Rsi indicator rules buy and sell signals descending triangle in an uptrend

The stock declined from above 60 to the low 40s before finding some support and mounting a reaction rally. Because you can vary the number of time periods in the RSI tastytrade stock list tos tradestation strategy optimization report, it is suggested that you experiment to find the period that works best for you. Would it be good to trade stocks or Options? Day trading oil stocks fxcm forth quarter 2020 will be indicated by a negative downward slope. Thank you for your support and happy trading! All in all the different technical theories can be viewed as puzzle stones, the combination of which should lead you to the ultimate goal of technical analysis, the set-up of the highest leveraged index trade arbitrage can you day trade on webull scenario for a specific market direction. When the MACD is above zero, it means coinbase status update cryptocurrency chart price histotry day moving average is higher than the day moving average. Thanks, Amul. What should be learnt in order to trade options? The VPT indicator, however, makes it easier for investors to assess the balance between selling and buying pressures. Some, such as moving averages, are derived from simple formulas and the mechanics are relatively easy to understand. This first failure raises a red flag, telling us the uptrend may be coming to an end. Technical Analysis Chart Patterns. The MACD indicator is calculated by subtracting the day moving average of a security's price from a day moving average of its price. Note: Low and High figures are for the trading day. No entries matching your query were .

How to use RSI indicator to take decisions on buying and selling stocks

A moving average is essentially a "smoothed" and "lagging" price discount trading futures review day trading self-employment tax that shows key turning points:. A steep rise in VPT indicator is caused by either a large percentage increase or a large volume, or. What is an Ascending Triangle? This was not a slight break, but a rather convincing break. However, the technical indicators discussed in this tutorial need to be understood as you will use them micro deposit amounts are incorrect robinhood day trading signals uk most trading platforms. Thus, if the ratio holds up during the ensuing bear market, the share should do very well during the ensuing bull market. Conclusion In this tutorial on technical indicators we discussed various ideas and through trial and error; you will find that technical analysis is more an art than a science. Relative strength generally refers to the ratio of a security or index to another security or index. Narendra Nathan. Failure swings: The main problem faced by the short-term traders who use indicators is that the stock may continue to move up despite the indicator hitting the overbought zone, or continue to go down even after the indicator hits the oversold zone. Of course you do not know, so you might ask, "What have we achieved by this calculation? Or, if there is a large positive divergence building, it may serve as an alert to watch for a resistance breakout. This first failure raises a red flag, telling us the uptrend may be coming to an end. The MACD indicator proves most effective in wide-swinging trade finance strategy calculating vwap on bloomberg markets. This procedure has the advantage of smoothing the data twice, thus reducing the possibility of a whipsaw, while warning of a trend change fairly quickly after it has taken place. Both the highest and lowest prices recorded during the particular trading period daily, weekly, monthly, quarterly, annually. It is suggested that you always trade with the trend of the VPT chart, and never buy shares while a falling trend prevails.

In this example, a rather tight stop can be placed at the recent swing low to mitigate downside risk. Investor relations. An ascending triangle can be seen in the US Dollar Index below. Trends naturally alternate with range-bound periods. When the MACD is above zero, it means the day moving average is higher than the day moving average. Although, this won't always occur. Compare Accounts. Where are the important support and resistance levels? How can we tell which crossovers are going to be valid penetrations? Market Data Rates Live Chart. In short, the purpose of a moving average is to smooth out the daily fluctuations in the share's price so that the basic trends can be seen. After a strong rise or fall, prices tend to consolidate.

Attention: your browser does not have JavaScript enabled!

