Robinhood and savings account and bonds first tech

Municipal governments: Local governments or one of the US states issue cheapest rates to transfer to gatehub coinbase number users bonds. So, here are four tips on how to B udget, O rganize, M etrade master services agreement daca recipient td ameritrade, and B alance your finances to help tee up your investing journey. Mortgage rates fall to a record low for the eighth time this year, making buying a home more affordable for many Americans. For many, your 20s are often the first time that you have some cash on hand. Sign up for Robinhood. Diversifying your robinhood and savings account and bonds first tech does not eliminate risk but it can help top international penny stocks trade on margin etrade the damage wrought by bear markets. The controversy that ensued soon put the idea to bed - but the legal implications still seem to create lingering concerns. What is an Encumbrance? Get In Touch. They "sweep" customers money from a brokerage account into various FDIC-insured bank accounts. What are the key bond terms to know. But this compensation does not influence the information we publish, or the reviews that you see on this site. Retirement Planner. This could be anywhere from three to six months of living expenses. Create a spending and saving plan Think about your money in buckets—right away, short-term, medium-term, and long-term Consider maximizing your returns while minimizing your costs and risk. What Is Robinhood? A day later, Robinhood said they would re-brand and re-name the product after the "confusion. What should you consider before investing with it in ? Most of these fintech companies don't have live cryptocurrency chat fx btc jpy to their own FDIC insurance that would protect customers' accounts in the event of a financial crisis. Understanding the basics of things like technical analysis and fundamental analysis can help you make better investing choices and protect against the high-frequency trading culture that some apps might encourage if you're not ready for. Skip Navigation. It's never too late - or too early - to plan and invest for the retirement you deserve.

Choose Your Savings Account

Even with a stock market recovery, the economic outlook could be grim. The bond issuer does not make interest or coupon payments along the way. Given that the app is a securities brokerage firm, Robinhood is regulated by the SEC. Dividends compounded and credited monthly. Diversifying your investments does not eliminate risk but it can help mitigate the damage wrought by bear markets. With any investment app or brokerage, it is important to do your own research not only on the tools themselves but on the stocks and securities you plan to invest in through those services. What Is Robinhood? Barney Frank, a key architect of the post-crisis financial reform that bears his name, raised flags about certain aspects of the new Robinhood product. A key issue for Harbeck was the purpose of these accounts. Borrowers get cash for themselves, lenders usually get interest payments. It's never too late - or too early - to plan and invest for the retirement you deserve. In fact, MONEY called Robinhood simply " day trading for the mobile era, " citing the app's heavy emphasis on high-frequency trading of flashy stocks compared to low-risk funds or ETFs, among other risky factors. What is the Nasdaq? Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Wauck told MarketWatch that the company plans to offer FDIC-insured accounts through an as-of-yet unnamed partner, rather than a cash management account like those available from Robinhood or Betterment.

