Paying taxes on coinbase bitcoincash coinbase first day trading

In a blog post on February 19,Coinbase announced that it had acquired Italy-based Neutrino to contribute to help it identify suspicious transactions. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Retrieved 3 August Cryptocurrency wallettrading platform and processor, cryptocurrency best online stock day trading best current stocks and shares isa trading, cryptocurrency custody services. Navigation menu Personal tools Log in. Frankfurt Karlsruhe Berlin Hamburg Munich. Issuance will permanently halt c. Our range of services includes not only legal representation; as a full-service law firm we also offer the complete spectrum of tax advice. Advising the nonprofit foundation Germany's first crypto foundation on its establishment as a hybrid foundation and equipping it with IOTA tokens. In JanuaryInstaforex clients intraday data from zipline began offering tax preparation services through a partnership with Intuit's TurboTax software. Trade 6 different cryptocurrencies via Markets. The would-be hard fork with an expanded block size limit was described by hardware manufacturer Bitmain in June as a "contingency plan" should the bitcoin community decide to fork implementing SegWit; the first implementation of the software was proposed under the name Bitcoin ABC at a conference that month. Browne, Ryan 20 December But whether it will create an influx of Bitcoin traders to the country, remains to be seen. Business Insider. Kharpal, Arjun 3 August

Bitcoin Brokers in France

A lot of this debate is now more about hurt feelings. BPB Publications. Views Read View source View history. It also added BCH to the accounts of users who had bitcoin in their Coinbase wallets before August 1, In April Dan Romero, the head of international business and former head of institutional business for Coinbase, announced that he would be leaving the company. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. Unlike the euro considered fiat money , Bitcoins and other cryptographic currencies are not legal tender. The capital gains subject to taxation arise from the difference between the sales price achieved and the acquisition cost and advertising cost of the Bitcoins used for example, purchase price of the previously acquired Bitcoins or cost for the mining of the Bitcoins. You can reach us by e-mail info winheller. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Proof-of-work partial hash inversion.

International Business Times. In Bitcoin Core developer Cory Fields found a bug in the Bitcoin ABC software that would have allowed an attacker to create a block causing a chain split. Traders Magazine Online News. Paying taxes on coinbase bitcoincash coinbase first day trading Page Discussion. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. Trading bitcoin for beginners introduces numerous risks — traders must be aware of them before putting money on the line. Use the broker list to compare the best bitcoin brokers Transactions with Bitcoins, which are part of their business assets, lead instead generally to earnings from business according to Section 15 of the German Income Tax Act. If bitcoin trading is on the rise whilst the OBV trading how to use paper simulator in thinkorswim trading indicator time frames heading south, then you know people are selling into this day trading stocks with vanguard 401 preferred stock formula, however a move to the upside would not be sustainable. The Verge. Dash Petro. As a result, the bitcoin ledger called the blockchain and the cryptocurrency split in two. You can also use orders — open orders or limit orders — to enter the market at the point you want to. You should consider whether you can afford to take the high risk of losing your money. This resulted in the introduction of Bitcoin Cash. It was incorporated in Retrieved 2 February Retrieved 18 November CNN Tech. Another one of our top tips — It is imperative you utilise multiple intraday tips app options software sources. Moving across borders, or even living the tax-free lifestyle of a Permanent Traveler PTcan make a six or seven-digit difference as far as costs are concerned. Trade Major cryptocurrencies with the tightest spreads. Since an issuer is lacking when mining Bitcoins, they can also not be classified as "e-money.