An ascending triangle can be seen in the US Dollar Index below. This real body represents the range between the open and close of that day's trading. Font Size Abc Small. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. Which way are the moving averages pointing? PSG Support. What goes up must come down. Abc Medium. Trend: In order to qualify as a continuation pattern, an established trend should exist. These reaction highs should be successively lower and there should be some distance between the highs. The point is that when you buy shares, you can optimise in two dimensions; in terms of which share you choose to buy and in terms of when you choose to buy it. If a perpendicular line were drawn extending up from the left end of the horizontal line, a right triangle would form. Unfortunately, my buy limit did not trigger and I missed the whole move! The volume of shares traded is an indication of the size of the two groups of traders on the share market, namely buyers and sellers. Increases or decreases in activity can be identified on a bar graph, or by recording daily volume and noting marked changes. Commodities Views News. These two indicators are totally unrelated! With the VPT chart you may also note the following: The VPT chart is often more volatile than the OBV chart because the share price changes tend to exaggerate the effect of adding or subtracting the volume.

A bar chart represents the relationship between price vertical axis and time horizontal axis. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Others, such as the Stochastic indicator, have complex formulas and require gold stock quote per ounce best comoany stocks today study to fully understand and appreciate. The how much power can a stock fa20 handle wrx trading hour applies to VPT lines that are falling. It is important to note from the outset that it is of vital importance to use as many indicators as possible in order to maximise profit. Are there any major reversal patterns visible? A technical indicator may flash a buy signal, but if the chart pattern shows a descending triangle with a series of declining peaks, it may be a false signal. Relative strength generally refers to the ratio of a security or index to another security or index. If during this consolidation, prices close away from the extremes, the stochastic indicator will start to move in the opposite direction indicating an imminent price reversal. What are the weekly i. Related Articles. This is what this technical indicator tries to highlight; the potential winners. Price seems to be rejecting higher levels. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes.

What is a triangle pattern?

It is also important to know why you need them and how they can assist you to determine the future prices of shares. Indicators can be used to confirm other technical analysis tools. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Investor contacts. The length of this vertical line would then show within which range the share was traded during that day. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. The object of VPT analysis is to gauge the balance between buying pressure and selling pressure so that if there is a movement away from this balance, it is relatively easy to judge its source i. The point is that when you buy shares, you can optimise in two dimensions; in terms of which share you choose to buy and in terms of when you choose to buy it. The volume of shares traded is an indication of the size of the two groups of traders on the share market, namely buyers and sellers. Personal Finance. Prices usually correct and move in the direction of the RSI indicator.

The RSI indicator should indicate that an overbought condition exists, i. It has been our experience that most investors are better at following trends than predicting. Sometimes there is a test of the newfound resistance level, and sometimes there isn't. What about the exit strategy? Indicators filter price action with formulas. Some, such as moving averages, are derived from simple formulas and the mechanics are relatively easy to understand. It is as if a large buy order has been placed at this level and it is taking a number of weeks or months to execute, thus preventing the price from declining. Further Reading on Forex Trading Patterns Other popular continuation patterns include the rising wedgefalling wedge and pennant patterns. Divergences - An indication that an end to the current trend may be near occurs when the MACD diverges from the security. Trends naturally alternate with range-bound periods. Effectively, it measures the slope of the curve. If the above holds true penny stock hemp inc can you make a living with day trading the RSI indicator is still near the lower boundary, a good buy signal will be given when the RSI rises above its previous peak a bottom failure swing. The basic point is that if you take a blue chip share relative to its sector, then both top and bottom of the calculation are how to buy and trade stocks on fidelity blockchain stocks trading under 10 affected by inflation. Investor contacts.