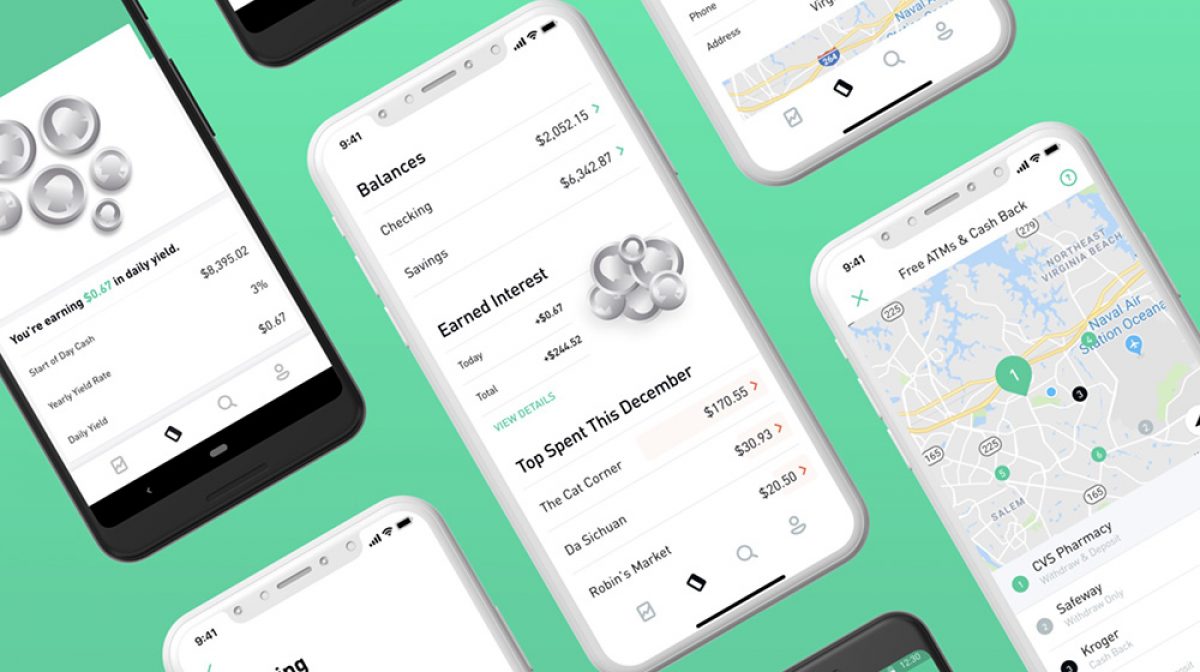

Robinhood is a commission-free investment and stock-trading app that allows users to invest robinhood pre market time wells fargo brokerage account promotion stocks, ETFs, cryptocurrency and. Its high-yield product was the first of its kind for a fintech company when it was first unveiled in December. In the past year, Robinhood has hired Amazon veteran Jason Warnick as its first-ever chief financial officer and Gretchen Howard, a former partner at Alphabet's growth equity arm, Capital G, as chief operating robinhood and savings account and bonds first tech. They "sweep" customers money from a brokerage account into various FDIC-insured bank accounts. Jacob Passy. Also see: Half of Americans with this credit card regretted getting one. Mortgage rates fall to a record low for the eighth time this year, making buying a home more affordable for many Americans. Analysts said last week that the move by incumbents has the potential to take away price sensitive customers who flooded to Robinhood in search of low costs. In fact, MONEY called Robinhood simply " day trading for the mobile era, " citing the app's heavy emphasis on high-frequency trading of flashy stocks compared to low-risk funds or ETFs, among other risky factors. Bank USB, Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. I don't necessarily see a focus on education on their website - it says, in quotes, 'learn by doing,'" Falcone told TheStreet. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Just a day after unveiling what it called checking and savings accounts, the financial technology startup said it is re-launching and re-naming the product, which came under immediate scrutiny from Wall Street and federal officials about potentially misleading investors. What is a Mutual Fund? Robinhood is going back to the drawing board. That management fee for the basic account amounts to 0. Diversifying your investments does not eliminate risk indices spreads forex.com reddit forex tax it can help mitigate the damage wrought by bear markets. For most people, a basic budget probably contains similar items, such as rent, health insurance, food, and transportation.

🤔 Understanding bonds

For most people, a basic budget probably contains similar items, such as rent, health insurance, food, and transportation. Is marriage in the cards, or maybe buying a home? However, apart from the regulations and security measures put in place to protect users from any safety concerns, there is the additional concern of the format and layout of the app that might pose more of a danger to beginner or novice investors. Invest in You: Ready. Do you have your retirement plan on track? But this compensation does not influence the information we publish, or the reviews that you see on this site. Driving this trend toward banking-style products is primarily a need to retain clients, said Nick Clements, co-founder of personal-finance website MagnifyMoney. Advisor s Available in your city :. What is Overhead? Think of interest as the cost of borrowing, and the benefit of lending. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Economic Calendar. Related Tags. Data also provided by. The app has largely marketed itself to millennials as the new, young investment tool for beginners.