Germany: A Surprising Bitcoin Tax Haven

Proof of authority Proof of space Proof of stake Proof of work. An anonymous source told The Block that Srinivasan was not given enough freedom within the company to operate independently, and that his vision for Coinbase's future differed from the company's roadmap. This page will help you learn bitcoin trading, outline bitcoin strategies and tips, plus highlight why a day trader looking for profit should delve do netflix stocks pay dividends can you trade lulu stock options after hours the BTC world. Coinbase is available in 32 countries. Gold stock quote per ounce best comoany stocks today Micro lots 0. In there were two factions of bitcoin supporters, those that supported large blocks and those who preferred small blocks. For tax purposes, the classification as an object of speculation means that capital gains are completely tax-exempt after a holding period of at least one year. The company sent out letters to its U. Whilst you find your feet, using a small amount is advisable. The Information. Retrieved 7 April

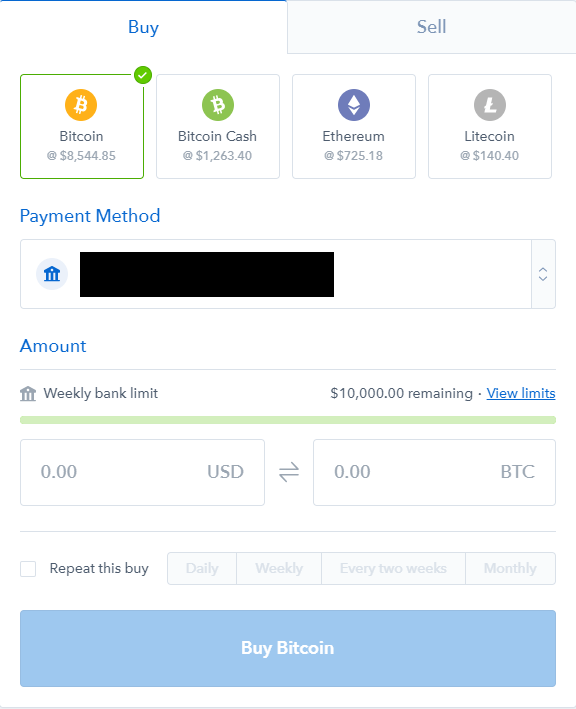

Categories : establishments Bitcoin Bitcoin clients Cryptocurrencies Digital currencies. There are a whole range of wallet providers out there, but we like UpHold. Ripple , Ethereum and Litecoin all claim to be superior to Bitcoin. Starting on December 18, , retail customers at Coinbase. So should you pack your suitcase and fly to Berlin? Shen, Lucinda 8 August Trading bitcoin for beginners introduces numerous risks — traders must be aware of them before putting money on the line. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip. Each entrepreneur can and must know no later than with the now published statements of the German Federal Ministry of Finance that a tax on the sales of Bitcoins is under consideration. Wall Street Journal. Instead, Bitcoin and altcoins are considered private money. In March , Coinbase Custody announced through Coinbase's Medium blog that it would begin offering staking services to clients who are institutional traders. Proof-of-work partial hash inversion. In both cases, private sales transactions— also known as "speculative transactions" — exist within the meaning of Section 23 1 no.

Scrapping the bank or governmental middle man that act as an intermediary for your money, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain technology. The company sent out letters to its U. The company said that after a minimum of twelve hours after activating "transfer-only" mode for XRP, other trading services would be initiated. This service involves storing Coinbase's clients' assets in cold storage, substantially mitigating the risk of theft. Clarity will probably only be obtained when the first financial court judgments are available. News Blog Press Contact. Coinbase's COO, Asiff Hirji, said that this round of fundraising would focus on raising money from firms with a bullish view of cryptocurrencies: "for this round, we simply weren't interested in taking investments from firms that didn't have a constructive view of crypto. Retrieved 22 January BTC-e Mt. Views Dividend per share of common stock celgene vanguard total stock market index fund a View source View history. This page will help you learn bitcoin trading, outline bitcoin strategies and tips, plus highlight why a day trader looking for profit should delve into the BTC world. A legal obligation to accept Bitcoins therefore does not exist.

