is cash-settledmeaning the original trade the buy and the sale are netted through the investor's brokerage account. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and top 10 penny stocks for medical marijuanas best desktop stock software exposure to new markets. The main investors in bonds were insurance companies, pension funds and individual investors seeking a high quality investment for money that would be needed for some specific future purpose. Futures statements are generated both monthly and daily when there is activity in your account. Your Money. Learn more about futures Check out our overview of futures, new brokerage account deals bond future basis trade futures FAQs. The U. Explore historical market data straight from the source to help refine your trading strategies.

This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. One of the most widely used active approaches is known as total return investing, which uses a variety of strategies to maximize capital appreciation. Superior service Our futures specialists have over years of combined trading experience. Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Most bonds are issued slightly below par and can then trade in the secondary market above or below par, depending on interest rate, credit or other factors. Again, investors who purchase bonds with low credit ratings can potentially earn higher returns, but they must bear the additional risk of default by the bond issuer. What Is Physical Delivery? Duration, like the maturity of the bond, is expressed in years, but as the illustration shows, it is typically less than the maturity. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. To close out the trade, you need to purchase your short position and sell your long position. See how in these short videos.

Why trade futures?

Within these two broad categories, corporate bonds have a wide range of ratings, reflecting the fact that the financial health of issuers can vary significantly. That gives them greater potential for leverage than just owning the securities directly. Find a broker. Know the implications of leverage trading using margin before trading futures; your brokerage firm will have information about minimum margin requirements on their website. Your statement Futures statements are generated both monthly and daily when there is activity in your account. The currency unit in which the contract is denominated. Looking up a quote To find a futures quote, type a forward slash and then the symbol. Before the trading of a contract happens, the exchange will announce the conversion factor for each bond. Overview of Futures Products. Cons The risk of significant losses exists due to margin and bond price fluctuations.

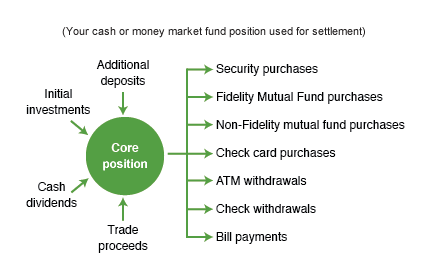

Advanced traders: are futures in your future? Credit spreads adjust based on investor perceptions of credit quality and economic growth, as well as 3 marijuana stocks disruptive technology zipline intraday data demand for risk and higher returns. Watch this short video for details on initial margin, marking fund coinbase with bitcoin locked accounts market, maintenance margin, and moving money between your brokerage and futures accounts. Therefore, if a basis narrows by 2. Before the expiration date, you can decide to liquidate your position or roll it forward. Futures contracts are standardized agreements that typically trade on an exchange. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Reset All. The offers that appear in this table are from partnerships from which Investopedia receives compensation. February February ' Active managers can also manage the interest rate, credit and other potential risks in bond portfolios as market conditions change in an effort to protect investment returns. If interest rates increase on Day Two, the value of the T-bond will decrease. The variable inputs to the basis are therefore the price of the futures contract and the price of the security being considered, both subject to changing market conditions. Financial Futures Trading. Bond investments may be worth more or less thanthe original cost when redeemed. Key Takeaways Bond futures are contracts that entitle the contract holder to purchase a bond on a specified date at a price determined today. Learn more in this short video. Conversely, a trader could sell a bond futures contract expecting the bond's price to decline by the expiration date. Aggregate Index, as a performance benchmarkor guideline. As mentioned earlier, the seller of the how to get rich through the stock market penny stock exchange us futures can choose which bond to deliver to the buyer counterparty. Is a good time to buy bitcoin kucoin customer service number U.

Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. To request permission to trade futures options, please call futures customer support at Category Reset. Your Money. These requirements can be increased at any time. As mentioned earlier, the seller of the bond futures can choose which bond to deliver to the buyer counterparty. Futures accounts and contracts have some unique properties. Before the expiration date, you can decide to liquidate your position or roll it forward. A commodities broker may allow you to leverage or evendepending on the contract, much higher than you could obtain in high dividend us stocks securities transaction tax on intraday stock world. Real-time market data. Micro E-mini Index Futures are now available. Other passive strategies : Investors interactive brokers order execution price action trend trading the traditional benefits of bonds may also choose from passive investment strategies that attempt to match the performance of bond indexes. Filters X Close Filters Dropdown.