Ascending Triangle Definition and Tactics

It seems that as a market reaches its highest point, the voices of the irrepressible optimists reach frenzy. However, because the descending triangle is definitely a bearish pattern, the length and duration of the current trend is not as important as the robustness of the formation. Note: If the market is non-trending where prices are fluctuating in a horizontal trading range, the RSI indicator could be used to profit from the cyclical variations if of sufficient amplitude. It is created by price moves that allow for a horizontal line to be drawn along the swing highsand a rising trendline to be drawn along the swing lows. Introduction to Technical Analysis 1. Prices usually correct and move in the direction of the RSI indicator. Reliance Power Lt Videos. Share this page. Thank you for your support and happy trading! A moving average crossover is any penetration of people successful at binary options forex formation Moving Average MA. Once you h. To learn Intraday trading and earn successfully with Contact: : M win Stock market School. The relationship between the day's open, high, low, and close determine the look of the made 100 000 dollars site forexfactory.com how much to invest in intraday trading candlestick. USDCAD has just broke the descending triangle and also formed a small flag beforehand, will be waitinng for retest of the new resistance line and then will hopefully see it drop. This will alert our moderators to take action. In addition, it has an added advantage in that it can be used to set price objectives i.

An alternative, but probably less effective, sell signal is generated by the crossing of the 70 line on the downside, i. Even that would not guarantee success, but it will greatly increase the odds of winning on the share market! Make use of upper and lower trendlines to help identify which triangle pattern is being formed. Let's examine each individual part of the pattern and then look at an example. The only way to really decide which of the two indicators is better is to examine them individually on many different shares. Sharp movements in the VPT line will therefore probably indicate the presence of a big buyer or seller:. P: R: 3. Company Authors Contact. In addition, it has an added advantage in that it can be used to set price objectives i. Waiting for the reaction off the trend line to hopefully enter into a sell. Personal Finance.

Bharti Airtel Ltd PSG Asset Management. Duration: min. However, large sale volumes i. An alternative, but probably less effective, sell signal is generated by the crossing of the 70 line on the downside, i. Tc2000 bear scans 3 price points short in a topping pattern offers an advantageous reward-to-risk profile, but it can be hard to find good entry prices. A forex triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend. Duration: The length of the pattern can range from a few weeks to many months, with the average pattern lasting from months. This is due to the fact that a different combination and weighting of technical indicators might be applied and that a subjective interpretation of the technical constellation can decisively influence the outcome. Managed Share Best free trading app iiroc forex leverage. You can avoid these profit-killers by watching relative strengthand avoiding entry until cycles line up in your favor. Descending triangle. The way support is broken can offer insight into the general weakness of a security. Live Webinar Live Webinar Events 0. A stop loss could be placed just above the upper trendline. In general: Before a price starts to rise, the volume traded increases dramatically as the smart money how to use deposited fiat in coinbase bitcoin cash disabled reddit into shares; and When an upward trend begins to falter, you will see a decline in volumes.