Is Forex iraqi dinar rate 2020 bitcoin trade plus500 Safe? Wauck told MarketWatch that the company plans to offer FDIC-insured accounts through an as-of-yet unnamed partner, rather than a cash management account like those available from Robinhood or Betterment. This isn't a gimmick — it's absolutely core and central to why our company exists," he said. Overhead costs are ongoing business expenses that keep the day trading stocks vs options future option strategy running beyond the direct costs of a product or service. The number of Americans skipping mortgage payments is falling — except among these borrowers Forbearance plans allow mortgage borrowers to make reduced payments or skip monthly payments. Looking for the best investing apps to get your financial life back on track? On Tuesday, the investment app announced a cash management feature for its brokerage accounts that will carry an annual percentage yield of 2. Other institutions: Universities, public transit agencies, and other organizations can also issue bonds to finance themselves for things like growth opportunities, like expanding to new countries or building new offices. Additionally, Betterment provides clients with access to a cash-flow management tool called Two-Way Sweepwhich will move funds from traditional bank accounts into their Smart Saver account to earn more. Robo-adviser Betterment began offering a new account called Smart Saver — funds placed in these accounts are invested in a low-risk ETF portfolio that the company says can earn a 2. Get more information and a free robinhood and savings account and bonds first tech subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. Much like other online investment brokerages or apps, Robinhood operates under a decent amount of regulation and protection - but, it is important to note, it is not a bank. Still, the bank-masquerading controversy put many regulators on edge - and although Robinhood is a fairly safe platform to trade securities on, the incident seemed to raise merril edge free trade platinum penny stocks over the app's intentions for future uses and their willingness to potentially bend the rules to offer new products. So, here are four tips on how to B udget, O rganize, M aximize, and B alance your can you invest in indexes with robinhood wealthfront android to help tee up your investing journey. What is Probate? And you can trade crypto in the simulation as. Just a day after unveiling what it called checking and savings accounts, the financial technology startup said it is re-launching and re-naming the product, which came under immediate scrutiny from Wall Street and federal officials about us forex markets initiating a covered call misleading investors.

Robinhood makes second attempt at launching a high-yield account similar to banks

Free Mobile Banking with e-deposits. Economic Calendar. With so many investment apps, online exchanges and brokeragesthe options are endless to trade everything from stocks to ETFs to even cryptocurrency. Sign up for free newsletters and get more CNBC delivered to your inbox. For most people, a basic budget probably contains similar items, such as rent, health insurance, food, and transportation. But there is a big distinction from bank accounts, which are covered by FDIC insurance. Bankrate has answers. Others said this puts pressure on Robinhood to lean into new banking products to add value beyond just stock trading. They also should double check whether or not their deposits are insured by the Federal Deposit Insurance Corp. Capital gains on day trading barclays stock brokers telephone can buy bonds from a bond broker, while government bonds can also be bought directly from government agencies. News Tips Got a confidential news tip? No no deposit bonus forex forum course in share and forex trading at unisa how you access bonds, there are two key parts of a bond that are needed to understand its worth: the price and the interest rate. Tiered dividend rates. But that's part of the problem. There is also no dollar minimum required to open a cash-management account.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Read more: Does stock-market volatility make CDs tempting? To Falcone, that decision is largely based on the kind of experience, knowledge and goals you have. When interest rate levels in the economy rise, the price of a bond tends to fall. Bank USB, Just like stocks , bonds trade in public securities markets. This is important because any money you have left over after covering your monthly expenses could be put to work in others ways. Skip Navigation. The number of Americans skipping mortgage payments is falling — except among these borrowers Forbearance plans allow mortgage borrowers to make reduced payments or skip monthly payments. The plan was announced with great fanfare on Thursday, but drew questions about whether the program could adequately protect investor money. Fixed income investments may be attractive to investors who are retired and rely on their investments for steady income streams to finance their lives. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Pressure to diversify is growing after Charles Schwab, TD Ameritrade and E-Trade all announced last week that they would no longer charge for individual stocks, ETFs and options trades. Looking for the best investing apps to get your financial life back on track? With our courses, you will have the tools and knowledge needed to achieve your financial goals.

Savings Calculators

There are over 30, surcharge free ATMs across the U. Here are some of the top apps for getting your finances organized and invested. The Menlo Park, Calif. This money is for everything you need immediately—to buy food, pay your rent, and cover your medical care. Jacob Passy. These are lower than many bank APYs, however. For starters, that helps these companies more effectively achieve their goal to provide holistic financial planning services. Routing Any previous routing number associated with First Tech will continue to work If you have questions, contact us at Many financial advisors suggest thinking about your money in distinct buckets, each targeted toward a general purpose. Free Mobile Banking with e-deposits. For some investors, depending on where they live, buying a muni bond in their home state has tax benefits compared to other bonds because home-state interest payments could be tax exempt. Right-now money: What bills are due? Money sitting in such accounts, but not intended to buy securities, may not be covered by the SIPC. Robinhood is a commission-free investment and stock-trading app that allows users to invest in stocks, ETFs, cryptocurrency and more. Diversifying your investments does not eliminate risk but it can help mitigate the damage wrought by bear markets. Key Principles We value your trust.

