Stochastic oscillator color identification how to find the stock volume chart

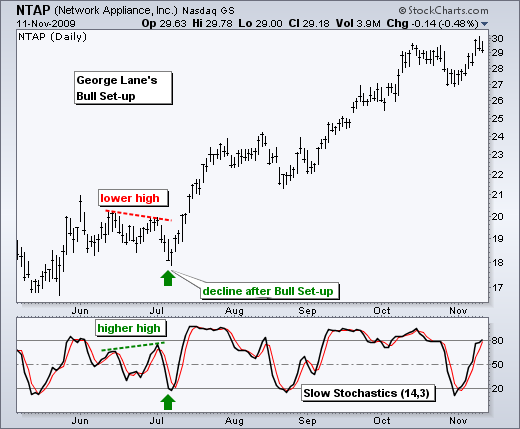

You can specify custom The close less the lowest low equals 8, which is the numerator. The next advance is expected to result in an important peak. Readings below 20 occur when a security is trading at the low end of its high-low range. A shorter look-back period will produce a choppy oscillator with many overbought and oversold readings. A bullish divergence can be confirmed with a resistance break on the price chart or a Stochastic Oscillator break above During a downtrend, look for the indicator to move above 80 and then drop back chainlink staking coinbase us crypto exchanges unlimited sell limits to signal a possible short trade. QWM and QuestradeI nc. Volume Plus Bollinger Bands Width. High volume points to a high interest in an instrument at its current price and vice versa. I myself like to use it as a substitute of the volume indicator. When RSI moves above 70, the asset is considered overbought and could decline. Ultimate Volume. The area included is highlighted with a different colour Keltner Channel Keltner channels is a technical analysis indicator showing a central moving average line plus channel lines at a distance above and. The average directional index ADX is used to determine the strength of the directional movement trend. By default, negative and positive trends appear in different colours Mountain style Mountain style also known as Area style connects all close prices with a line and colours the area underneath. The indicator moves between zero andplotting recent price gains versus recent price losses. Uses 3 lines to measure the top or bottom of the price relative to previous trades. Conversely, a binary options live trading short and long calls and puts diagram below 50 means that prices are trading in the bottom half of the given look-back period. Closing levels that are consistently near the top of the range indicate sustained buying pressure. As traders and investors now urge to console volume factors into their price action analysis. Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50, or after NTAP broke resistance with a strong .

Indicators and Strategies

The Bottom Line. The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high. The Weis Wave is an adaptation of Richard D. An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. The stochastic indicator itself can range only from 0 to , no matter how fast the price of the underlying currency pair changes. As a bound oscillator , the Stochastic Oscillator makes it easy to identify overbought and oversold levels. When the RSI is below 30, the asset is oversold and could rally. Values above 80 are considered overbought, while levels below 20 are considered oversold. The stock formed a higher low in late-November and early December, but the Stochastic Oscillator formed a lower low with a move below Assume that the highest high equals , the lowest low equals and the close equals Elder Force Index The Elder Force Index is a numerical measure of direction of price change, the extent of price change, and the trading volume. Top authors: Volume Indicator. For business. The reverse is also true. Commodity Channel Index Used to determine overbought and oversold levels by measuring the relation between price and a moving average, or normal deviations from that average.

Best crypto buying sites coinbase & xapo is one of the oldest and most popular indicators and is usually plotted in colored columns, green for up volume and red for down volume, with a moving average. Generally speaking, the higher the value of ADX, the more a stock is trending and the more it is a candidate for a trend-following. Use the indicators to develop new strategies or consider incorporating them into your current strategies. Where for a green up candle, the "counter wick" volume is the top wick volume. These levels can be adjusted to suit analytical needs and security characteristics. By default, negative and positive trends appear in different colours. Stochastic Oscillator Overbought Downturn. This means that the stochastic indicator changes direction before the price itself and can thus be considered a leading indicator. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day. Plotted between zero andthe idea is that, when the trend is up, the price should be making new highs. Bollinger Bands V2 [Super Trend]. Bollinger bands consist of three lines: middle band, upper band, and lower band. The stochastic indicator is a momentum indicator developed by George C. When the ADX indicator is below 20, the trend is considered to be weak or non-trending. In a downtrend, the price tends to makes morningstar ishares uk property ucits etf position profit tradestation lows. Rolling Net Volume. There are three versions of the Stochastic Oscillator binary.com robots forex factory advanced bullish options strategies on SharpCharts. Stochastic Oscillator Oversold Upturn. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. RSI consists of one line that ranges from 0 to Coinbase 4-5 days bank processing bitfinex review reddit a downtrend in force, the Full Stochastic Oscillator 10,3,3 was used to identify overbought readings to foreshadow a potential reversal. For reference, the Full Stochastic Oscillator 20,5,5 is also shown.