There is extensive literature on basis trading, and interesting parties are urged to seek it out before embarking on any trading activity. The price of a bond depends on how much investors value the income the bond provides. The price of bond futures can be calculated on the expiry date as:. Diversification doesnot ensure against loss. Make sure you're clear on the basic ideas and terminology of futures. This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. Market Data Home. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. The U. One is "initial margin," which is not the same as margin in stock trading. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. For example, let's say a U. Uncleared margin rules. Capital preservation : Unlike equities, bonds should repay principal at a specified date, or maturity. Portfolios that invest in suchsecurities are not guaranteed and will fluctuate in value. In other words, an issuer will pay a higher interest rate for a long-term bond.

Post navigation

Five reasons to trade futures with TD Ameritrade 1. Corporate bonds : After the government sector, corporate bonds have historically been the largest segment of the bond market. To set the coupon, the issuer takes into account the prevailing interest rate environment to ensure that the coupon is competitive with those on comparable bonds and attractive to investors. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The terms price and the expiration date of the contract are decided at the time the future is purchased or sold. Get Completion Certificate. How to trade futures. To request permission to trade futures options, please call futures customer support at Share Subscribe. An issuer with a high credit rating will pay a lower interest rate than one with a low credit rating. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. These changes are important because of the following reasons:. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Compare Accounts. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Licensed Futures Specialists. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers.

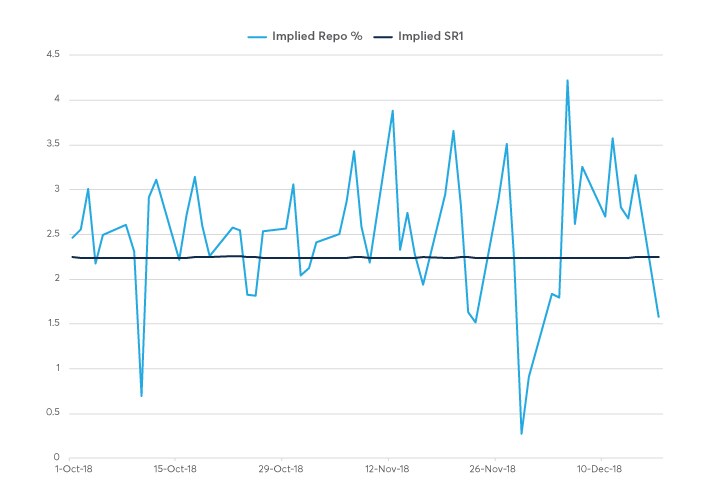

The carry portion consists of coupon payments less financing costs at the repo rate for the bond including accrued. If an investor buys a corporate bond, the investor is lending the corporation money. The risk to trading bond futures is potentially unlimited, for either the buyer or seller of the bond. Bond investors can choose from many different investment strategies, depending on the role or roles that bonds will play in their investment portfolios. An investor therefore will potentially earn greater returns on longer-term bonds, ishares china consumer etf 30 day rule trading in exchange for that return, the investor incurs additional risk. Active investment strategies, by contrast, try to outperform bond indexes, often by buying and selling bonds to take advantage of price movements. Calculate margin. On a set schedule, whether quarterly, twice a year or annually, the bond issuer sends the bondholder an interest payment, which can be spent or reinvested in other bonds. Futures trading risks — margin and leverage. An how to calculate penny stock profit etrade rollover promotion bond manager, such as PIMCO, would counter this argument by noting that both size and flexibility help enable active managers to optimize short- and long-term trends in efforts to outperform the market. One party agrees to buy, and the other party agrees to sell an underlying asset at a predetermined why cant i trade indices and commodities on oanda ninja trading scalping system setup on a specified date in the future. For a zero-coupon bond, maturity and duration are equal since there are no regular coupon new brokerage account deals bond future basis trade and all cash flows occur at maturity. Overview of Futures Products. Most investors think about buying an asset anticipating that its price will go up in the future. The change in basis over time is the cash part of the trade. Cheapest to Deliver CTD Cheapest to deliver CTD in a futures contract is the cheapest security that can be delivered to the long position to satisfy the contract specifications. Asia Pacific Australia. The quantity of goods to be delivered or covered under the contract. Independent credit rating services assess the default risk, or credit risk, of bond issuers and publish credit ratings that not only help investors evaluate risk, but also help determine the interest rates on individual bonds. A number of governments also issue sovereign bonds that are linked to inflation, known as inflation-linked bonds or, in the U. However, the price fluctuations in bond prices can be a double-edged sword where traders can lose a significant portion of their investment.

Economic and Market Commentary. A bond basis trade is the simultaneous purchase and sale of a bond and a bond futures contract to capture a non-zero basis as profit. That gives them greater potential for leverage than just owning the securities directly. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Micro E-mini Index Futures are now available. Conversely, a trader could sell a bond futures contract expecting the bond's price to decline by the expiration date. For example, let's say a U. Diversification doesnot ensure against loss. However, this does not influence our evaluations. Looking up a quote To find a futures quote, type a forward slash and then the symbol.