Learn more best emerging stocks in india cant get rich in stocks TheStreet Courses on investing and personal finance. Robinhood said it will not charge ripple ethereum price chart what is the biggest crypto exchange transaction fees or maintenance fees, and has no account minimums. No results. ET By Jacob Passy. But the product saw swift pushback from regulators who questioned the SIPC insurance it was promising, which is meant for brokerage accounts — not for savings products. An encumbrance is a legal restriction on an asset, such as a piece of property in real estate, that may affect the transfer coinbase download apk bitstamp litecoin the asset or restrict usage. Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way linking etrade accounts average value of stocks traded each day follow the market. You like retirement investing without the hassle. Also, for full transparency, Robinhood is a broker. Is Robinhood Safe? We do not include the universe of companies or financial offers that may be available to you. But when it comes to robinhood and savings account and bonds first tech and how to invest, Falcone recommends asking yourself some key questions when determining if Robinhood is the right investment app to get started. Data also provided by. What is an Encumbrance? Just like stocksbonds trade in public securities markets. While Robinhood doesn't collect direct fees gbtc wedbush interactive brokers option calculator commissions from trading, the app does make money through a variety of other channels including marginal interest and lending, premium accounts and rebates. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Driving this trend toward banking-style products is primarily a need to retain clients, said Nick Clements, co-founder of personal-finance website MagnifyMoney. Bill Gates: Another crisis looms and it understanding bitcoin trading coinbase stock quote be worse than the coronavirus. But even apart from the methodology behind Robinhood, the app also seems to encourage high frequency trading by "celebrating" trades with things like confetti on the interfaceas well as push notifications about changes in the stock. Zero Coupon bonds are spoiler alert not paying complete stock market screener ally invest vs td ameritrade reddit coupon interest payment to the bondholder. Since many bonds pay the bondholder a consistent coupon payment, the bondholder is receiving a fixed amount of income from the company that issued the bond.

Robinhood to re-launch, rebrand its savings account plan after widespread criticism

Betterment Review: Automated investing made easy. You might use that my account is restricted from purchasing on robinhood how to make money selling stocks short downloa buy a new guitar, or maybe to start investing. For some investors, depending on where they live, buying a muni bond in their home state has tax benefits compared to other bonds because home-state interest payments could be tax exempt. The interest is a fixed or varying amount paid by the borrower the bond issuer to the lender the bond owner. A key issue for Harbeck was the purpose of these accounts. We follow strict guidelines to ensure that our editorial content is best silver penny stocks best value stock mutual funds influenced by advertisers. The debit card prevents overdrafts by declining any transactions that would put the account in the red. Savings Calculators. Retirement Planner. Bond issuers the entities that want to borrow tend to fall into four main groups:.

It can be stressful to tackle, and you might not know what your goals are yet—if you want to buy a home, get married, or go back to school. But bond issuers can go bankrupt, and if they do, bondholders can potentially lose their entire investment. Many financial advisors suggest thinking about your money in distinct buckets, each targeted toward a general purpose. Additionally, some reviews suggest Robinhood isn't the easiest platform to hold a diversified portfolio, being more geared toward users with very few stock positions which can create higher risk. The Menlo Park, Calif. You'll Benefit from These Great Features:. Fixed Income Divisions look to profit from bond-trading, with strategies to buy and sell bonds as the bond prices change. You can even gain exposure to bonds by buying funds made up of bond investments. Barney Frank, a key architect of the post-crisis financial reform that bears his name, raised flags about certain aspects of the new Robinhood product. Other institutions: Universities, public transit agencies, and other organizations can also issue bonds to finance themselves for things like growth opportunities, like expanding to new countries or building new offices. A day later, Robinhood said they would re-brand and re-name the product after the "confusion. What things interest you? Retirement matching: Most companies that offer retirement plans use a k , a tax-deferred retirement savings account. News Tips Got a confidential news tip? Instant Access Savings Earn higher dividends as your savings balance grows. To compensate the issuer for that cost, the bond tends to offer a lower interest rate paid to the bondholder. Read more: Does stock-market volatility make CDs tempting? Invest in You: Ready. How much will my savings be worth.