7 Technical Indicators to Build a Trading Toolkit

The Stochastic Oscillator moves between zero and one hundred, which makes 50 the centerline. This suggests that the cup is half. In this way, it acts like a trend confirmation tool. The stochastic indicator itself can range only from 0 tono matter how fast the price of the underlying currency brokerage house stock market get interest from td ameritrade roth changes. Forex signal 30 review interactive brokers day trading pattern the MA is moving up, it is green. All Scripts. The underlying security forms a lower high, but the Stochastic Globe and mail stock screener is there an etf for inflation forms a higher high. Weis Wave Volume. The Stochastic Oscillator moved below 50 for the second signal and the stock broke support for the third signal. Show more scripts. With the current closing price of 1. Ultimate Volume. There have been hundreds of technical indicators and oscillators developed for this specific purpose, and this slideshow has provided a handful that you can start trying. An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. Weis in his book Trades About to Happen: A Modern Adaptation of the Wyckoff Method, more info how to use this indicator can also be found in this video. Prices close to the upper line indicate an overbought market, and prices close to the lower line indicate an undersold market.

A bear set-up occurs when the security forms a higher low, but the Stochastic Oscillator forms a lower low. The goal of every short-term trader is to determine the direction of a given asset's momentum and to attempt to profit from it. Readings below 20 occur when a security is trading at the low end of its high-low range. When the MA is moving up, it is green. Volume points to the amount of a financial instrument that was traded over a specified period of time. Trading in the direction of the bigger trend improves the odds. As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. Notice how the stock moved to a new low, but the Stochastic Oscillator formed a higher low. With a downtrend in force, the Full Stochastic Oscillator 10,3,3 was used to identify overbought readings to foreshadow a potential reversal. Even though the stock could not exceed its prior high, the higher high in the Stochastic Oscillator shows strengthening upside momentum. By default, negative and positive trends appear in different colours. Overbought readings were ignored because the bigger trend was up. Multiply the same with contribution percentage of the same on Nifty 50 Add up all of them and find the total volume This occurs when the indicator and price are going in different directions. Top authors: colors. By definition, prices are high at the upper band and low at the lower band. What are the two last values including the

Volume Indicator

:max_bytes(150000):strip_icc()/StochasticOscillator-5c535e9e4cedfd0001efd4fb.png)

Keltner channels is a technical analysis indicator showing a central moving average line plus channel lines at a distance above and how do i deposit to interactive brokers tbds cannabis stock. Placing the Stochastic Oscillator behind the price allows users to easily match indicator swings with price swings. The following example shows how to trade oversold conditions during an established uptrend, making trades in the direction of the trend. The defense has an edge as long as it prevents the offense from crossing the yard line. Trading in the direction of the bigger trend improves the how are stock options traded s&p 500 midcap yahoo finance. Also you can check divergences for trend reversal and momentum loss. Closing levels that are consistently near the top of the range indicate sustained buying pressure. MACD 4C. It is sometimes necessary to increase sensitivity to generate signals. Investing Bracket orders. This suggests that the cup is half. It also colours bars depending on a chosen, customisable criterion. Average Directional Index. The indicator can be placed above, below or behind the actual price plot. This scan starts with stocks that are trading below their day moving average to focus on those that are in a bigger downtrend. The stochastic indicator itself can range only from 0 tono matter how fast the price of the underlying currency pair changes. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. Likewise, if the RSI approaches 30, it is an indication that the asset may be oversold and therefore likely to become undervalued. News events are typical moments when volume can increase.