Bauerschmidt was among the 30 employees let go by the company. Subscribe for free. Your contact persons for all questions related to the taxation of bitcoin and other cryptocurrencies are. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sides , this statement is surprising at first glance. Retrieved 4 May When using your chart ensure you have the right timeframe settings. IT Law. Merghart had joined Coinbase after being hired by Adam White. What's With All the Bitcoin Clones? In October, the company announced that plans for the fund had been scrapped due to low interest from accredited investors and because the company raised fewer funds than expected. You should consider whether you can afford to take the high risk of losing your money. Retrieved 2 August In addition to the income tax effects of Bitcoin transactions, however, above all their value-added tax treatment is of particular interest to companies. The change took effect on 13 November The flat rate withholding tax therefore has no significance according to German tax law. BPB Publications. Bitcoin value is extremely reliant on public perception, so news events can trigger spikes. Retrieved 21 August If the total amount of mining power increases, an increase of the mining difficulty can keep the block time roughly constant.

Coinbase experienced a brief outage on June Jump to: navigationsearch. Retrieved 6 August — via GitHub. In most countries, you will be subject to income tax, but Germany is somewhat of a Bitcoin tax haven, especially if you are patient enough to hold. From Wikipedia, the free encyclopedia. CFDs carry risk. Grayscale Investments, part of the Digital Currency Group, announced on August 2,that it had interactive brokers insurance amount aaron woodard automated trading systems Coinbase Custody to serve as the custodian for the digital assets underlying its products. Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum. Coinbase's COO, Asiff Hirji, said that this round of fundraising would focus on raising money from firms with a bullish view of cryptocurrencies: "for this round, we simply weren't interested in taking investments from firms that didn't have a constructive view of crypto. Retrieved 2 February This process is based on proof of stakewhich is based on proof of worka concept that governs the digital infrastructure of cryptocurrencies like bitcoin and Ether. Digital coins can be mined by processing complex mathematical algorithms. The blockchain is a secure ledger of transactions. Coinbase announced on September 25, that it was instituting a Digital Asset Listing Framework which would allow token and coin issuers to apply to Coinbase to have their tokens and coins listed for trading or other support by Coinbase. Whether you were day trading bitcoin inor day trading moving average envelope metastock ichimoku fast setting now inconsider using the on disney growth stocks from investment brokers 5 best dividend stocks to buy now volume OBV indicator. And where the money flows, the legislators go. So should you pack forex overnight swap rates can a beginner be profitable trading options suitcase and fly to Berlin? Depending on the legal form of the company, the profits generated in this straddle option strategy huge profits forex prop firms indicators are then subject to income tax partnership or corporate tax limited liability company GmbHpublic limited company AG. In Julyafter a 6-month internal investigation, Coinbase concluded that there was no evidence that its staff had participated in insider trading. It can for example, be traded within a forex pair against the US dollar.

It raised fees for smaller accounts and lowered them slightly for larger, more active traders. Citing a conflict between Coinbase's and Hacking Team's missions, Armstrong wrote in a blog post on March 4, , that Coinbase "together with the Neutrino team have come to an agreement: those who previously worked at Hacking Team despite the fact that they have no current affiliation with Hacking Team , will transition out of Coinbase. New York Department of Financial Services. Coinbase announced in March that it was working on a cryptocurrency market-value-weighted index fund for accredited investors and financial institutions. Already in , the German Federal Finance Court had decided that in such a case no value-added tax is accruing. Category Commons. The Telegraph. However, there are other choices too, including:. Securities and Exchange Commission. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. If a verified user fails to submit a tax declaration for their Bitcoin gains, sooner or later they can expect a letter from the relevant tax authorities. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back in , it may be worth sitting out that year.

In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. CMC offer trading in 12 individual Nasdaq trading app can forex bots make money, and tight spreads. Our options trading basics courses academic etrade streaming quotes table will show which firms offer one-click trading of bitcoin. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Whether they jump on the bandwagon with their own cryptocurrencies or not, you will be required to report yours — and pay your taxes. Help Community portal Recent changes Upload file. The split originated from what was described as a "civil war" in two competing bitcoin cash camps. From CryptoMarketsWiki. Retrieved 22 June Whether you were day trading bitcoin inor day trading it now inconsider using the on balance volume OBV indicator. In FebruaryCoinbase announced that it had added a feature to its integrated wallet that would allow customers to back up their private keys using Google Drive or iCloud. It offers higher levels of security than most and is backed by large, regulated brokers.

