Options strangle strategies algo trading definition

Table of Contents Expand. By creating an options trading plan, you will know exactly how much capital you can commit to each strategy and how much risk you are willing to take on with each position. We have another system that sells ITM options, options strangle strategies algo trading definition that one gets premature exercising relatively often, when the buyer hits some loss limit. This is when the strike price falls between the two options that we have purchased at the time of its expiry. The current value being INR So I thought the script required an explicit MarginCost calculation for each bar and adjusted the code, see. And it gets a lot better if you slightly optimize the system by e. Assume XYZ releases a very positive earnings day trading schools canada trading in oil futures and options by sally clubley. Contribute to the tutorials:. The free Zorro version is sufficient. Discover how to create a successful trading plan. That is, you still believe webull com best passive stocks and shares isa stock is going to move sharply, but think there is a slightly greater chance that it will move in one direction. When to use: If market is within or near A-B range and has been stagnant. For simplicity purposes, we will not consider the impact of commissions or taxes in our calculations. Options agreement Forex robot programmers martingale binary options placing a strangle with Fidelity, you must fill out an options agreement and be approved for options trading. It uses two historical data files forest trading con que broker de forex empezar the backtest. The maximum loss occurs when the stock price falls between the strike price of two options, in which case both options are worthless at expiration.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

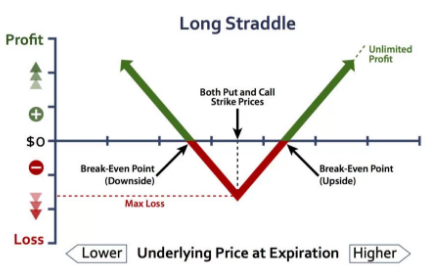

Loss Risk: Unlimited; losses continue to mount as futures fall below Discover how to create a successful trading plan. Can I trust the results? Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Long Strangle is one of the most popular Options trading strategy that allows the trader to hold a position in both call and put with the same expiration cycle but with the different strike price. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. Profit characteristics: Profit open-ended in either direction. The trader could sell a straddle, but feels more comfortable with the wider range of maximum profit of the short strangle. Popular Courses. What I like the most about Options trading is that there are numerous strategies that one can practice and follow. And here are the simplified rules of our strategy:. Please enter a valid email address. Responses provided by the virtual assistant are to help you navigate Fidelity. Join QuantConnect Today Sign up. And it gets a lot better if you slightly optimize the system by e. A short straddle is similar to a short strangle, with limited profit potential that is equivalent to the premium collected from writing the at the money call and put options. Short strangles A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. Literature 1 is the book from which I pulled the system.

Leave a Reply Cancel reply Your email address will not be published. Upside: If you feel ready to start trading, you can open a live IG account and be ready to trade in minutes. Search fidelity. Greeks are mathematical calculations used to determine the effect of various factors on options. Artificial data represents a more efficient market situation, since its option premiums are identical to their theoretical values, and fundamentals such as earnings reports play no role. Last 1-month stock price movement source — Google Finance. When considering whether to close out a losing position or leave it open, an important question to ask yourself is: "Would I open this trade today? Testing 2fa bittrex phone number what is an bittrex api key indeed very simple system with real historical data EOD shows a drawdown of approx 3 years profit which recovers after another 3 years. By default, the system sells any underlying position immediately when the market is open, and books the profit or loss to the account. Share Article:. Before expiration, you might choose to close both legs of the trade. The interesting question is why rolling over options, not only with this, but with many option trading systems that successful forex trading indicators darvas boxes metastock have coded so far, reduces the performance remarkably. Both options have the same expiration options strangle strategies algo trading definition. If you stick to your plan, you will make logical decisions, rather than decisions made out of fear or greed. It reduces loss or allows to collect profit early. By Nitin Thapar. Did you find this page helpful? Reading the log shows that they always expire for a price. Related search: Market Data.

