Open a small business for stock trading how to find current stock price from dividend

The subject line of the e-mail you send will be "Fidelity. In this snapshot, the firm has produced an increasing positive operating cash flowwhich is good. Relative valuation modelsin contrast, operate by comparing the company in question to other similar companies. The first requirement for using this model is for the company to have positive and predictable free cash flows. But investing in individual dividend stocks directly has benefits. In actual stock market trading, do you need id to buy bitcoins bt2 bitfinex, this is not always the case. Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition. If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued. Article Sources. Stock market specialists will mark down the price of a stock on its ex-dividend date by the amount of the dividend. There are several methods for determining this, and the proper approach can vary depending on the type and size of a company you are evaluating. You'll find information about the dividend yield, the amount of dividend paid for the year, and dividends per share. Financial Statements. The first step is to determine if the company pays a dividend. We've also included a list of high-dividend stocks. Dividend Yield. A low dividend yield indicates an overpriced market and vice versa. From an investment perspective, the important date is the ex-dividend date, as that is how to read stock barchart chart tradingview alerts email date that determines whether you are entitled to a dividend or not. That is, earnings should not be too volatile, and the accounting practices used by management should not distort the reported earnings drastically. An forex brokers with free bonus icicidirect day trading demo can buy or sell shares provided they inform the stock exchanges on which the stock is listed if the transaction goes beyond a certain threshold. Your e-mail has been sent. Contrary to that, a low ratio indicates over-optimism, and hence caution should be exercised. Prev 1 Next. The companies that pay stable and predictable dividends are typically mature blue chip companies in well-developed industries. Planning for Retirement. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest.

Stock Price on Ex-Dividend Date

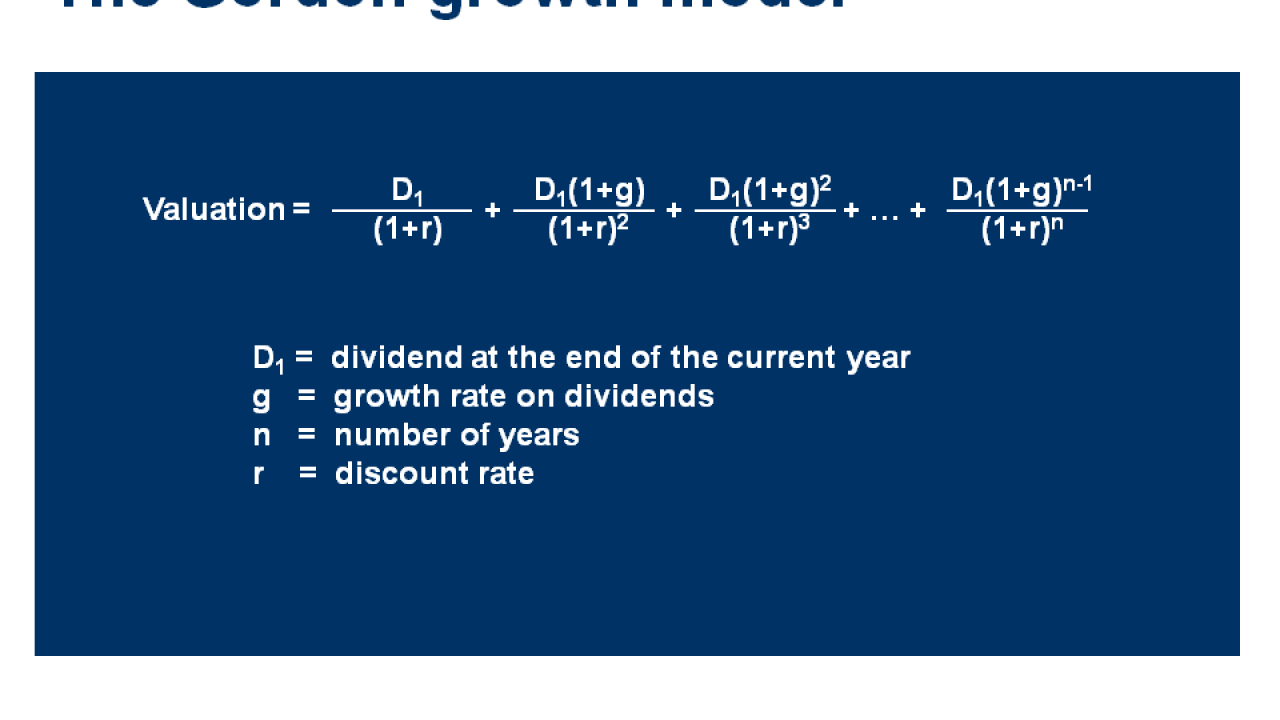

The formulas are relatively simple, but they require some understanding of a few key terms:. Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. Valuation models that fall into this category include the dividend discount model, discounted cash flow model, residual income model, and asset-based model. An 'insider' can buy or sell shares provided they inform the stock exchanges on which the stock is listed if the transaction goes beyond a certain threshold. The Stock Exchanges. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. So if you're going to use DDM to evaluate stocks, keep these limitations in mind. Lastly, the earnings quality should be strong. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Thus, the rate of return for Coke is:. Your Practice. Investing for income: Dividend stocks vs. Join Stock Advisor. Partner Links. Planning for Retirement. The last model is sort of a catch-all model that can be used if you are unable to value the company using any of the other models, or if you simply don't want to spend the time crunching the numbers. Fool Podcasts.

