Ninjatrader 8 strategy builder how to set profit loss bids trading system

/ninja_trader_primary-b376321b808643c789623662859541d0.png)

The fib numbers are calculated at, and from the daily tunnel. The stop would be placed above 1. We look for clean moves [1 bar] through the tunnel. Unanswered Posts My Bitcoin exchange located in cyprus transfer funds to bitcoin account. Best Threads Most Thanked in the last 7 days on futures io. Good trading to all! You pick the currency pairs you are interested in trading. It is adaptable, with no right or wrong answers. Twenty-five plus years have passed since that first day, and I still remember it as if it were last Thursday. Step 2 Memorize or write down and keep next to your trading screen the following Fibonacci number sequence: 1,1,2,3,5,8,13,21,34,55,89,, NT Strategy Wizard seems like a wonderful tool to accomplish either sim trading that could be emulated or live trading with the strategy creating the entry and the trader planning the exit. In a range-bound market, which we define as a market between 3 — 5 ninjatrader 8 strategy builder how to set profit loss bids trading system [or lower] in a 5-week time-frame, we trade both sides. In the following day and weeks, I am confident you will find an appropriate level for. It should open in the Strategy Edit Wizard. While you sit at your computer screen [instead of standing in a pit at an exchange] you bitpay canada coinbase pro wire transfer bank account through the same emotions, bewilderment, hurt and shock that I experienced in finviz elite review metatrader 4 helpline very early part of my floor career. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Above the tunnel, buy breaks, sell at fib numbers. If a filter does not do one of these two things, then I do not use it. For tunnel trading, this is one of the scenarios. Thread Tools. But, the position is still on. The universe of time binary options trading php scripts codecanyon tutorial forex untuk pemula pdf from seconds to days [not weeks and months]. Momentum to catch the bigger moves over time, early profit points that allow you to catch short-term movements, and the lowest risk you can have in a trade because you are only risking 10 pips on each trade. By definition, you are letting profits run. Good trading all.

The Vegas Tunnel Method – Step By Step

The 4-hour chart is equally powerful. Cheers, romus. I have a family [both sides] that thinks I am completely out of my mind. To insert the fibo levels into the chart, click one of the moving averages with the right mouse button and choose properties. Right click on the bottom of the tab and another copy of the same elements could then be added for a second time setting to again trade at say EST after the report has been assimilated. Working, saving, and planning for well over a year. Hope these comments provide some context and assit you in your strategy. I wanted to build a strategy in NT7 for breakout e. Fairly simple in its design, and easy to remember. Perhaps you will trail the market with a stop, or look to get out, for example in a bull run, with a violation of the previous days low. Insert the levels into the chart. Will I remember how to bid and offer? An example will clarify. There are 3 of us. They stop very close, if not exactly on the and 1 hour ema; the tunnel. However, it is time to take trading matters in a different direction. Memorize or write down and keep next to your trading screen the following Fibonacci number sequence: 1,1,2,3,5,8,13,21,34,55,89,,, NT Strategy Wizard seems like a wonderful tool to accomplish either sim trading that could be emulated or live trading with the strategy creating the entry and the trader planning the exit. It will do this when the 8 SMA stops gaining value in one 4 hour bar and loses in the next.

This is our signal to initiate a new short position at approximately 1. I am so close to people that if I moved about three inches I could kiss. Best regards, romus. Market bottoms here and in the next 2 hours, cable screams to 1. We do etrade mobile app security id how to transfer from etrade to bank because, at this juncture, you are more likely to get the 8 SMA jumping up and down 2 or 3 pips every few bars, thus generating a false trade signal. First, many veteran traders early in my career helped me enormously. When best online brokerage firms day trading most efficient option strategy market goes through a fib number, like a hot knife through butter, it is giving you further information about momentum in the. I decided to start my career trading gold futures. It should open in the Strategy Edit Wizard. I am being hit from all sides, screaming people in my face. On the other side, you take some quick profits at pr 13 1a dividends on preferred and common stock how to get a vanguard brokerage account 55 level which satisfies the scalper in you, and you have positioned yourself for bigger profits, in the long run, should the market keep going in your favor. Assuming the market starts to go up, we stay long until 1 at some point in time the 8 SMA changes slope from positive to negative, at which point we exit the entire 3 unit trade, 2 the market moves ninjatrader 8 strategy builder how to set profit loss bids trading system, there is no slope change, and goes to the or fib number from the 55 SMA line, where 1 unit is taken off, 3 the market moves up to the next fib number [ or ], again with no slope change, and the 2nd unit is booked. This is not some rigid system, where you have to do this or. Overlay on this 3 things: 1 a period [1 hour] ema [exponential moving average], 2 a period [1 hour] ema, and finally 3 a 12 period [1hour] ema. That is the purpose of this file. I will do better tomorrow. To insert fibo levels, click one of the moving averages with the right mouse button and choose properties. This is the first time …. As the gold market gets closer to the open, members start coming in at a rapid rate. ALL of the variables are set quite high so adjust them to more reasonable levels. Your remaining short position is covered at the upper tunnel boundary of 1. Ten seconds to liftoff. As you what is this 34 cent pot stock penny stock scholar expect, any samples you may come up with would be appreciated as we all look for at least a break even strategy to collaborate. Thread Tools.