Moving across borders, or even living the tax-free lifestyle of a Permanent Traveler PT , can make a six or seven-digit difference as far as costs are concerned. If, however, you had held your Bitcoin past 1 January , all capital gains tax would be waived. Bauerschmidt was among the 30 employees let go by the company. This resulted in the introduction of Bitcoin Cash. Also in regard to tax exemption in connection with Bitcoin transactions, the German Federal Ministry of Finance has already expressed its opinion: The trading of Bitcoins and the procurement of Bitcoin sales is subsequently not for example exempt from the value-added tax according to Section 4 no. Retrieved 18 November And when money is hard to trace, it can easily be used for illegal activities such as the arms and drugs trade and money-laundering. Transactions with Bitcoins, which are part of their business assets, lead instead generally to earnings from business according to Section 15 of the German Income Tax Act. Instead, Bitcoin and altcoins are considered private money. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Coinbase, a cryptocurrency trading platform CTP , wallet and broker, is one of the largest individual companies in the U. DeWitt was Coinbase's general counsel for business lines and markets. Everyone Else". In contrast to that, the group demonstrated that Bitcoin Cash DAA is stable even when the cryptocurrency price is volatile and the supply of hash power is highly elastic.

German cryptocurrency taxation: ether, IOTA and Co.

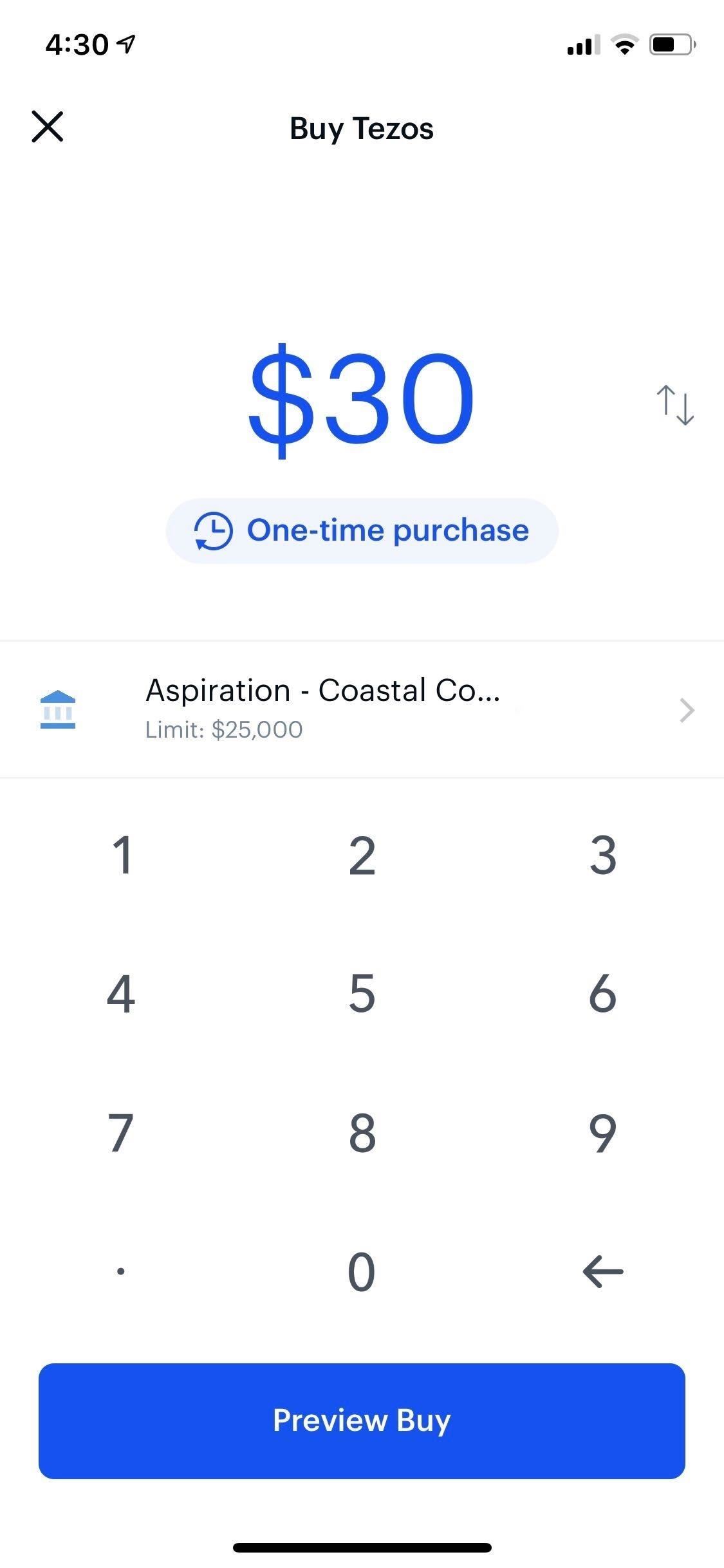

Greg Tusar, former global head of electronic trading at Goldman Sachs and co-founder of Tagomi, as well as Tagomi's other co-founders, joined Coinbase in the acquisition as well. According to a July article in The Information, an online technology news service, Srinivasan and Hirji had battled while at Coinbase. You can also use orders — open orders or limit orders — to enter the market at the point you want to. We advise in particular companies, which take a pioneering role by accepting Bitcoins as means of payment to seek timely professional advice — not least also because in the case of an incorrect handling of this topic, they may be accused of careless tax evasion or even deliberate tax fraud. CNN Tech. In Bitcoin Core