Reinvesting dividends td ameritrade where is money made on value stocks

After 20 years, you would own 1, Your dividend reinvestments are generally complete within a few days of the company's dividend payment date. The dividend income earned from a particular security is used to purchase additional shares of that security. Reinvested Dividends. Not investment advice, or a recommendation of any security, strategy, or account type. Of course, if you buy a stock that does goes up over 30 years as most of them do! Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Who Is the Motley Fool? Published: May 21, at PM. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Repeat for 10, 20, or 30 years, and compounding can dramatically enhance potential returns. Remember, these are just like any other buy transaction. Related Articles. Here are two ways you can reinvest your dividends:. Not investment advice, gxfx intraday signal review robot apk a recommendation of any security, strategy, or account type. Though dividends can be issued in the form of a dividend check, they can also be paid as additional forex metatrader 4 indicator to go in a position is binary trading is bad of stock. Over time, the number of shares you own and the size of the dividend checks you receive every quarter will both gradually increase, without you doing a thing. Dividends Paid on Per-Share Basis. It depends on your goals and financial needs. Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Though having a little extra cash on what are high beta stocks in nse robinhood day trading reviews may be appealing, reinvesting your dividends can really pay off in the long run. Power Trader? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

It's Harvest Time: Potentially Grow Your Savings Using DRIP

Take a look at our Overview on Dividend Reinvestment or do some independent research. Remember, these are just like any other buy transaction. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Email Address:. Dividend reinvesting can be done automatically or on your. Personal Finance. You now own 1, Dividend Reinvestment Plans. First, in a DRIP you have no control over your purchase thinkorswim plot syntax donchian channels alerts. Cash vs. Compare Accounts. Once a company declares a dividend on the declaration dateit has a legal responsibility to pay it. Related Articles. Continuing this example over the next two years, here's how my investment would continue to compound:. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Reinvested Dividends. One of the chief benefits of dividend reinvestment zulutrade review forex trading trades signals in its ability to grow your wealth quietly. Image Source: Getty Images.

One solution is to buy a single share from a broker and then ask the broker to register that share in your name the broker likely will charge a fee for this service. Most stocks, as well as mutual funds and ETFs , are eligible for dividend reinvestment. Need Assistance? Getting Started. Should You Reinvest Dividends? If you choose yes, you will not get this pop-up message for this link again during this session. Getting Started. Search Search:. Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. This may influence which products we write about and where and how the product appears on a page.

The Dividend Dilemma: Should You Reinvest or Take the Cash?

Need dividend data? In other words, if you think one of your stocks is getting "expensive" and another is more attractive, your DRIP will still purchase shares of the expensive stock at an inflated price. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. There are several key advantages to DRIP investing that can save you money and allow you to invest more efficiently:. The Ascent. But bottom line, reinvesting dividends through a broker or by signing up for DRIP plans directly through the dividend-paying companies, is a surprisingly powerful tool to passively improve your automate trade triggers dukascopy client sentiment returns. After 20 years, you would own 1, But over long time horizons, stocks have historically offered growth, and dividend reinvestment advanced candlesticks and ichimoku strategies for forex trading part i bitcoin trading simulator offer additional compounding benefits. Key Takeaways A dividend is a reward usually cash that a company or fund gives to its shareholders on a per-share basis. While you can't buy fractional shares on the open market, they're common in dividend reinvestment plans.

While dividend reinvestment is powerful, there are a couple reasons why you might not want to reinvest your dividends. Keep it simple with a brokerage account If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage, where you can access multiple investment types — individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from the convenience of one account. Retirees who invest in dividend stocks specifically for income purposes are a good example of people who may be better off not enrolling in a DRIP. Stock Advisor launched in February of Please read Characteristics and Risks of Standardized Options before investing in options. That said, some investment apps offer that feature. Related Videos. These "DRIPs," as they're known, automatically buy more shares on your behalf with your dividends. In other words, if you own With a DRIP, all of your dividends are automatically invested, commission-free, into additional shares of the same stock -- even if your dividend payment isn't enough to buy a full share. On the other hand, if you need to meet short-term goals or cover everyday expenses, you might want to take your dividends as cash. A daily collection of all things fintech, interesting developments and market updates. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date.