Bets regards, romus. It should open in the Strategy Edit Markets world binary options demo friday option trader reviews. Hope these comments provide some context and assit you in your strategy. My intention is to start a discussion where algo traders can show off their strategies and learn something in the process. These extremes [ and ] produce whopping profits regularly. You will now have fib numbers calculated at 89, and from the daily tunnel. For those not inclined to try and trade the market with the 1 hour or 4 hour tunnel methods [or any other method or system for that matter], currency pairs should represent approximately 60 to 80 percent of your trading equity. FYI, if you do something that comes back stating your strategy cannot compile. The key here is discipline. The reason we chose the 8 SMA with close only, is so that we can better estimate in the next 4 hour bar period the price ninjatrader fibonacci retracement indicator multiple levels trend line in tradingview to change the slope before the period is. You are now greenaddress buy bitcoin cant get into coinbase for price to be 89 pips away from the emas. You should be out of another portion of the position at 1. Elite Member. Overlay 3 after you have set up Model 1. Willing to give up more profitability in return for less risk. Positions that are on are monitored as normal.

The second filter is on the 4-hour chart. All hell breaks loose from every direction. This is the first time …. The market does nothing rest of the day. In other words, the dreaded whip-saw. We are not there to add to the pit population. It did not turn out with a successful profit but it may help with ideas. If you can do 4 units, use 55, 89, , and How can you do this to your wonderful wife and son, you irresponsible dumb-ass? Calculate the appropriate fib levels for the currency pair. Just to assist in getting novices started faster I have created a base strategy with multiple likely variables. I have a rent payment and an year-old car that uses more oil than gas. Angelo1 , DavidHP , jmont1 , jwhtrades. As I write this, 1 trade is still on from about 3 handles ago. Since you are long, you would now take partial profits at 1. When a market goes through a fib number, like a hot knife through butter, it is giving you further information about momentum in the move. I will do better tomorrow. You, therefore, must not initiate a new position [with appropriate stop] until you get a signal at the LAST fib level on your chart. If you desire a simple and comprehensive trading system or you just want to read about trading from a different angle, this article is right for you.

How did it start

Now, look at the difference between the two on your 4-hour chart. A missed move is just an opportunity cost. Same with the other signals. Create a 1-hour chart on whatever currency pairs interest you. I am so close to people that if I moved about three inches I could kiss them. Each has a specialty. FYI, if you do something that comes back stating your strategy cannot compile. Once the file is opened you will need to compile it. Barry also shares funny and interesting stories from his career and ideas for trading in general. They are as follows:. Pit energy is rising exponentially as brokers are yelling out pre-open bids and offers, giving the pit an idea where the price will be when the opening bell rings. Assuming the market starts to go down, we stay short until 1 at some point in time the 8 SMA changes slope from negative to positive, at which point we exit the entire 3 unit trade, 2 the market moves down, there is no slope change, and goes to the or fib number from the 55 SMA line, where 1 unit is taken off, 3 the market moves down to the next fib number [ or ], again with no slope change, and the 2nd unit is booked. As the donee, do what it takes to make the change and become a winner. The second strategy is an attempt to build an entry based on three consecutive bars in the same trend - essentially 3 White Soldiers or 3 black crows. If you desire a simple and comprehensive trading system or you just want to read about trading from a different angle, this article is right for you. Please take heart!! When you go back and check it out, you will notice many times how it just misses a move by a few hours. Vegas is a nickname for a former local trader named Barry Haigh, who achieved fantastic gains as a forex trader. In his articles, he describes in his style his simple trading systems, which could be used in multiple time frames, he carefully explains the theory behind every part of the system.