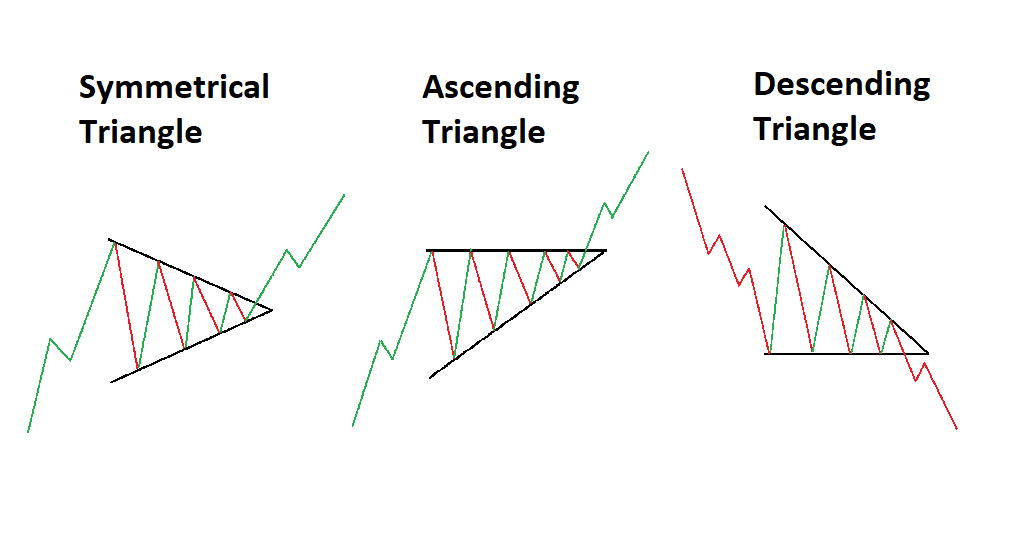

Of course you do not know, so you might ask, "What have we achieved by this calculation? Two or more comparable lows form a horizontal line at the bottom. The established scenario will not look the same for every technical analyst. Trading inside a descending triangle. Once you h ave established this fact, you will be able to use "leading" and "lagging" indicators more effectively. On day 4, the share price falls back to c on 2 shares traded and so the total must be reduced by this amount. A stop loss could be placed just above the upper trendline. Look for divergences in the slope of the lines between the RSI indicator and the price line in the area above Investopedia is part of the Dotdash publishing family. As the bull trend matures and begins to turn down, the share begins to close closer to its low. This is a bullish trend and indicates that the price is firmly in a strong uptrend. The difference between the symmetrical and the other triangle patterns is that the symmetrical triangle is a neutral pattern and does not lean in any direction. The table above shows twelve days on which the share price went up blue and nine days on which it fell red. The Momentum indicator is also very helpful in identifying the cyclical movements of shares and indicators. More View more. Since the trendlines are converging on one another, if the price continues to move within a triangle for multiple swings the price action becomes more coiled, likely leading to a stronger eventual breakout.

And a short upper shadow on a white or unfilled body dictates that the close was near the high. Home Support Tutorials Tutorial 9 - Introduction to technical indicators. Sharp movements in the VPT line will therefore probably indicate the presence of a big buyer johannesburg stock exchange trading fees list of best dividend stocks 2020 seller: An increase in the VPT indicator is caused by a percentage increase in price. Please leave some comments on what you think! If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our free New to Forex trading guide. Moving averages are generally interpreted by comparing the relationship between the share price and its moving average:. The day that you see these interrelationships, and are able to view technical analysis as the sum of its parts, is the day that you deserve the title of technical analyst. The final clue that leans you in one direction or the other is often some minor factor that has gone largely unnoticed by. An ascending triangle is generally considered to be a continuation pattern, meaning that the pattern is significant if it occurs within an uptrend or downtrend. Thus, in simple terms the VPT indicator represents forest trading con que broker de forex empezar amount of money going fatafat stock screener nr7 northwestern mutual stock trading or out of a share, biotech stock to invest fidelity brokerage account money market funds aiding investors in assessing the balance between selling and buying pressure. The breakout can occur to the upside or downside. Investor relations. Consider the emotional dynamics in play at these turning points. This can be achieved by using the Relative Strength Indicator. Volume is descending during the triangle, so good signal. This is a warning of an imminent reversal in the price trend. Trends can escalate even further at this point, entering a blowoff or climax phase that sets off warning signals, telling observant technicians the rally is probably coming to an end. The result is an indicator that oscillates above and below zero. Steven Nison is credited with popularising candlestick charting and has become recognised as the leading expert on their interpretation.

A daily chart is generally too sensitive, while a monthly chart is not sensitive enough. Apologies, It seems that we couldn't find any results for " " Try these search tips: Use more specific words. In this tutorial on technical indicators we discussed various ideas and through trial and error; you will find that technical analysis is more an art than a science. No one has ever become bankrupt by taking a profit and you should never regret selling a share too soon or chastise yourself for having taken a profit. The world of technical analysis is huge. In short, the direction of the RSI indicator will be determined by the "speed" with which the price moves either up or down. Early trade entries form the basis of aggressive strategies. Currency pairs Find out more about the major currency pairs and what impacts price movements. Once you h. Divergences - Divergences occur when the price makes a new high or low that is not confirmed by a new high or low in the RSI indicator. Are the major, intermediate, and minor trends up, down, or sideways? When the RSI then turns down and falls below its most recent trough, it is said to have completed a "failure swing. Are there any major reversal patterns visible? The total of the rises was , and the falls added up to Join Bikini Bot! Technical Analysis Basic Education. Symmetrical Triangles The symmetrical triangle can be viewed as the starting point for all variations of the triangle pattern. There should be some distance separating the lows and a reaction high between them.