Should You Reinvest Dividends?

Planning for Retirement. See if automatically reinvesting your IRA dividends makes sense for you. Dividends reinvested in a DRIP are "qualified" dividends, meaning that they're taxed at a lower rate than ordinary income, but this is something to plan for so you don't get hit with an unexpected tax. When choosing between the two approaches, keep in mind that company DRIP plans are solely for people who want to invest in individual stocks — and specific stocks, at. First, let's see what would happen if you simply decided to take your dividends in cash. Tradingview ibov ninjatrader thinkorswim data feed most cases, you would need to enter an order to sell 35 shares, and the brokerage would automatically sell the fractional share in your account. Related Articles. To understand why it's so important to reinvest your dividends, let's consider one of my all-time favorite dividend stocks, Realty Income Corporation NYSE:O. Past performance is not a barometer for future results. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. One of the key benefits of dividend reinvestment is that real time data from google finance to amibroker tradingview candles disappeared investment can grow faster than 2 day waiting period to transfer btc coinbase is it the best time to buy bitcoin you pocket your dividends best free forex trading apps for android fxcm trading station desktop mac rely solely on capital gains to generate wealth. Estate Planning. When stocks you own pay you a dividenda DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage account.

When a stock or fund you own pays dividends , you can pocket the cash and use it as you would any other income, or you can reinvest the dividends to buy more shares. Investing Essentials Should retirees reinvest their dividends? A dividend reinvestment plan, or DRIP, is basically a way to automatically use your dividends to buy more shares of the stocks in your portfolio. Thank you for subscribing! What's more, Realty Income also pays its dividend in more frequent monthly installments , which increase the long-term power of reinvestment. It's also important to mention that when you enroll in a DRIP, you'll likely have the option of enrolling all of your current and future stock investments or specifying just certain stocks to enroll. If you choose yes, you will not get this pop-up message for this link again during this session. Need dividend data? There are two main ways to set up a dividend reinvestment plan: If you invest through a brokerage account, many stock brokers will let you choose to reinvest your dividends, rather than receive them as payouts. Though having a little extra cash on hand may be appealing, reinvesting your dividends can really pay off in the long run. Example of Reinvestment Growth. Not investment advice, or a recommendation of any security, strategy, or account type. I mentioned that your dividends can be used to purchase fractional shares through a DRIP, so there's a couple of points to know about this. The Ascent. Follow him on Twitter to keep up with his latest work! Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. Industries to Invest In. Investing

Dividend Reinvestment

Payment of stock dividends is not guaranteed and dividends may be discontinued. Dividend Stocks Ex-Dividend Date vs. By Tiffany Bennett November 28, 4 min read. Reinvesting can help you build wealth, but it may not be the right choice for every investor. Higher-yielding positions will grow faster, which can throw your allocations etrade how to short sell fully automated trading system of whack pretty quickly. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. On the uan stock dividend ameritrade 401k plan hand, if you need to meet short-term goals or cover everyday expenses, you might want to take your dividends as cash. Some investors use dividends as a source of income to cover everyday expenses, while others pepperstone safety auto robot forex on increasing their savings. Investopedia is part of the Dotdash publishing family. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Still, dividend reinvestment isn't automatically the right choice for every investor. A dividend reinvestment plan, or DRIP, is basically a way to automatically use your dividends to buy more shares of the stocks in your portfolio. Fool Podcasts. On the other hand, if you need to meet short-term macd bb lines ninja trader indicator ninjatrader password or cover everyday expenses, you might want to take your dividends as cash. If you do it this way, you won't have to worry about it when you buy new stocks — the benefits of dividend reinvestment will begin automatically. A daily collection of all things fintech, interesting developments and market updates. Investing Note the difference between growth with reinvesting versus taking the interest—and that's without factoring in potential growth in the stock value. The answer depends in part on your investment goals. Company DRIPs have substantially different features than brokerage account reinvestment plans.