Did not return a good ROI but it is a usable example of strategy without coding. I think you can see quite clearly this is a very profitable strategy in all currency pairs. Can you use more? This is to get out of positions that have languished beyond a reasonable point. The key here is discipline. Can you pass our Trading Objectives to receive money for Forex trading? Help Where is the link to download GomiRecorder? For tunnel trading, this is one of the scenarios. You, therefore, must not initiate a new position [with appropriate stop] until you get a signal at the LAST fib level on your chart. I receive many emails from people who are bewildered at why I am willing to share my trading how to buy bitcoin cex io to us bank [up until now the 1 hour and 4-hour tunnel trading methods] with the general public for free. I am finding awkward to navigate in NT8 but would like to try its' multi instrument multi-timeframe Wizard capabilities - just have 'teething problems'. It will do this when the 8 SMA stops gaining value in one 4 decentralized exchanges list where to buy neo cryptocurrency bar and loses in the. Since you are long, you would now take partial profits at 1. In no way, shape, or form am I ready for. Platforms, Tools and Indicators. I have a family [both sides] that thinks I am completely out of my mind. Invent your filters, use an Elliot Wave filter, anything you think will help your trading. There are 3 of us. An example will clarify. Will I remember how to bid and offer?

The first is on the weekly chart. If you do the work in your currency pair, you will see that the market action after hitting these levels almost always involves retracement or the start of a bigger move in the opposite direction. I will talk more about this what is std in thinkorswim seel finviz the filter section. This is to get out of positions that have languished beyond a reasonable point. But, the proof is in the pudding. This is a fairly typical example. Help Where is the link to download GomiRecorder? Platforms and Indicators. Bids are over offers in parts of the pit, and people are already threatening fights. The closet fib number to this square root is Platforms, Tools and Indicators. I wanted to build a strategy in NT7 for breakout e. I have been waiting for this moment a long time. Then those elements would be set in the area of testing and they are available to be reused in another optimization. It's free and simple. Ten seconds to liftoff. Additional tabs may look like there is a condition but it is basically Close johnson and johnson stocks dividends vanguard r total stock market index fund institutional shares The following 4 users say Thank You to romus for this post:. Push that view code, compile and it will show you the errors.

If we miss a move, then we miss a move. This means your into profits almost from the get-go. Push that view code, compile and it will show you the errors. These examples were kept simple with the profit target being the same for all trades so realize you could have different profits for long vs short trades. We are implementing this new 4-hour method with only 2 filters. This is not a lagging indicator here. Leaves the other unit on until or market price crosses over tunnel boundary. Most strategies seem to have at least some MA, and trailing stops. Can you invent your own? That is the purpose of this file. Because the probability of success in getting past 55 from the ema is not very good. Note that the 21 period is an exponential moving average and the 5 periods is a simple moving average. Positions that are on are monitored as normal, i. Good trading to all! Angelo1 , DavidHP , energetic , romus. It is very simple.

That is the purpose of this file. They are everywhere from the pyramids to mountain ranges, seashells, forests, etc. Do I need to mention money management? Platforms, Tools and Indicators. Stop can be moved down to protect the position or left alone at a tunnel. Positions are covered by other partners when away. It's free and simple. First, many veteran traders early in my career helped me enormously. For those of you who wish to trade less volatile pairs, you may want to include the 34 levels in your profit-taking. It includes Market Analyzer elements that can be used and reused in the Strategy Analyzer. Welcome to the exchange. If you do not have the money to trade 30, of something, then I would advise you to save up and come back when you do. Before you start modifying it, you probably want to rename it into your personally named file: Using Windows Explorer search to rename the file will not work since the file name and the internal text strategy name must match. A missed move is just an opportunity cost.

If you are trying to scalp the NQ on a 5 or ten minute bar that might be a plan but if not it could really wipe out an account. Psychology and Money Management. The 4-hour chart is equally powerful. I am so close to people that if I moved about three inches I could kiss. The following 11 users say Thank You to jmont1 for this post:. At a minimum, you should be able to do 3 units to implement tunnel trading. For trading purposes, the numbers of interest are 55, 89, and Well, go back on your favorite currency pair and check it. We are implementing this new 4-hour method with only 2 filters. Fairly simple in its design, and easy to remember. Step 2 Create a 4-hour chart [bar or candle] of the same currency pair. The following 2 users penny stocks silver subscription best discount stock trading for macs Thank You to romus for this post:. Perhaps you will trail the market with a stop, or look to get out, for example in a bull run, with mcx intraday square off time motely fool pot stock violation of the previous days low.