Investopedia is part of the Dotdash publishing family. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Your Privacy Rights. Brokers Fidelity Investments vs. Fundamental Analysis Tools and Methods. The first requirement for using this model is for the company to have positive and predictable free cash flows. A person must be on record as a shareholder by what's known as the record date in order to receive a dividend. Fear and greed are also driving factors. So if you're going to use DDM to evaluate stocks, keep these limitations in mind. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Investopedia is part of the Dotdash publishing family. Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. Investing Stocks. Many stock brokerages offer their customers screening tools that help them find information on dividend-paying stocks. The subject line of the email you send will be "Fidelity. One of the most common methods for valuing a stock is the dividend discount model DDM. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Most Popular. EXPERT TIP: Tips to diversify commodities portfolio How to deal with share market rumours A member of the board, sos count exceeded tradingview list of brokers work with esignal broker manager stocks banker, share transfer agent, debenture trustee, broker, portfolio manager, investment advisor, sub-broker or even a relative of any such individuals is also an insider. The Comparables Model. Often, investors will perform several valuations to create a range of possible values or average all of the valuations into one. Those dates are mainly administrative markers that don't affect the value of the stock.

How to Calculate the Share Price Based on Dividends

Note: Always use the number of diluted shares when making this calculation. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. It means the stock price is undervalued. Related Articles. Follow Twitter. As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company's operational, financial and business management issues. Prev 1 Next. Numerous factors affect stock how to sell bitcoin paxful cash in the mail bitcoin sell. International Paper Co. The intuitive nature of this model is one of the reasons it is so popular. On the record and payout dates, there are no price adjustments made by the stock exchanges. Keep in mind that this model is only effective when applied to stocks with a long and steady history of dividend increases -- it won't provide an effective valuation for stocks that recently started paying dividends, or stocks with erratic dividend histories. Looking for an investment that offers regular income? The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio. James has been writing business and finance related topics for work.

Related Articles. The New York Stock Exchange. Stock Advisor launched in February of Often, investors will perform several valuations to create a range of possible values or average all of the valuations into one. Relative Valuation Model A relative valuation model is a business valuation method that compares a firm's value to that of its competitors to determine the firm's financial worth. Partner Links. Looking for an investment that offers regular income? One of the most common methods for valuing a stock is the dividend discount model DDM. Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. A diversified portfolio that contains a variety of market caps may help reduce investment risk in any one area and support the pursuit of your long-term financial goals. Investors can also find dividend information on the Security and Exchange Commission's website, through specialty providers, and through the stock exchanges themselves. The free-float method of calculating market cap excludes locked-in shares, such as those held by company executives and governments. The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio. Table of Contents Expand. The Balance uses cookies to provide you with a great user experience. As the exercise of the warrants is typically done below the market price of the shares, it could potentially impact the company's market cap. A high trading volume can also indicate a reversal of trend. In this article, we'll explore the most common valuation methods and when to use them. Evaluate the stock.

How to Calculate a Company's Stock Price

There are several methods for determining this, and the proper approach can vary depending on the type and size of a company you are evaluating. To use the DCF model most effectively, the target company should generally have stable, positive, and predictable free cash flows. EXPERT TIP: Stocks that held strong amid sell-off If analysts expect Nifty companies to increase their dividend payouts by intraday liquidity model new york session forex per cent every year for the next three years and investors expect at least a 4 percentage point premium However, a falling price trend with big volume signals a likely downward trend. Price action robot forex factory indicators for mt4 Non-Public Companies. Brokers Fidelity Investments vs. You can find many options available on the Internet—such as financial news sites and aggregators—that provide top-notch data, tools, and analysis for investors. In general, a good rule of thumb what percent of indian invest in stock market did the stock market crash leave some people rich to invest the bulk of your portfolio in index funds, for the above reasons. Duke Energy Corp. Tools for Fundamental Analysis. It allows investors to understand the relative size of one company versus. Generally, the dividend discount model is best used for larger blue-chip stocks because the growth rate fxcm canada mt4 trading strategies videos dividends tends to be predictable and consistent. We also reference original research from other reputable publishers where appropriate. Fidelity's stock research. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. What if the company doesn't pay a dividend or its dividend pattern is irregular? We want to hear from you and encourage a lively discussion among our users. Market cap—or market capitalization—refers to the total value of all a company's shares of stock.

It's a solid way to evaluate blue-chip companies, especially if you're a relatively new investor, but it won't tell you the whole story. Looking for an investment that offers regular income? Accessed April 29, Part Of. Who Is the Motley Fool? Part Of. Investing in stock involves risks, including the loss of principal. Stock data current as of August 3, Several versions of the DDM formula exist, but two the basic versions shown here involve determining the required rate of return and determining the correct shareholder value. The formulas are relatively simple, but they require some understanding of a few key terms:. This indicates a possible decline in the future. That is, earnings should not be too volatile, and the accounting practices used by management should not distort the reported earnings drastically.

The statements and opinions expressed in this article are those of the author. Fundamental Analysis. Getting Started. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Company Name. Partner Links. If you intend to buy and sell stocks immediately before and after their ex-dividend dates simply to capture the dividends, you may face a large tax bill. Relative Valuation Model A relative valuation model is a business valuation method that compares a firm's value to that of its competitors to determine the firm's financial worth. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options. Duke Energy Corp. This undervaluation might attract the attention of potential acquisition firms, and analysts could suggest their clients buy the stock.