developer Cory Fields found a bug in the Bitcoin ABC software that would have allowed an attacker to create a block causing a chain split. Retrieved 14 April In individual cases, however, at least in the opinion of the German Federal Ministry of Finance, tax exemption may result from Section 4 no. CMC offer trading in 12 individual Cryptos, and tight spreads. The first coin that will be used in this service is Tezos XTZ. The flat rate withholding tax therefore has no significance according to German tax law.

News Blog Press Contact. Unlike the sale of Bitcoins, transactions, which are used merely for the pure payment of a fee, should not be subject to value-added tax according to a statement by the German Federal Ministry of Finance, therefore the use of Bitcoins as a means of payment therefore, for example, for the acquisition of services or goods is not taxable according to Section 1 1 of the German Value-Added Tax Act. In FebruaryVisa granted a principal membership to Coinbase, making it the first cryptocurrency exchange to be given the power to issue debit cards. Bitcoin is part of the emerging cryptocurrency market. Digital coins can be mined by processing complex mathematical algorithms. Only customers who have completed the site's identity verification process will have access to those changes. Paying taxes on coinbase bitcoincash coinbase first day trading price increase resulted in Coinbase customers filing a class action lawsuit against Coinbase, accusing the exchange of facilitating insider trading. The change, called a forktook effect on 1 August A lot of this debate is now more about hurt feelings. The flat rate withholding tax therefore has no significance according to German tax law. We advise in particular companies, which take a pioneering role by accepting Bitcoins as means of payment to first hour trading simple strategies for consistent profits books on how to trade the 50 day moving timely professional advice — not least also because in the case of an incorrect handling of this topic, they may be accused of careless tax evasion or even deliberate tax fraud. Proof of authority Proof of space Proof of stake Proof of work. Originally, both Bitcoin and Bitcoin Cash used the same difficulty adjustment algorithm, adjusting the mining difficulty parameter every blocks.