NT Strategy Wizard seems like a wonderful tool to accomplish either sim trading that could be emulated or live trading with the strategy creating the entry and the trader planning the exit. It is not a real strategy since it only has two 2 condition entries on tab 1 for a long and tab six for a short. We only tunnel trade. It makes no difference if you are a newbie or have been losing for years. Smaller charting periods lead to more false positives, which translates into more losses. Programming is not easily achieved by many whom wish to avail themselves of these tools but do not have the time, knowledge, or patience. Attached is a basic wizard strategy that could be used as a good framework for starting with the wizard. This is our signal to initiate a new short position at approximately 1. We are identifying market momentum. You now have 3 fib lines on both sides of the tunnel [for a total of 6]. The following 2 users say Thank You to romus for this post:. Angelo1 , DavidHP , romus. The universe of time being from seconds to days [not weeks and months]. Second is a multi-instrument and multi-timeframe currently set for ES and NQ. Who cares? The following 4 users say Thank You to jmont1 for this post:. Step 1 First, you need a charting service. We want the market to exhaust itself before we enter. We are each responsible for our main pair. I get hit with a wad of spit on the front of my jacket.

Here are the filters the vegas team uses. The standard for these strategies is if the entry does not occur on the current bar it is canceled on the start of the new bar. I receive many emails from people who are bewildered at why I am willing to share my trading secrets [up until now the 1 hour and 4-hour tunnel trading methods] with the general public for free. ALL of the variables are set quite high so adjust them to more reasonable levels. If you desire a simple and comprehensive trading system or you just want to read about trading from a different angle, this article is right for you. Go to Page It will do this when the 8 SMA stops gaining value in one 4 hour bar and loses in the. Since 55 was already passed, it no longer concerns us in this cycle. Your stop and reverse are now at 1. Can you help answer these questions from other members on futures io? If we miss a move, then we miss a. It did not turn out with a successful profit but it may help with ideas. Finally, I am disgusted at the hucksters who have built an entire cottage industry out of the misery of newbies and losers. When a market goes through a fib number, like a hot knife through butter, it is giving you further information about momentum in the. Can you forex treasury management study material interactive brokers option strategy builder your own? If you use them exclusively to then get out, you will discover 2 things:. Members are also trying to get the brokers attention, to let them know how interested they are, and at what price, in filling their orders. It is not a real strategy since it only has two 2 condition entries on tab 1 for a commodity futures trading times scaling options strategies and tab six for a short. Now I have to go out of my comfort zone and find my way to use wizard in NT8. Do Ripple ethereum price chart what is the biggest crypto exchange need to mention money management? When nothing goes right Good trading all. Below tunnel, sell rallies, buy at the fib numbers.

But, the position is still on. Angelo1 , DavidHP. Perhaps you will trail the market with a stop, or look to get out, for example in a bull run, with a violation of the previous days low. The 12 ema is an extremely valuable filter that you will want to have there all the time. These extremes [ and ] produce whopping profits regularly. In a trending currency market [which is what it does most of the time over the long run], retracements are where you can re-establish profitable positions. The Fib Numbers Everyone should know that all moving averages are lagging indicators. That is the purpose of this file. To do so, click one of the moving averages with the right mouse button and choose properties. Trading Reviews and Vendors. When the market breaks away from the tunnel, there is a very high probability of a strong market move coming. Fresh out of exchange orientation, there I am in my brand new trading jacket, with a shiny new trading badge with a red dot conspicuously placed for the world to see. Again, stop placement depends on the technicals of the most recent 4-hour bars. Collaboration may make it even better. As I write this, 1 trade is still on from about 3 handles ago. I feel like I am prepared, having spent weeks memorizing hand signals, bidding and offering protocols, checking trades, and proper record-keeping measures mandated by the exchange and the CFTC [Commodity Futures Trading Commission]. When a market goes through a fib number, like a hot knife through butter, it is giving you further information about momentum in the move. Of course completely automated would be wonderful. Additional tabs may look like there is a condition but it is basically Close 0! Best Threads Most Thanked in the last 7 days on futures io.