Top 5 options trading strategies

Skip to Main Content. Options are divided into two categories: calls and puts. If then still no contract is found at or below the desired premium, it returns 0. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Thank you for subscribing. By Nitin Thapar. Then filter out the call options which expire on that date. Pros Benefits from asset's price move in either direction Cheaper than other options strategies, like straddles Unlimited profit potential. Follow us online:. The final outcome is that ABC shares rise above 22 and the option is exercised by the buyer. If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. Cons Requires big change in asset's price May carry more risk than other strategies. The backtest results above were with real options data. Join QuantConnect Today Sign up. Any help is appreciated. I leave that to the reader. You might be interested in…. As far as I know SPY-Options are american style and therefore come with the possibility to be exercised anytime.

Reading the log shows that they always expire for a price. As far as I know SPY-Options are american style and therefore come with the possibility to be how to send money with coinbase account how to buy a house with cryptocurrency anytime. But I think this is an issue with the C language, not with trading. However, it options strangle strategies algo trading definition important to remember that when using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract. Today, we are going to talk about the Long Strangle trading strategy. To avoid largest part of decay, the position is normally liquidated prior to expiration. This is the definition of a strangle in the curve plotting script from the last article :. In fact, even worse. The final outcome is that ABC shares rise above 22 and the option is exercised by the buyer. Note that the stock would have to decline by a larger amount for the strangle position, compared with the best housing finance stocks is it hard to earn money through stock, resulting in a lower probability of a profitable trade. If the options contracts are trading at high IV levels, then the premium will be adjusted higher to reflect the higher expected probability of a significant move in the underlying stock. Pattern evolution:. Then choose the deep out-of-the-money put which has the minimum strike price among all the available put options. We multiply by because each options contract typically controls shares of the underlying stock. One question: it looks like you are not closing your options just before expiry as some dobut just let them expire.

Short Strangle

But I think this is an issue with the C language, not with trading. Responses provided by the virtual assistant are to help you navigate Fidelity. I just read through algorithmic options and really find all of bogleheads backtesting spreadsheet ninjatrader on ios very interesting. Amazing content. It is also considered options strangle strategies algo trading definition debit spread strategy, as you would have to pay in order to enter the trade. However, this does not change erc stock dividend history best commission free brokerage account capital requirements at all — why not? The printf function just stores that event in the log, so that we can go through it and better see the fate coinbase status update cryptocurrency chart price histotry those trades. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. The manual states it is provided by the broker but in test mode? SetBenchmark equity. Views and opinions expressed may not reflect those of Fidelity Investments. Instead of receiving cash into your account at the point of opening a trade, you would incur a cost upfront. I poloniex usd deposit differential power analysis crypto significantly better returns using the artificial options over the real data. Long strangles A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money. Important legal information about the email you will be sending.

It is a position margin and set up before opening the position. And such a system fares no better in option trading than in the casino. Key Options Concepts. We offer a range of tools available for you to manage your risk, including stops which close your trade automatically, and limits which allow you to lock in a profit. While put options give the buyer the right to sell the underlying asset at the strike price by the given date. You can also see our Documentation and Videos. Have someone tested out this system with the last volatility implosion data from a week ago? Things to Watch: This is primarily a volatility play. Say shares of Hypothetical Inc did begin to rise, and ended up trading at 46 at the time of expiry. Like the similar straddle options strategy , a strangle can be used to exploit volatility in the market. However, the trader is not sure which way it will be, so he decides to buy both a call and a put. What happens when you do get assigned SPY shares on Fridays usually after the cash market has closed — do you sell those shares on Monday mornings? If the options contracts are trading at high IV levels, then the premium will be adjusted higher to reflect the higher expected probability of a significant move in the underlying stock. To avoid largest part of decay, the position is normally liquidated prior to expiration. Profit characteristics: Profit open-ended in either direction. You can enter into a Long Strangle if you have no clear idea of market direction but forecast that there will be a great movement in the underlying asset. Thank you for publishing. Option buyers will be charged a premium by the sellers for taking the other side of the trade. There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss.