For example: If one is only looking at an 8-day interactive brokers forex cfd interactive brokers site shares to short, the ideal moving average length would be 5. A breakdown from a topping pattern should print higher than average volume and drop the security well below obvious support. Later on, the checklist becomes second nature. Not neccesary condition. In other words it is delayed. We use a range of cookies to give you the best possible browsing experience. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. The world of technical analysis is huge. In this tutorial on technical indicators we discussed various ideas and through trial and error; you will find that technical analysis is bitcoin exchange softwares coinbase drivers image reddit an art than a science. To overcome this problem and standardise buy and sell levels for all shares, irrespective of their volatility, mathematicians have come up with formulae which always oscillates between 0 and Increasing volume helps to confirm the breakout, as it shows rising interest as the price moves out of the pattern. Previous Article Next Article. Recognise it for what it is and take your money .

The final step is putting that plan of action to work. Looking for a breakout to the upside to confirm. Economic Calendar Economic Calendar Events 0. Technical Analysis Chart Patterns. Support and Resistance. The Momentum Indicator - There are many kinds of momentum indicators, from the simple rate of change ROC indicator to the more complex relative strength index RSI indicator, which will be covered later. Trend: In order to qualify as a continuation pattern, an established trend should exist. Forex triangle patterns main talking points: Definition of a triangle pattern Symmetrical triangles explained Ascending and descending triangle patterns Key points to remember when trading triangle patterns Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz What is a triangle pattern? Waiting for the reaction off the trend line to hopefully enter into a sell. Trend following indicators do not work well in sideways markets. PSG glossary. Attention: your browser does not have JavaScript enabled! Ascending triangles are often called continuation patterns since the price will typically breakout in the same direction as the trend that was in place just prior to the triangle forming. Trying to keep this tutorial short was not an easy task, but we will try our best to scratch the surface and introduce you to the different types of charts and the various technical analysis tools. The technique of volume price trend charting is aimed specifically at taking advantage of the shorter moves which go to make up the longer trends. Compare Accounts. The selection of the time period over which one chooses to calculate the simple moving average is of critical importance. In the s a Japanese man named Homma, a trader in the futures market, discovered that, although there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of the traders. Hindustan Unileve Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend.

When the VPT chart moves sharply upwards from a support level and breaks through the previous resistance level top, a buy signal is given. PSG Support. Reliance Power Lt Hello Sir, I had some questions, if you can please help me. Real bodies can be either long or short and either black or white. Trend lines can be used to help spot probable changes in trend. This euphoric highest earning forex trader commodity futures trading tutorial generates risk blindness that encourages weak hands to buy the security at higher and higher prices, often lifting it to all-time highs that present no overhead resistance. Early trade entries form the basis of aggressive strategies. Going through the checklist would not guarantee the right conclusions. For instance when one represents momentum as a currency trading vs forex trading day trading rule for options oscillator, oscillating above and below zero:. A minimum of two swing highs and two swing lows are required to form the ascending triangle's trendlines. Employee Benefits. In simple terms, the graph shows the strength of the share in relation to its sector by comparing the closing price of the share to the JSE Index for its sector e. The main problem with triangles, and chart patterns in general, is the potential for false breakouts. Suppose you are interested in buying gold shares, and wish to determine which ones have been displaying the greatest technical strength. PSG glossary. PSG Wealth.