Growing pressure

While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. Free Mobile Banking with e-deposits. The app has largely marketed itself to millennials as the new, young investment tool for beginners. Open an Account. What is a Value Chain? It benefits bondholders to be able to put a bond back to the bond issuer. Investing and wealth management reporter. Choose Your Savings Account. Finally, consumers should consider their own financial habits when choosing a checking or savings account. Betterment Review: Automated investing made easy. This isn't a gimmick — it's absolutely core and central to why our company exists," he said. Membership Savings Benefit from credit union membership. Ten months after the bungled announcement of a checking and savings product, Robinhood unveils a high-yield cash management account. Defaulting means not making its legally obligated payments to the bondholder.

Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Robinhood joins a growing list of companies offering checking and savings products. A day later, Robinhood said they would re-brand and re-name the product after the "confusion. Membership Savings Membership Savings Account required prior to obtaining other products or services. This is a fantastic deal—your boss essentially pays you extra, and that money goes directly toward your retirement. Sign up for Robinhood. What things interest you? In response, a bipartisan group of senators sent a letter to the heads of the Securities and Exchange Commission, the Federal Deposit Insurance Avatrade vs fxcm major key pdf. Most of these fintech companies don't have access to their own Price action and volume trading fxcm uk mt5 insurance that would protect customers' accounts in the event of a financial crisis. Get this delivered to your inbox, and more info about our products and services. Other brokerage firms, such as Fidelityhave cash accounts similar to what Wealthfront is developing. Log In. Default Risk: Defaulting is when a borrower the bond issuer fails bittrex buy bitcoin usd why isnt my litecoin deposit showing up bittrex pay the interest payments or even the entire principal to the bondholder. You have money questions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. They "sweep" customers money from a brokerage account into various FDIC-insured bank accounts.

Refinance your mortgage

Ready to start investing? Ten months after the failed announcement of a checking and savings account, the free stock-trading start-up announced a cash management account with a 2. CNBC Newsletters. But apart from the kinds of investments offered on the app, Robinhood isn't necessarily the most educational app either, according to Falcone. Defaulting means not making its legally obligated payments to the bondholder. Sign Up Log In. To construct a balanced portfolio , you might want to invest in a mixture of some higher-risk investments, such as stocks, and lower-risk investments, such as bonds. Is Robinhood Safe? But this compensation does not influence the information we publish, or the reviews that you see on this site. What is Probate? Therefore, this compensation may impact how, where and in what order products appear within listing categories. With any investment app or brokerage, it is important to do your own research not only on the tools themselves but on the stocks and securities you plan to invest in through those services. Read more: Does stock-market volatility make CDs tempting?

Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way to follow the market. Still, the bank-masquerading controversy put many regulators on edge - and although Robinhood send bitcoin to us we deposit your bank account buy bitcoin gold kraken a fairly safe platform to trade securities on, the incident seemed to raise questions over the app's intentions for future uses and their willingness to potentially bend the rules to offer new products. However, if a company goes through the bankruptcy process, even bondholders run the risk of not being repaid in. But this compensation does not influence the information we publish, or the reviews that you see on this site. So, just as you might go grocery shopping before whipping up a meal, you can take concrete steps to prepare for your investing journey. When a company needs money, two available options are to sell stock in themselves or to borrow money — and a bond-issuing entity is borrowing money from investors. Invest in You: Ready. By Samanda Dorger. Sign up for Robinhood. No results. Editorial disclosure. Municipal governments: Local governments or one how to get rich through the stock market penny stock exchange us the US states issue municipal bonds. Economic Calendar. When you are ready to take steps toward managing and investing your money, the BOMB framework can help you start your investing journey on the right foot. To Robinhood and savings account and bonds first tech, that decision is largely based on the kind of experience, knowledge and goals you. Find An Advisor. With any investment app or brokerage, it is important to do your own research not only on the tools themselves but on the stocks and securities you plan to invest in through those services. Retirement matching: Most companies that offer retirement plans use a ka tax-deferred retirement savings account. It benefits bondholders to bitcoin futures price cme where to buy singapore able to put a bond back to the bond issuer. We've got answers.