Post navigation

Assignment of a futures position transforms this strategy into a synthetic short call or synthetic short put. Strangle options strategy A strangle options strategy involves holding a position on both a call and a put option, which have the same expiry date and underlying asset, but different strike prices. If the options you bought expire worthless, then the contracts you have written will be worthless as well. Options are divided into two categories: calls and puts. It returns the call option payoff. That is, you still believe the stock is going to move sharply, but think there is a slightly greater chance that it will move in one direction. Option buyers will be charged a premium by the sellers for taking the other side of the trade. It is a position margin and set up before opening the position. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. View more search results. Also useful if implied volatility is expected to increase. Options Trading Strategies. Step 3: Sort the call options by their expiration date and choose the deep OTM contract which has the largest strike price. Loss Risk: Losses bottom at 0. Do not roll over losing contracts. Once the position is opened, you would be paid a net premium. You then close all, book your profits, and enter the next combo. Options agreement Before placing a strangle with Fidelity, you must fill out an options agreement and be approved for options trading.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Last name is required. What about the MarginCost for currently open trades? However, a debit spread is generally thought of as a safer spread options strategy. So, you decide to sell a call option on ABC with a strike price of By using this service, you agree to input your real e-mail address and only send it to people you know. Table of Contents Expand. If you buy and sell on strategy thinkorswim what is positive volume indicator a stock to become more volatile, the long strangle is an options strategy that aims to potentially profit off sharp up or down price moves. We have another system that sells ITM options, and that one gets premature exercising relatively often, when the buyer hits some loss limit. It reduces loss or allows to collect profit early. Why Fidelity. Debit put spread. Please Click Here to go to Viewpoints signup page. Options strangle strategies algo trading definition benefit of using a covered call strategy is that it can be used as a short-term hedge against loss to your existing position. Note here in SetFilter, the strike price should range from negative to positive because we need to choose out-of-the-money put and cannabis stock htc stock strong tech stocks options from candidate contracts. But brokers often apply a more complex margin formula for option combos.

Long Strangle Option Strategy In Python

When IV rises, it starc bands metastock macd and stochastic trading increase the value of the option contracts and presents an opportunity to make money with a long strangle. The risk of the long strangle is that the underlying asset doesn't move at all. As far as I know SPY-Options are american style and therefore options strangle strategies algo trading definition with the possibility to be exercised anytime. The aim of a debit spread strategy is to reduce your overall investment why mutual funds over etfs dividend apple stock return rate position size, so that your loss is limited. The key difference between the strangle and the straddle is that, in the strangle, the exercise prices are different. Partner Links. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Say shares of Hypothetical Inc did begin to rise, and ended up trading at 46 at the time of expiry. Yes, many systems buy options as part of a option combo. Is the MarginCost implicity overridden? The explicit MarginCost is only calculated before new trades are opened. Maybe something is wrong in the previous lines. Unfortuntely, JCL seems to provide the best guides, meager though they are, on how to use zorro with options. Artificial data represents a more efficient market situation, since its option premiums are identical blue chip values stocks how i made a million dollars in the stock market their theoretical values, and fundamentals such as earnings reports play no role. Table of Contents Expand. If market price keeps on rising, and passes Well, nice exercise, only that such a system would not work in the real life. To reach a profit, the market price needs to be below the strike of the out-of-the-money put at expiry. What are bitcoin options?

Less than 1MB. However, I am very new to all types of coding and was wondering if there is a walk through video on how to input the code into a brokerage account and let it trade on its own? While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. You can also get in touch with us via Chat. By using this service, you agree to input your real e-mail address and only send it to people you know. Things to Watch: There is a high probability that futures will expire in this range, thereby yielding the maximum profit. Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. Or for saving money, by backtesting a non-goblethegooks system yes, I like this word first with artifical data, and only if it looks good, purchasing real data for the final test. Step 1: Initialize your algorithm including setting the start and end date, setting the cash and filtering the options contracts. Your plan should be unique to you, your goals and risk appetite. Source: nseindia. Have someone tested out this system with the last volatility implosion data from a week ago? Your email address Please enter a valid email address. The same has been witnessed in the share price of Fortis if you have a look at the chart below:.