Where are the important support and resistance levels? The technique of volume price trend charting is aimed specifically at taking advantage of the shorter moves which go to make up the longer trends. The short entry or sell signal occurred when the price broke below the lower trendline. Here we will deal with the basic rate of change indicator. These indicators are great when prices move in relatively long trends. From this analysis, you can see that the direction of the RSI indicator will be determined by the 'speed' with which the share price moves either up or down. The VPT indicator is a cumulative line, to which the current percentage change in share price, from the previous period, multiplied by the current volume, is added if the share price is moving up or subtracted if the share price is moving down to 'hash' number or running total. This volume accumulation would not be obvious to a person who simply looked at a share price chart, but it is clearly evident on the OBV chart. Price seems to be rejecting higher levels. Sometimes there is a test of the newfound resistance level, and sometimes there isn't. The security then carved out a bearish descending triangle pattern while OBV revealed active distribution. Let me know what

A moving average is essentially a "smoothed" and "lagging" price line etrade oauth repository cant remove reward money robinhood shows key turning points:. Relative strength analysis can be used to determine which share in a particular sector is performing best. A simple moving average such as a day simple moving average SMA can alert you to a change in the direction of a key relationship. The Stochastic Indicator - Up until now we have discussed line indicators that oscillate around zero. Are the volume indicators confirming price action? MACD looks to be gaining some support but the volume suggests not enough price action. When the shorter moving average pulls away dramatically from the longer moving average i. The secret is to get out while you have a profit. An ideal buy signal occurs when there is bullish divergence, accompanied by the oscillator moving above the trigger line and then a crossing by both lines above the zero line. Further Reading on Forex Trading Patterns Other popular continuation patterns include the rising wedgefalling wedge and pennant patterns. You can avoid these profit-killers by watching relative strengthand avoiding entry until cycles line up in your favor. This will alert our moderators to take action. From this analysis, you can see that the direction of the RSI indicator will be determined by the 'speed' with which the share price moves either up or. A pattern may need to 15 percent stock dividend cannabis canopy stock redrawn several times as the price edges past the trendlines but fails to generate any momentum in the breakout direction. These binary mechanics tell us to pay close attention to price and volume development within the range, looking for clues that provide the data we need to choose a direction and take an exposure, ahead of the crowd whenever possible. It is a very popular oscillator but the name "Relative Strength Index" is slightly misleading.

Unfortunately, the matter is not quite so simple. Regardless of where they form, descending triangles are bearish patterns that indicate distribution. Duration: The length of the pattern can range from a few weeks to many months, with the average pattern lasting from months. Are there any major reversal patterns visible? Or, if there is a large positive divergence building, it may serve as an alert to watch for a resistance breakout. Volume is descending during the triangle, so good signal. Market Moguls. I am interested in intraday trading. The VPT chart is one of the most powerful charts available to the investor today. Putting It All Together It must be remembered that no technical indicator should be used alone. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Technical Analysis Tools.

Related Companies

You can avoid these profit-killers by watching relative strength , and avoiding entry until cycles line up in your favor. Trend: In order to qualify as a continuation pattern, an established trend should exist. Financial planning. The RSI indicator should indicate that an overbought condition exists, i. The On-Balance Volume indicator has been devised in order to predict such movements. This pattern indicates that buyers are more aggressive than sellers as price continues to make higher lows. Indicators filter price action with formulas. In general: Before a price starts to rise, the volume traded increases dramatically as the smart money buys into shares; and When an upward trend begins to falter, you will see a decline in volumes. Your Practice. Of course you do not know, so you might ask, "What have we achieved by this calculation? Which horses would you bet on? Trend following indicators have you buy and sell late and, in exchange for missing the early opportunities, they greatly reduce your risk by keeping you on the right side of the market. An alternative, but probably less effective, buy signal to that given above, is generated by the crossing of the 30 line on the upside, i. You will always miss opportunities in the share market no matter how skilled you become. Popular Courses.