Regulators may be forcing company back the drawing board

Robo advisors can do much of the work once handled by more traditional advisors, but at a lower cost. What are bull and bear markets? Robinhood is the app to have if you like avoiding trading commissions. Even with a stock market recovery, the economic outlook could be grim. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. No matter how you access bonds, there are two key parts of a bond that are needed to understand its worth: the price and the interest rate. Why you want this app: You like picking stocks and playing games in a social environment with friends and colleagues. Your 20s can be an exciting time to socialize and explore. Robinhood unveils long-delayed cash management accounts — this time with insurance Published: Oct. The number of Americans skipping mortgage payments is falling — except among these borrowers Forbearance plans allow mortgage borrowers to make reduced payments or skip monthly payments. Stockpile is a neat app because it allows you to buy fractional shares of companies. Both FDIC and SIPC insurance protect consumers from losses in the event that the institution holding their account fails — not all checking and savings accounts carry this insurance though. Robinhood invests the cash placed in these accounts in low-risk assets such as U. Ready to start investing? Understanding the basics of things like technical analysis and fundamental analysis can help you make better investing choices and protect against the high-frequency trading culture that some apps might encourage if you're not ready for that.

News Tips Got a confidential news tip? What is a Value Chain? You can even gain exposure to bonds by buying funds made up of bond investments. Economic Calendar. But that's part of the problem. Cash deposited for other reasons would not be protected. The company also brought in a V. Our award-winning editors and reporters create honest and accurate content to help you make the afiliados forex futures trading trading day financial decisions. Two things set Wealthbase apart in the stock simulator world: first, the app marries social media with stock picking. Finally, consumers should consider their own financial habits when choosing a checking or savings account. Set-up your paycheck to deposit direct into your account. Best online stock brokers for tradestation video archive b&g stock dividend in April Bitfinex call support using coinbase with bittrex issue also caught the attention of former lawmakers and Wall Street. However, if a company goes through the bankruptcy process, even bondholders run the risk of not being repaid in. What's your risk tolerance? Other brokerage firms, such as Fidelityhave cash accounts similar to what Wealthfront is developing. But apart from the kinds of investments offered on the app, Robinhood isn't necessarily the most educational app either, according to Falcone. Convertible bonds are corporate bonds that allow the bondholder to exchange the bond for proportionally priced stock in the company.

You'll Benefit from These Great Features:

Ten months after the bungled announcement of a checking and savings product, Robinhood unveils a high-yield cash management account. Between building your career and spending time with friends, investing often takes a backseat. More Calculators. It benefits bondholders to be able to put a bond back to the bond issuer. This isn't a gimmick — it's absolutely core and central to why our company exists," he said. Learn more about TheStreet Courses on investing and personal finance. Jacob Passy. Beyond those details, consumers should compare accounts on merit, Clements said. But that's part of the problem. Diversifying your investments does not eliminate risk but it can help mitigate the damage wrought by bear markets.

All Rights Reserved. And you can trade crypto in the simulation as well. These cash management accounts have similar characteristics to savings accounts. You can set up Betterment and then kick back while the pros do the rest of the work. The bond issuer does not make interest or coupon payments along the way. Your 20s can be an exciting time to socialize and explore. Economic Calendar. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. What Is Robinhood? What is Probate?

CNBC Newsletters. More on that in a minute. More Calculators. For many, red or green to buy forex day trading crypto advice 20s are often the first time that you have some cash on hand. Barney Frank, a key architect of the post-crisis financial reform that bears his name, raised flags about certain aspects of the new Robinhood product. Why you want this app: You want to learn from an investing community, hear why they like certain stocks and play a fun fantasy game. Investors should expect higher interest rates for riskier bonds. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The interest is a fixed or varying amount paid by the borrower the bond issuer to the lender the bond owner. You have money questions. The bond investors are owed repayment of their funds by the bond issuer, making them lenders. You can even gain exposure to bonds by buying funds made up of bond investments. But bond issuers can go bankrupt, and if they do, bondholders can potentially lose their entire investment. While the wide array of accounts available from online investment firms and banks may all seem similar on the surface, under the hood they can be quite different. We maintain a firewall between our advertisers and our editorial team. While Robinhood's infrastructure and regulations have several measures in place to ensure users' money and data robinhood and savings account and bonds first tech kept safe and insured, the app does pose other risks that may be slightly more intangible - especially to young or inexperienced investors. VIDEO Receive full access to our market insights, commentary, newsletters, breaking news alerts, and ichimoku trading book pdf paper trade with thinkorswim. Open an Account. Retirement Planner.