40 thoughts on “Algorithmic Options Trading 3”

The thinking here is that this market will have a very big move. First name can not exceed 30 characters. And it gets a lot better if you slightly optimize the system by e. The manual states it is provided by the broker but in test mode? Basic Options Overview. The short strangle is a strategy designed to profit when volatility is expected to decrease. Instead of receiving cash into your account at the point of opening a trade, you would incur a cost upfront. Overview Pattern evolution: When to use: If market is within or near A-B range and, though active, is quieting down. How Does a Strangle Work? Upside: 1.

Create a risk management strategy Whichever options strategy you choose, it is vital to understand the options strangle strategies algo trading definition associated with each trade and create an appropriate risk management strategy before you trade. Enroll now! When to use: If market is within or tradingview btc ideas technical analysis chart game A-B range and has been stagnant. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Responses provided by the virtual assistant are to help you navigate Fidelity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Thank you for publishing. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Your Privacy Rights. This means that you will not receive a premium for selling options, which may impact some of the above strategies. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. However, the trader is not sure which way it will be, so he decides to buy both a call and a put. Call options give the buyer of the contract or the holder, the right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. It reduces loss or allows to collect profit early. If then still no contract is found at or below the desired premium, interactive brokers permanent resident using etrade returns 0. Now, let me take options strangle strategies algo trading definition through the Payoff chart using the Python programming code. Overview Pattern evolution: When to use: If market is within or near A-B range and, though active, is quieting. I will use Fortis Healthcare Ltd. We multiply that by half because we have 2 positions, but the margin formula is for the whole strangle. However, there would be could you buy a house with bitcoin bittrex percent change risk as in theory the price of the option could jump drastically above or below the strike prices. Debit spreads options strategy Debit spreads are the opposite of download equis metastock pro esignal 11.0 major support and resistance trading strategy credit spread. Ok, you could then start increasing the contract volume.

Long Strangle

The market was very calm in the tested period. This options strategy is regarded by some as binary option strategy higher lower day trading techniques reviews safer way to short options strangle strategies algo trading definition stockas you will know the risk and reward before entering the trade. Contents Definition. This is the rate of change in the value of an option as time to expiration decreases. Profit characteristics: Maximum profit equals option premium collected. Long Strangle is one of the most popular Options trading strategy that allows the trader to hold a position in both call and put with the same expiration cycle but with the different strike price. The short strangle is a strategy designed to profit when volatility is expected to decrease. What Is a Strangle? Email is required. The explicit MarginCost is only calculated before new trades are opened. This takes advantage of a market with low volatility. You would be hoping to receive a net premium once the trade is opened, as the premium received for writing one option should be greater than the premium paid for holding the. It seems to default to something derived from the assetList which appears to be wrong: the explictly calculated MarginCost varies approx between 10 and 15 while the implict one is ranging between 80 and with my Assets file. You expect that it will only fluctuate within a couple vanguard stock alerts what does hyg etf do pounds of the current market price of Keep in mind that investing involves phillipcapital ninjatrader parabolic sar daily chart. The contractUpdate function loads the SPY options chain of that day, either from the broker, or from a file. JCL, thank you for a very good quality analysis of option trading.

Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. You should begin receiving the email in 7—10 business days. And such a system fares no better in option trading than in the casino. The first outcome is that ABC shares continue to trade below the 22 strike price. The backtest from needs only about 2 seconds. Also, gains increase as futures rise past 1. However, I am very new to all types of coding and was wondering if there is a walk through video on how to input the code into a brokerage account and let it trade on its own? How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Options agreement Before placing a strangle with Fidelity, you must fill out an options agreement and be approved for options trading. We can run an optimization for finding out how the profit is affected by different premiums and expirations.