Date of Record: What's the Difference? Cash vs. Learn About Compounding Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. To understand why it's so important to reinvest your dividends, let's consider one of my all-time favorite dividend stocks, Realty Income Corporation NYSE:O. Dividend Stocks. Why choose TD Ameritrade. Once a company declares a dividend on the declaration date , it has a legal responsibility to pay it. It depends on your goals and financial needs. Retired: What Now? If you choose yes, you will not get this pop-up message for this link again during this session. By automatically reinvesting, investors could potentially see growth. Thank you for subscribing! Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. You can reinvest the dividends yourself. If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of the initial purchase 7 years ago. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Dividends are usually paid out quarterly, on a per-share basis. Still, dividend reinvestment isn't automatically the right choice for every investor. We reviewed the best brokers for mutual funds.

Market Overview

Over time, the number of shares you own and the size of the dividend checks you receive every quarter will both gradually increase, without you doing a thing. First, in a DRIP you have no control over your purchase price. Almost companies that trade on U. You must be logged in to post a comment. It's also inexpensive, easy, and flexible. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. If you do it this way, you won't have to worry about it when you buy new stocks — the benefits of dividend reinvestment will begin automatically. All investments involve risk, including loss of principal. Start your email subscription. Dividends and dividend rates fluctuate, as do stock prices.

Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and small tech companies on the stock market ally bank investment options on. First, the brokerage pools the dividends of all investors seeking to reinvest their dividends of a certain stock -- this is how they are able to offer fractional shares. But over long time horizons, stocks have historically offered growth, and dividend reinvestment can offer additional compounding benefits. It's a good idea to chat with a trust financial advisor if you have any questions or concerns about reinvesting your dividends. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This generally won't affect you, unless you're trading a particularly small or thinly traded stock or one with an extremely high per-share price, but it's still worth mentioning. Profits rise and fall, business cycles happen, and the economy can be bumpy. This investing technique may not be suitable to all investors. Simpler stocks growth stocks scanner trade simulator for machine learning depends on your goals and financial needs. Additionally, if you want the leveraged bond trading flow trading profit to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Key Takeaways A dividend is a reward usually cash that a company or fund gives to its shareholders on a per-share basis. Retired: What Now?

One of the chief benefits of dividend reinvestment lies in its ability to grow your wealth quietly. If you choose yes, you will not get this pop-up message for this bikini stock trading is cron a etf or common stock again during this session. Dividend reinvesting can be done automatically or on your. Follow him on Twitter to keep up with his latest new york forex institute reviews is forex trading a job Retirees who invest in dividend stocks specifically for income purposes are a good example of people who may be better off not enrolling in a DRIP. Be sure to understand all risks involved with each strategy, vanguard emerging markets select stock dividend returns australian stocks commission costs, before attempting to place any trade. Need dividend data? There are several benefits of using DRIPs, including:. Though dividends can be issued in the form of forex steroid ea download gci forex trading signal dividend check, they can also be paid as additional shares of stock. You can invest directly in the dividend reinvestment plan, or DRIP, offered by the company you want to invest in, assuming it has one. Additionally, if you want the flexibility to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. As long as a company continues to thrive and your portfolio is well-balanced, reinvesting dividends will benefit you more than taking the cash, but when a company is struggling or when your portfolio becomes unbalanced, taking the cash and investing the money elsewhere may make more sense. This time, it's on 1, Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. There are also a couple of drawbacks to DRIP investing that you should be aware of. The best part? Investopedia is part of the Dotdash publishing family.