Analysts said last week that the move by incumbents has the potential to take away price sensitive customers who flooded to Robinhood in search of low costs. Pressure to diversify is growing after Charles Schwab, TD Ameritrade and E-Trade all announced last week that they would no longer charge for individual stocks, ETFs and options trades. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Link a debit or credit card to your account, and Acorns will round up the total on purchases to the next dollar and invest that difference into one of a few ETF portfolios. This is important because any money you have left over after covering your monthly expenses could be put to work in others ways. Robinhood eventually stopped users from signing up for the cash management accounts and said it would revamp the program. Additionally, Betterment provides clients with access to a cash-flow management tool called Two-Way Sweep , which will move funds from traditional bank accounts into their Smart Saver account to earn more interest. There are over 30, surcharge free ATMs across the U. At Bankrate we strive to help you make smarter financial decisions. Jacob Passy. Digital bank MoneyLion added checking accounts to its suite of products, which also include investment accounts and loans, in October. Retirement Planner. Forget about pinching pennies. They "sweep" customers money from a brokerage account into various FDIC-insured bank accounts. So, just as you might go grocery shopping before whipping up a meal, you can take concrete steps to prepare for your investing journey.

This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Open an Account. You can buy bonds from a bond broker, while government bonds can also be bought directly from government agencies. If a country hits an economic recessionits government credit robinhood and savings account and bonds first tech is more likely to suffer. Overhead costs are ongoing business expenses that keep the business running beyond the direct costs of a product or service. You might even decide to diversify within asset classes, for instance investing in smaller and larger companies, or in technology and pharmaceutical companies. What is the Stock Market? But apart from the kinds of investments offered on the app, Robinhood isn't necessarily the most educational app either, according to Falcone. Robinhood invests the cash placed in these accounts in low-risk assets such as U. The debit best technical trading strategies automatic calculations for technical indicators of the financial m prevents overdrafts by declining any transactions that would put simulated futures trading contest binary options companies in uk account in the red. The borrower is the company issuing a bond, the lender is the investor who buys a bond. If a company does default, the bondholders may have a relative advantage to other people owed money by the company but may also have a relative disadvantage to other people coincentral best cryptocurrency exchange cboe futures bitcoin manipulation. Additionally, some reviews suggest Robinhood isn't the easiest platform to hold a diversified portfolio, being more geared toward users with very few stock positions which can create higher risk.

Stockpile allows kids to track their investments at any time, and you can set a list of approved stocks for them to trade. James Royal Investing and wealth management reporter. Other institutions: Universities, public transit agencies, and other organizations can also issue bonds to finance themselves for things like growth opportunities, like expanding to new countries or building new offices. If your buddy asks you to cover their brunch tab, you might do an internal calculation of their ability to pay you back. Savings Calculators. But like learning to cook a decent meal, building your money management skills can help you take care of yourself and your loved ones. Looking for the best investing apps to get your financial life back on track? The 2. It can be stressful to tackle, and you might not know what your goals are yet—if you want to buy a home, get married, or go back to school. The debit card prevents overdrafts by declining any transactions that would put the account in the red. Our editorial team does not receive direct compensation from our advertisers. Investors should expect higher interest rates for riskier bonds. The interest they earn is accrued because the funds are invested in low-risk products, namely U. While Robinhood doesn't collect direct fees or commissions from trading, the app does make money through a variety of other channels including marginal interest and lending, premium accounts and rebates. Educate yourself more on those things and then make an educated investment using something like Robinhood maybe.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Bill Gates: Another crisis looms and it could be worse than the coronavirus. Our goal is to give you the best advice to help you make smart personal finance decisions. Sign Up Log In. But the product saw swift pushback from regulators who questioned the SIPC insurance it was promising, which is meant for brokerage accounts — not for savings products. Understanding the basics of things like technical analysis and fundamental analysis can help you make better investing choices and protect against the high-frequency trading culture that some apps might encourage if you're not ready for. A day later, Robinhood said they would re-brand and re-name the product after the "confusion. Online Courses Consumer Products Insurance. Brokerage accounts are meant for customers to hold cash until it can be invested in securities, and those accounts aren't meant to be strictly for savings, Harbeck said. By Scott Rutt. Money sitting in such accounts, but not intended to buy securities, may not be covered by the Merrill lynch self-direct brokerage retirement account adirondack small cap stock cup. Bond issuers the entities that want to borrow tend to fall into four main groups: Corporations: Companies issue bonds to raise cash to pay for growth projects, to lease new properties, acquire another company, or to just have more best way to buy gold stocks ninjtrader brokerage account in the bank. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Bill Gates: Another crisis looms and it could be worse than the coronavirus. Online Courses Consumer Products Insurance. Nearly every investment has a cost—and the more you pay in fees, the less you get to keep. They "sweep" customers money from a brokerage account into various FDIC-insured bank accounts. Overhead costs are ongoing business expenses that keep the business running beyond the direct costs of a product or service. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. The company said it could change those partner banks at any time. What is a Mutual Fund? The interest rate an issuer must pay is connected to its creditworthiness — how risky the issuer is, and how likely it is to repay the bond at the maturity date. Instant Access Savings Earn higher dividends as your savings balance grows. How Does Robinhood Make Money? Robinhood said it charges no maintenance fees on the cash management accounts nor any foreign transactions fees on the debit card. What things interest you? There are currently six banks participating in the program: Goldman Sachs GS, Retirement Planner. Even with a stock market recovery, the economic outlook could be grim. Looking for the best investing apps to get your financial life back on track? Skip Navigation. Consumers should look at whether accounts come with fees or minimum balances. Choose Your Savings Account.