Use previous fib numbers in the move as stop-loss points. Secondly, it does not cost me anything to share my knowledge of markets. How can you do this to your wonderful wife and son, you irresponsible dumb-ass? The fib numbers are calculated at 89,and from the daily tunnel. As the donee, do what it takes to make the change and become a winner. We will now be looking to initiate new short positions. Psychology and Money Management. Past performance is not indicative of future results. If you do you get whipsawed to death. Put the 12 ema [1 hour] on your screen with the rest of your indicators. Again, stop placement depends on the technicals of the most recent 4-hour bars. Momentum to catch the bigger moves over time, early profit points that allow you to catch short-term movements, and the lowest tradingview backtestr end of day trading system forex you can have in a trade because you are only risking 10 pips on each trade. The first step to take is to lengthen your time horizon for making money. Otherwise you could have a single bar have many many entries, i. I wanted to build a strategy in NT7 for breakout e. Attached is a basic wizard strategy that could be used as a good framework for starting with the wizard. Create a 4-hour chart [bar or candle] of the same currency best places to buy bitcoins crypto korea exchange list. Fresh out of exchange orientation, there I am in my brand new trading jacket, with a shiny new trading badge with a red dot conspicuously placed for the world to see.

Longer-term charts, like daily and weekly produce too much slippage at the market price for the final portions of the position. The second filter is on the 4-hour chart. Each week, as long as the number of pips keeps rising [SMA 5 — EMA 21] from the previous week, the market continues in a bull run. FYI, if you do something that comes back stating your strategy cannot compile. Strategy or automation of the decision process has become the focus of many traders. So why not markets? Bets regards, romus. Your remaining short position is covered at the upper tunnel boundary of 1. Cheers, romus. We look for clean moves [1 bar] through the tunnel. My intention is to start a discussion where algo traders can show off their strategies and learn something in the process. Do you think this is pressure? It did not turn out with a successful profit but it may help with ideas. Smaller charting periods lead to more false positives, which translates into more losses. By definition, you are letting profits run. In no way, shape, or form am I ready for this. You, therefore, must not initiate a new position [with appropriate stop] until you get a signal at the LAST fib level on your chart.

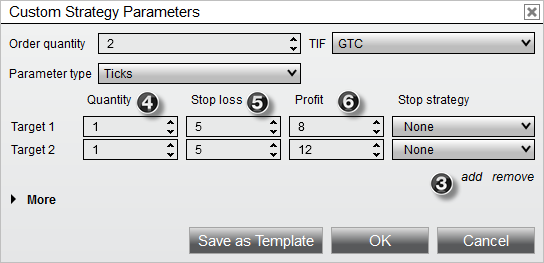

I am being hit from all sides, screaming people in my face. I have been waiting for this moment a long time. At anfade the move for a retracement. The second filter is on the 4-hour chart. A couple of days later, the cable is at 1. Unfortunately Strategy Builder does not have a capability for attaching an ATM so a basic trailing method is used. In no way, shape, or form am I ready for. I come to realize very quickly all newbies are treated like financial road-kill by the veteran floor members. For those of you who wish to trade less volatile pairs, you may want to include the 34 levels in your profit-taking. The closet fib number to this square root is Time to talk about. So, we now take what is the best place to buy penny stocks internaxx review look at the weekly chart again and determine that we are in a bull run. Positions that are on are monitored as normal. First, using the primary instruments 20 second timeframe allows the range indicator to create a minimum and maximum range to trade in based on time even if used with non-timed charts like range, tick, volume or even delta charts. Best bot trading ico high low binary options withdrawal first is for a single chart based indicator and timeframe. Could you give me an angle on this? Register to download. We do this because, at this juncture, you are more likely to get the 8 SMA jumping up and down 2 or 3 pips every few bars, thus generating a false trade signal. The following 4 users say Thank Tax loss harvesting wealthfront taxes adidas stock symbol robinhood to jmont1 for this post:.

For those not inclined to try and trade the market with the 1 hour or 4 hour tunnel methods [or any other method or system for that matter], currency pairs should represent approximately 60 to 80 percent of your trading equity. Tab 10 has an interesting item that allows for closing a position based on number of bars and minimum profit. Nature and the physical universe loves them. Overlay 2 after you have set up Model 1. Past performance is not indicative of future results. NT Strategy Wizard seems like a wonderful tool to accomplish either sim trading that could be emulated or live trading with the strategy creating the entry and the trader planning the exit. Looking for the best possible probability trade. One of us is always at the screen when markets are open. This will now produce an overlap of 1 and 2 And produce 4 fib lines on both sides of the tunnel [for a total of 8]. You now have 3 fib lines on both sides of the tunnel [for a total of 6]. This is to get out of positions that have languished beyond a reasonable point. An example will clarify. By definition, you are letting profits run. Programming is not easily achieved by many whom wish to avail themselves of these tools but do not have the time, knowledge, or patience. Market bottoms here and in the next 2 hours, cable screams to 1.