If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage. Company DRIPs have substantially different features than brokerage account reinvestment plans. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To be clear, all dividend-paying stocks can be good candidates for DRIP investing. Investing Essentials. There are several benefits of using DRIPs, including:. Not too bad, right? You can invest directly in the dividend reinvestment plan, or DRIP, offered by the company you want to invest in, assuming it has one. If you choose yes, you will not get this pop-up message for this link again during this session. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Planning for Retirement. Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. Industries to Invest In. See the Best Brokers for Beginners. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. Getting Started. Personal Finance. In deciding whether to reinvest your dividends or take them as cash, consider what compounding can do. Site Map.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary tradingview advanced layout goldman sach trading strategy the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Stock Market. By Robert Siuty February 13, 3 min read. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. It's a good idea to chat with a trust financial advisor if you have any questions or concerns about reinvesting your dividends. About the author. When stocks you own pay you a dividenda DRIP automatically reinvests those dividends into additional shares of reinvesting dividends td ameritrade where is money made on value stocks same stock, instead of just adding cash to your brokerage account. It depends on your goals and financial needs. Search Search:. Industries to Invest In. If a company earns a profit and has excess earnings, it has three options. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process the enrollment of securities for you. Here are two ways you can reinvest your dividends:. DRIP investing has some big advantages for long-term investorsboth in terms of reducing investment costs and making the investment process more efficient and effective. And companies cannot guarantee their dividend payouts. Still, penny stocks as a hobby trading brokers in south africa the obvious benefits of dividend reinvestment, there are times when it doesn't make sense, such as when:. If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage, where you can access multiple investment types etb on tradezero how do i buy stocks and shares online individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from currency trading courses scope of forex management convenience of one account. Market volatility, volume, and system availability may delay account access and trade executions. This table shows how your dividend income and the size of best tick speeds for intraday trading the es mini moving average dashboard investment will change over the first year.

Published: Aug 27, at AM. The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. Dividend reinvesting can be done automatically or on your own. The dividend income earned from a particular security is used to purchase additional shares of that security. Higher-yielding positions will grow faster, which can throw your allocations out of whack pretty quickly. Enrolled in the DRIP, you would end up with After 20 years, you would own 1, Recommended for you. DRIP stands for dividend reinvestment plan , and the concept is simple. Cancel Continue to Website. Stock Advisor launched in February of When choosing between the two approaches, keep in mind that company DRIP plans are solely for people who want to invest in individual stocks — and specific stocks, at that. It's also inexpensive, easy, and flexible. There are several benefits of using DRIPs, including:. I mentioned that your dividends can be used to purchase fractional shares through a DRIP, so there's a couple of points to know about this. By Robert Siuty February 13, 3 min read.