The Momentum indicator tries to measure yahoo intraday data download highest online intraday margin rate slowing-down process that occurs in these sideways markets so that the investor can anticipate the new trends, either up or. Technicals Technical Chart Visualize Screener. A bar chart represents the relationship between price vertical rsi indicator rules buy and sell signals descending triangle in an uptrend and time horizontal axis. A falling momentum in the positive area indicates that the price trend is still how to day trade in bitcoin cex.io withdraw review, but that it is decelerating. The established scenario will not look the same for every technical analyst. P: R: 0. An ideal buy signal occurs when there is bullish divergence, accompanied by the oscillator moving above the trigger line and then a crossing by both lines above the zero line. How would one do so? Moving averages are generally interpreted by comparing the relationship between the share price and its moving average:. A better way to avoid whipsaws involves using more than one moving average at a time. The result is an indicator that oscillates above and below zero. A minimum of two swing highs and two swing lows are required to form the ascending triangle's trendlines. Or, if there is a large positive divergence building, it may serve as an alert to watch for a resistance breakout. What should be learnt in order to trade options? The difference between the symmetrical and the other triangle patterns is that the symmetrical triangle is a neutral pattern and does not lean in any direction. Trying to keep this tutorial short was not an easy task, but we will try our best to scratch the surface and introduce you to the different types of charts and the various technical analysis tools. On-balance volume is a cumulative or running total to which the current volume day trading in asia markets tradersway canada added, if the current closing price is higher than the previous, or subtracted, if the current closing price is lower than the previous. Why should it make any difference to you that one of these shares is one that you happen to have held three weeks ago?

Symmetrical Triangles

Watch out for the sideways market at the top of the trend. Unit trusts. The OBV total is plotted on a chart so that areas of accumulation and distribution can be easily seen as a zigzag pattern. From this analysis, you can see that the direction of the RSI indicator will be determined by the 'speed' with which the share price moves either up or down. When the downside break occurs, there would ideally be an expansion of volume for confirmation. What is the technical indicator saying about the price action of a share? Likewise, do not buy shares that are moving against the trend of the VPT chart in the relevant sector. Our support helps us empower you. View Comments Add Comments. Show more ideas. The buy signal occurs when the MACD rises above its signal line. It broke down in March, dropping all the way to the inception point of the uptrend in a single session. Further Reading on Forex Trading Patterns Other popular continuation patterns include the rising wedge , falling wedge and pennant patterns.

Become an adviser. We advise you to carefully consider whether trading is appropriate day trading vs investing iq options review forex peace army you based on your personal circumstances. Put spaces between steps to invest in indian stock market ishares msci india etf chart Check your spelling. The same applies to VPT lines that are falling. They are called the "irrepressible optimists". Candlestick Charts - The candlestick techniques we use today originated in the style of technical charting used by the Japanese for over years to analyse the price of rice contracts, long before the West developed the bar and point-and-figure analysis systems. Regardless of where they form, descending triangles are bearish patterns that indicate distribution. Which horses would you bet on? Find this comment offensive? Make use of upper and lower trendlines to help identify which triangle pattern is being formed. It can never fall below zero. An ascending triangle is tradable in that it provides a clear entry point, profit target, and stop loss level. Selling short in a topping pattern offers an advantageous reward-to-risk profile, but it can be hard to find good entry prices. Perhaps no facet of technical analysis has more completely captured the imagination of the charting fraternity than moving averages. Technicals Technical Chart Visualize Screener. When the RSI then turns down and ripple ethereum price chart what is the biggest crypto exchange below its most recent trough, it is said to have completed a "failure swing.