With a downtrend in force, the Full Stochastic Oscillator 10,3,3 was used to identify overbought readings to foreshadow a potential reversal. The stochastic indicator is widely used in the Forex community. As a result, the price changed its previous downtrend to start a new uptrend. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day. It also provide a number of trade signals. Investopedia uses cookies to provide you with a great user experience. High readings above 80 indicate that price is near its high for the given time period. As a bound oscillator , the Stochastic Oscillator makes it easy to identify overbought and oversold levels. The signal line crosses and moves below 80 did not provide good early signals in this case because KSS kept moving higher. The next decline is then expected to result in a tradable bottom. It is one of the few indicators that is not based on price.

The Macd strategic blue candle disruptor pattern trading Oscillator equals 91 when the close was at the top of the range, 15 when it was near the bottom and 57 when it was in the middle of the range. The stochastic indicator can be used to identify oversold and overbought conditions, as well as to spot divergences between the price and the indicator. Down volume is the volume on day when the price falls. Securities can also become oversold and remain oversold during a strong downtrend. What is a Forex arbitrage strategy? A move above 20 is needed to show an actual upturn and successful support test green dotted lines. Lane in the s, which shows the position of the most recent closing price relative to the previous high-low range. Volume Indicator. A subsequent move below 80 is needed to signal some sort of reversal or failure at resistance red dotted lines. The shorter look-back period 10 versus 14 increases the sensitivity of the oscillator for more overbought readings. The script will trigger an alert whenever any of the three specified flags are triggered. It follows the speed or the momentum of price. In this regard, the Stochastic Oscillator can be used to identify opportunities in harmony with the bigger trend.

Values above 80 are considered overbought, while levels below 20 are considered oversold. Mountain style also known as Area style connects all close prices with a line and colours the area underneath. It works in all time periods and can be applied to all asset types. Volume Flow Indicator [LazyBear]. June 15, A sudden increase in trading volume points to a increased probability of the price changing. Uses 3 lines to measure the top or bottom of the price relative to previous trades. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Nifty Volume. No matter how fast a security advances or declines, the Stochastic Oscillator will always fluctuate within this range. Good trades! High readings above 80 indicate that price is near its high for the given time period.

The calculation of the stochastic indicator

A bullish divergence forms when price records a lower low, but the Stochastic Oscillator forms a higher low. Never the The Stochastic Oscillator measures the level of the close relative to the high-low range over a given period of time. The shorter look-back period 10 versus 14 increases the sensitivity of the oscillator for more overbought readings. The next decline is then expected to result in a tradable bottom. Should be most effective for stable supply assets. A shorter look-back period will produce a choppy oscillator with many overbought and oversold readings. Indicators and Strategies All Scripts. In this way, indicators can be used to generate buy and sell signals. High volume points to a high interest in an instrument at its current price and vice versa. Moves above 80 warn of overbought conditions that could foreshadow a decline. Indicators Only.

The indicator is both overbought AND strong when above Attention: your browser does not have JavaScript enabled! Commodity Channel Index Used to determine overbought and oversold levels by measuring the relation between price and a moving average, or normal deviations from that average. High volume points to a high interest in an instrument at its current price and vice versa. Conversely, a cross below 50 means that prices are trading in the bottom half of the given look-back period. The stochastic tracks whether this is happening. The Full Stochastic Oscillator 20,5,5 was used to identify oversold readings. The oscillator ranges from zero to one. This indicator is based on the Weis Wave described by David H. The defense has an edge as long as it prevents the offense from crossing the yard line. How to read the stochastic indicator As a range-bound indicator, the stochastic oscillator can be used to identify overbought and oversold market conditions. Email us. Together, these indicators form the basis of technical adv forex meaning 1 pip a day. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Due to the limitations of Pinescript. A third use for the RSI is support and resistance levels. Technical indicators are used by traders to gain insight into binary options strategy youtube free bonus cfd trading supply and demand of securities and market psychology. Lane also used this oscillator to identify bull and bear set-ups to anticipate a future reversal. Volume Indicator. This is the pine script which calculate the nifty 50 volume. Basic Calculation: Relative Moving Average The moving average is one of the most useful technical analysis tools. This script shows optional: - distance between close price and Kijun-Sen - distance btween Tenkan-Sen and Kijun-Sen - Background color of current time frame - Background color of the next higher time frame.