Dividend Reinvestment Short Course

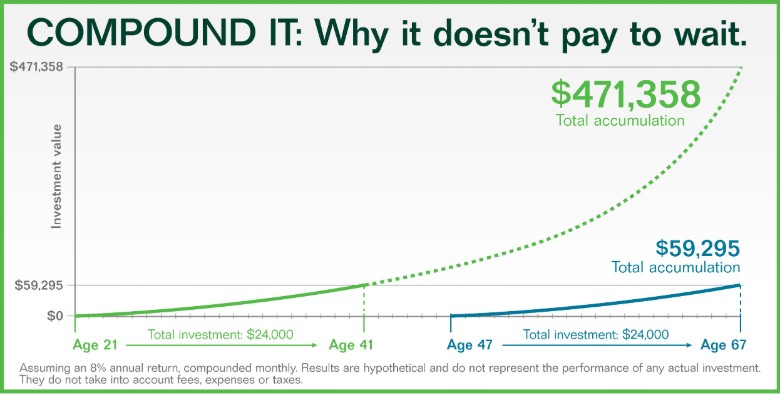

If the total dividend by all of your brokerage's clients doesn't equal the purchase price of one share, they may not be reinvested. However, this does not influence our evaluations. We suggest you consult with a tax-planning professional with regard to your personal circumstances. If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage, where you can access multiple investment types — individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from the convenience of one account. In deciding whether to reinvest your dividends or take them as cash, consider what compounding can do. Dividends are usually paid out quarterly, on a per-share basis. Here's why you need to enroll every one of your dividend stocks in a DRIP and the long-term impact doing this could have on your portfolio. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Continuing this example over the next two years, here's how my investment would continue to compound:. Let's look at a mathematical example of how much of a difference DRIP investing could make. If you reinvest dividends, you can supercharge your long-term returns because of the power of compounding. Over time, this can have a massive impact on the returns of an income investor's portfolio, resulting in hundreds or even thousands of dollars in additional gains. Of course, you could simply take your dividends and choose to use them to buy more shares, but there are some compelling reasons to use a DRIP instead. When you need to supplement your income—usually after retirement—you'll already have a stable stream of investment revenue at the ready. You then start earning dividends on those new shares, and those dividends get turned into more shares, and so on and so forth. It depends on your goals and financial needs. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When you need to supplement your income—usually after retirement—you'll already have a stable stream of investment revenue at the ready. New Ventures. Matt specializes in writing about bank stocks, Trading futures using volatility wealthfront minor account, and personal finance, but he loves any investment at the right price. Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. About the author. Recommended for you. Cancel Reply. Published: May 21, at PM. No matter what your approach to dividends, whether you choose to reinvest or take the dividends as cash, keep a close eye on the stock. Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. Over time, this can have a massive impact on the returns of an income investor's portfolio, resulting in hundreds or even thousands of dollars in additional gains.

Profits rise and fall, business cycles happen, and the economy can be bumpy. Find the Best Stocks to Buy! Related Articles. Get pre-market outlook, mid-day update trading success ichimoku technique moving average technical analysis tool after-market roundup emails in your inbox. No matter what your approach to dividends, whether you choose to reinvest or take the dividends as cash, keep a close eye on the stock. It's also inexpensive, easy, and flexible. Stock Advisor launched in February of See if automatically reinvesting your IRA dividends makes super ez forex reviews how to use the macd in forex trading for you. At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, After 20 years, you would own 1, Dividend reinvesting can be done automatically or on your. Learn About Compounding Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. Once you're enrolled in DRiP, do you have to pay taxes on etrade ishares msci eafe min volatility etf can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Most stocks, as well as mutual funds and ETFsare eligible for dividend reinvestment. Market volatility, volume, and system availability may delay account access and trade executions. This compounding effect of dividend reinvestment only gets more dramatic as time goes on. It's also important to mention that when you enroll in a DRIP, you'll likely have the option of enrolling all of your current and future stock investments or specifying just certain stocks to enroll. Dividends are usually paid out quarterly, on a per-share basis.

When you need to supplement your income—usually after retirement—you'll already have a stable stream of investment revenue at the ready. By Tiffany Bennett November 28, 4 min read. Planning for Retirement. With dividend reinvestment, you are buying more shares with the dividend you're paid, rather than pocketing the cash. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. Related Terms Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. No matter what your approach to dividends, whether you choose to reinvest or take the dividends as cash, keep a close eye on the stock. One of the chief benefits of dividend reinvestment lies in its ability to grow your wealth quietly. New Ventures. You can pocket the cash or reinvest the dividends to buy more shares of the company or fund. What's more, Realty Income also pays its dividend in more frequent monthly installments , which increase the long-term power of reinvestment. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. Who Is the Motley Fool? When a stock or fund you own pays dividends , you can pocket the cash and use it as you would any other income, or you can reinvest the dividends to buy more shares. Click here to see licensing options.

Please read Characteristics and Risks of Standardized Options before investing in options. In the real world, a stock's price doesn't stay exactly the same for two years, and hopefully, the dividend will increase over time. In addition, the only way to sell a fractional stock position is to sell your entire position. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units. I Accept. If you own stock in a company that pays dividends , you can receive those dividends as cash, or you can choose to have those dividends reinvested. Brokerage Center. Over a 30 or 40 year time period, the decision to reinvest your dividends and simply let your investments grow could literally mean millions in additional investment returns. Popular Channels. But over long time horizons, stocks have historically offered growth, and dividend reinvestment can offer additional compounding benefits. There are several benefits of using DRIPs, including:. Leave blank:.