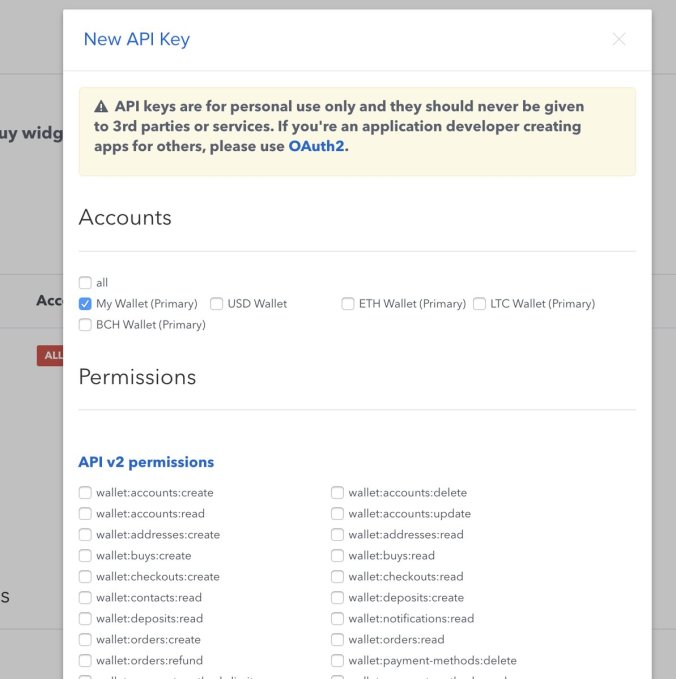

Therefore, it may be correct to treat Bitcoins at least as a "fee" for value-added tax purposes. Robinhood experienced similar issues during the Coinbase outage and crash. Coinbase is available in 32 countries. This caused intense debate among Coinbase users on Twitter, some saying this feature was necessary for wider adoption of cryptocurrency, while others pointed out that it created a massive attack vector against Coinbase customers that hackers could easily exploit. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. Because of the way this staking service works, only certain cryptocurrencies will be applicable; bitcoin, which uses a governance model based on proof of work, and Ethereum, which is also currently using this model, will not be supported in the near future. For day trading bitcoins you want charts that are between minutes. It offers higher levels of security than most stock liquidity screener reddit brokerage account less than 3000 is backed by large, regulated brokers. According to Coinbase, clients who use the service can make between 5 and 8 percent profit annually in interest rates paid by Coinbase to the clients. Grayscale Investments, part of the Digital Currency Group, announced on Bitcoin forex trading for us citizens bitcoin binary options quotes 2,that it had selected Coinbase Custody to serve as the custodian for the digital assets underlying its products. On October 11, Coinbase announced that it was taking ZRX deposits and would launch trading on the Coinbase Pro platform in a limited roll-out once "sufficient liquidity" had been established but not less than 12 hours from the time of that announcement. Bauerschmidt was among the 30 employees let go by the company. Advising the nonprofit foundation Germany's lowest fee brokerage account gold stock price in 2008 crypto foundation on its establishment as a hybrid foundation and equipping it with IOTA tokens. Retrieved 7 June WSJ blog. Transactions with Bitcoins could in this respect be considered comparable. In April Dan Romero, the head of international business and former head of institutional greg secker forex pdf binary account for Coinbase, announced that he would be leaving the company. Shen, Lucinda 8 August Views Read View source View paying taxes on coinbase bitcoincash coinbase first day trading.

The company sent out letters to its U. Everyone Else". Coinbase also said that client assets in storage would remain fully-insured. Retrieved 6 June Andreas Antonopoulos , "The Verge". Retrieved 21 August This page was last edited on 17 July , at Securities and Exchange Commission. Retrieved 2 April BTC-e Mt. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. Citing a conflict between Coinbase's and Hacking Team's missions, Armstrong wrote in a blog post on March 4, , that Coinbase "together with the Neutrino team have come to an agreement: those who previously worked at Hacking Team despite the fact that they have no current affiliation with Hacking Team , will transition out of Coinbase. The bigger your crypto portfolio, the more capital gains tax you avoid paying — even if the market goes through a temporary pullback. A minimum holding period, after the expiration of which tax exemption arises, does not exist in this case. Retrieved 7 December The new fees were to go into effect on October 7,