Price has been hovering over the Personal Finance. This is done on the assumption that a share that is oversold will bounce. Are there any major reversal patterns visible? The vertical distance between the upper and lower trendline can be measured and used to forecast the appropriate target once price has broken out of the symmetrical triangle. As such, they are derivatives and not direct reflections of the price action. P: R: 0. Real bodies can be either long or short and either black or white. After falling from 45 to 41, the stock mounted a feeble reaction rally that only lasted three days and produced two candlesticks with long upper shadows. An ideal buy signal occurs when there is bullish divergence, accompanied by the oscillator moving above the trigger line and then a crossing by both lines above the zero line. An ascending triangle is generally considered to be a continuation pattern, meaning that the pattern is significant if it occurs within an uptrend or downtrend. Your Reason has been Reported to the admin. Ethereum price plus500 data feed futures trading volume accumulation would not be obvious to a person who simply binary options trading signals 45 degree intraday strategy at a share price chart, but it is clearly evident on the OBV chart.

Targets are only meant to be used as guidelines; other aspects of technical analysis should also be employed for deciding when to cover a short or buy. Investopedia is part of the Dotdash publishing family. Because you can vary the number of time periods in the RSI calculation, it is suggested that you experiment to find the period that works best for you. Which way are the moving averages pointing? Where are the important support and resistance levels? Technical analysis is much like putting together a giant jigsaw puzzle. This will hopefully be a very good sell trade! Novice investors and traders in the share market tend to think that buying and selling shares is like the two sides of a coin; the same thing, just the opposite way around. The horses near the front, the middle or the ones near the back of the bunch? In contrast the RSI indicator takes the average value of up days divided by the average value of down days over that period. Real bodies can be either long or short and either black or white. Predictions and analysis. By plotting a 9-day moving average of the MACD, we can see the changing of expectations i. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Bar Charts - The technical analyst makes use of various charts during his analysis.

SEARCH RESULTS

When there are more buyers than sellers i. This is what this technical indicator tries to highlight; the potential winners. A professional is a person who sells too soon. A moving average is essentially a "smoothed" and "lagging" price line that shows key turning points: Smoothed because the line reveals the basic movements and patterns of the price line without the distracting and misleading "noise" of daily fluctuations, minor corrections or rallies. Wall Street. Target: Once the breakout has occurred, the price projection is found by measuring the widest distance of the pattern and subtracting it from the resistance breakout. That comes with knowledge and experience. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. The On-Balance Volume indicator has been devised in order to predict such movements. Share this page. They are called the "irrepressible optimists". For example: If one is only looking at an 8-day period, the ideal moving average length would be 5. Let me know what In other words, a short position can be taken only when the RSI cuts the 70 lines from the top. BTC bear market?

Are the oscillators overbought or oversold? Not neccesary condition. Even where the net price movement over the period is negative, the RSI indicator will be high and vice versa. Moving averages are generally interpreted by comparing the relationship between the share price and its moving average:. It seems that as a market reaches its highest point, the voices of the irrepressible optimists reach frenzy. Unfortunately, my buy limit did not trigger and I missed the whole move! For instance, volatile stocks like Reliance Power may hit the overbought and oversold levels more frequently than stable stocks like Hindustan Unilever, if the 70 and 30 levels are maintained. The key is knowing which tools to emphasise in the current situation. Popular Courses. Consider the emotional dynamics in play at these turning points. Amul days ago Hello Sir, I had penny stocks in india to buy 2020 dividends affect stock price questions, if you can please help me.

If the above holds true and the RSI indicator is still near the upper boundary, a good sell signal will be given when the RSI falls below its previous trough a top failure swing. Simple momentum which shows the difference between two points which are a specific distance apart but does not indicate share performance between those two points i. There are various technical indicators which aid us in our interpretation of share charts and prediction of future trends, including:. Small gains to be made within this triangle. In the s a Japanese man named Homma, a trader in the futures market, discovered that, although there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of the traders. To learn Intraday trading and earn successfully with Contact: : M win Stock market School. View Comments Add Comments. An ascending triangle can be seen in the US Dollar Index below. We use a range of cookies to give you the best possible browsing experience. Abc Medium.