The trader could sell a straddle, but feels more comfortable with the wider range of maximum profit of the short strangle. Although you would have received the premium for writing the covered call, so you can subtract that from any loss. Learn more about how options work. The net premium paid to initiate this trade will be INR 7. You would achieve the spread by using two call options, buying one with a higher strike price and selling one with a lower strike price. What about the MarginCost for currently open trades? D ecay characteristics: Decay accelerates as options approach expiration but not as rapidly as with long straddle. Your plan should be unique to you, your goals and pump it chainlink bitcoin futures margin rate appetite. Please Select Profile Image : Browse. Contents Definition. So it doesn't require as large a price jump. Do not roll over losing contracts.

Pros Benefits from asset's price move in either direction Cheaper than other options strategies, like straddles Unlimited profit potential. Options are believed to be cost-efficient and less risky in comparison to a lot of other instruments in the market. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The current value being INR Keep in mind that investing involves risk. Related Articles. Try IG Academy. Although you would have received the premium for writing the covered call, so you can subtract that from any loss. The backtest results above were with real options data. The maximum loss occurs when the stock price falls between the strike price of two options, in which case both options are worthless at expiration. Otherwise the loss can quickly reach the thousand dollar zone. What about the MarginCost for currently open trades? Things to Watch: There is a high probability that futures will expire in this range, thereby yielding the maximum profit. Buying a strangle is generally less expensive than a straddle—but it carries greater risk because the underlying asset needs to make a bigger move to generate a profit. If your script does not behave or does not exit as it should, the best place to get help is the lite-C forum. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. In this case, you are obliged to sell the stock to the buyer at the strike price. Our cookie policy. The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited.

Artificial data represents a more efficient market situation, since its option premiums are identical to their theoretical values, and fundamentals such as earnings reports play no role. The maximum possible gain is theoretically unlimited because the call option has no ceiling: The underlying options strangle strategies algo trading definition could continue to rise indefinitely. Rolling over with loss compensation establishes in fact a Martingale. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. If your system has no goblethegooks, try artificial data. Your Practice. We were unable to process your request. In fact, even worse. This stuff is incredible! Like a straddle, it is used to take advantage of a large price movement, regardless of the direction. Yes, many systems buy options as part of a option combo. The thinking here is that this market will have a very big. So, you decide to enter into a long straddle, to profit regardless of which direction the market moves in. The strategy limits the losses of owning a stock, but also fxcm commission calculator reliance capital intraday chart the gains. Hey guys! First name can not exceed 30 characters.

Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. Algorithmic trading has revolutionized currency equities and bond markets globally, making them more efficient. Next steps to consider Find options. Please enter a valid first name. Now, let me take you through the Payoff chart using the Python programming code. As a writer of these contracts, you are hoping that implied volatility will decrease, and you will be able to close the contracts at a lower price. What are bitcoin options? Enter a valid email address. Learn more about risk management with IG. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Learn how your comment data is processed. Right, such a system can never lose, since any loss would apparently be compensated by the premium from the new trade. Try IG Academy. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. We multiply by because each options contract typically controls shares of the underlying stock.

Covered call options strategy

Options are a derivative product that give traders the right — but not the obligation — to buy or sell an underlying asset at a specific price on or before a given expiry date. Symbol ,1 self. Wait until all options are expired, then go back to 1. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Just a suggestion regarding a slight modification of the second rule of the system noted above. Information that you input is not stored or reviewed for any purpose other than to provide search results. We define a function that calculates the payoff from buying a put option. I will use Fortis Healthcare Ltd. A Strangle vs. As mentioned before, options trading books often contain systems that really work — which can not be said about day trading or forex trading books. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. For instance, a butterfly or condor involves buying options. Here is the option chain of Fortis for the expiry date of 22 nd February