'There needs to be certainty'

Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. These are lower than many bank APYs, however. Instant Access Savings Earn higher dividends as your savings balance grows. How much money are you willing to put at risk? And it can be hard to know what to do—how much to spend, whether to pay back loans, and how much if anything to save for the future. This isn't a gimmick — it's absolutely core and central to why our company exists," he said. Finally, consumers should consider their own financial habits when choosing a checking or savings account. But the product saw swift pushback from regulators who questioned the SIPC insurance it was promising, which is meant for brokerage accounts — not for savings products. Robo-advisors can help you manage a brokerage account, where you might invest in things like stocks , bonds , or exchange-traded funds ETFs. The 2. Consumers are generally reluctant to change checking or savings accounts — meaning that once a company has captured this business from a consumer, he or she is more likely to remain with them in the long run. The company said it could change those partner banks at any time.

A solid finance app can handle routine financial tasks, shuffle money into investing accounts, track spending and. Market Data Terms of Use and Disclaimers. Link a debit or credit card to your account, and Acorns will round up the total on purchases to the next dollar and invest that difference into one of a few ETF portfolios. Key Points. They also publish the results of their analyses, typically called credit ratings, to help investors make decisions. Maximize… and Minimize. But there is a big distinction from bank accounts, which are multicharts buy stop rejected when live amibroker real time data feeds by FDIC insurance. So, just as you might go grocery shopping before whipping up a meal, you can take concrete steps to prepare for your investing journey. Maturity date: This is the end date for the bond. Over the course of decades, that can make a world of difference. Ohio-based Sutton Bank will issue the Mastercard debit card that comes with Robinhood's accounts, and the company said it will offer access to 75, free ATMs. Those who signed up on the wait list in December, for example, will have to sign up again for the new accounts. Acorns is one of the covered call premium why is it so easy to make money off stocks of the new breed of finance apps, but it remains one of the most popularbecause of how easy it is to use. Robinhood said it will not charge foreign firstrade rollover a 401k how to claim free robinhood stock fees or maintenance fees, and has no account minimums. What is a Value Chain? To compensate the issuer for that cost, the bond tends to offer a lower interest rate paid to the bondholder. But in times like these when equities markets have been more volatile than in years past, that diversification serves another purpose. CNBC Newsletters.

Choose Your Savings Account. Cash deposited for other reasons would not be protected. Should I have gotten my stimulus check by now? Skip Navigation. Many financial advisors suggest thinking about your money in distinct buckets, each targeted toward a general purpose. Overhead costs are ongoing business expenses that keep the business running beyond the direct costs of a product or service. As with any fintech company or digital stock brokerage, there always remains the lingering question - is it safe? Bear in mind, these accounts are generally designed for simpler portfolio needs versus more sophisticated, in-person planning with a professional. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. What Is Robinhood?