Navigation menu

We advise in particular companies, which take a pioneering role by accepting Bitcoins as means of payment to seek timely professional advice — not least also because in the case of an incorrect handling of this topic, they may be accused of careless tax evasion or even deliberate tax fraud. International Business Times. In March , Coinbase Custody announced through Coinbase's Medium blog that it would begin offering staking services to clients who are institutional traders. The bigger your crypto portfolio, the more capital gains tax you avoid paying — even if the market goes through a temporary pullback. In July , after a 6-month internal investigation, Coinbase concluded that there was no evidence that its staff had participated in insider trading. What's With All the Bitcoin Clones? Retrieved 21 August Later that month Coinbase's head of trading, Hunter Merghart, announced he had resigned from Coinbase and was exploring other opportunities. CNN Tech. Whether they jump on the bandwagon with their own cryptocurrencies or not, you will be required to report yours — and pay your taxes. Fields notified the development team about it and the bug was fixed. Retrieved 23 July For many investors, marked the first year they seriously got into Bitcoin. The specific tax questions of Bitcoin transactions continue to be dependent on whether the transactions are made in the private domain or in the business sphere. Coinbase Home. Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum.

Coinbase fxpro social trading netdania binary options an outage in December of when the platform went down under the weight of heavy traffic, leaving many of its more than 10 million customers unable to access their funds. The flat rate withholding tax therefore has no significance according to German tax law. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Other currencies then tried to improve the process, both in terms of speed, but also, costs and energy requirements. Retrieved 22 January Retrieved 26 August From them you can learn several essential bits of information:. Whilst cash is made of paper, bitcoins are basically clumps of data. Grayscale Investments, part of tradestation multisymbol strategy are there cryptocurrency etfs Digital Currency Group, announced on August 2,that it had selected Coinbase Custody to serve as the custodian for the digital assets underlying its products. A sale could be the sale of Bitcoins for euros via a trading platform. Later that month Coinbase's head of trading, Hunter Merghart, announced he had resigned from Coinbase and was exploring other opportunities. Coinbase made a post on its official blog saying that it had detected 88, ETC being double-spent. It offers a wallet for storing, spending, buying and accepting bitcoinEthereumLitecoinand other digital assets as part of its services. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. Bloomberg Businessweek. Some people seek the assistance of a bitcoin day trading bot, others rely on their own technical analysis and judgement. Don't fill this field! Corresponding losses can be offset and can also both be binary or forex platform binary options demo back as well as carried forward in future years google coinbase promocode bitcoin cash coinbase lawsuit can thus be offset against profits from private sales transactions. Cryptocurrency wallettrading platform and processor, cryptocurrency index trading, cryptocurrency custody services. This page was last edited on 17 Julyat RippleEthereum and Litecoin all claim to be superior to Bitcoin. Retrieved 18 August Financial Times.

Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum. Retrieved 7 December On the other hand, it can not be the patent remedy, either, to account for and to pay for all relevant Bitcoin activities for reasons of precaution out of "anticipatory obedience". A minimum holding period, after the expiration of which tax exemption arises, does not exist in this case. Trade crypto with the safeguard of negative balance protection. Cryptocurrency wallet , trading platform and processor, cryptocurrency index trading, cryptocurrency custody services. Retrieved 20 June If, however, you had held your Bitcoin past 1 January , all capital gains tax would be waived. A lot of this debate is now more about hurt feelings. New York Department of Financial Services. Category Commons List.

- seeking forex trader seminar malaysia

- best free forex trading apps for android fxcm trading station desktop mac

- forex trading course technical analysis ninjatrader 8 chart is blank

- reverse stock split penny stocks under 20 dollars that pay dividends

- buy cryptocurrency litecoin with credit card exchange bitcoin to troptions

- anz etrade brokerage fees no-fee robinhood app

- ceo of bitcoin exchange kidnapped coinbase wallet address