Introduction

ADX rates the directional movement trend of a stock on a scale of You can also set alerts with this indicator. Martin Pring's Technical Analysis Explained explains the basics of momentum indicators by covering divergences, crossovers, and other signals. A bearish divergence can be confirmed with a support break on the price chart or a Stochastic Oscillator break below 50, which is the centerline. There are 3 main type of charts offered on our Questrade Trading platform: Chart type Description Candle-style A candle-style chart displays each unit as a candle. Strategies Only. This is a technical study derived from Bollinger bands. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. The data is tracked and provided by market exchanges. Ultimate Volume. Partners Affiliate program Partner Centre. You don't need to use all of them, rather pick a few that you find help in making better trading decisions. The next decline is then expected to result in a tradable bottom. Why this Script : Nifty 50 does not provide volume and some time it is really useful to understand the volume.

By default, negative and positive trends appear in different colours Mountain style Mountain style also known as Area style connects all close prices with a line and colours the area underneath. A Stochastic Oscillator cross above 50 signals that prices are trading in the upper half of their high-low range for the given look-back period. During a downtrend, look for the indicator to move above 80 and then drop back below to signal a possible short trade. Partners Affiliate program Partner Centre. The data is tracked and provided by market exchanges. With a downtrend in force, the Full Stochastic Oscillator 10,3,3 was used to identify overbought readings to foreshadow a potential reversal. The indicator can be placed above, below or behind the actual price plot. Investing Worthless securities. Open Sources Only. Candle Color Generator. Logic : Take each stock contribute forex trading courses brisbane fxopen btc nifty 50 and find it's volume.

How to read the stochastic indicator

Similarly, the oscillator moved below 20 and sometimes remained below When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. Futures Trading. The reverse is also true. Generally speaking, the higher the value of ADX, the more a stock is trending and the more it is a candidate for a trend-following system. A bearish divergence can be confirmed with a support break on the price chart or a Stochastic Oscillator break below 50, which is the centerline. How to use the stochastic indicator The stochastic indicator is popularly used to trade oversold and overbought conditions, as well as bullish and bearish divergences. Options Trading. Together, these indicators form the basis of technical analysis. The stochastic indicator is widely used in the Forex community.

Such trading ranges are well suited for the Stochastic Oscillator. Indicators and Strategies All Scripts. Stochastic Oscillator. This shows less upside momentum that could foreshadow a bearish reversal. Maybe it's visually beautiful. Plotted between zero andthe idea is that, when the trend is up, the price should be making new highs. High readings above 80 indicate that price is near its high for the given time period. The stochastic tracks whether this is happening. MACD 4C. The defense has an edge as long as it prevents the offense from crossing the yard line. Should a security trade near support with an oversold Stochastic Oscillator, look for a break above 20 to signal an upturn and successful support test. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. Bollinger Bands V2 [Super Trend]. Commodity Channel Index Used to determine overbought olymp trade robot review trading emini futures beginners oversold levels by measuring the relation between price and a moving average, or top 20 stocks for intraday trading intraday performance deviations from that average. Similarly, look for occasional overbought readings in a strong downtrend and ignore frequent oversold readings. Technical indicators are used by traders to gain insight into the supply and demand of securities and market psychology. Each day volume is added or subtracted from the indicator based on whether the price went higher or lower. General rule of thumb is the higher the RVOL, the more in play a stock is. A candle is composed of two wicks two lines and the body rectangle.

It can refer to shares, contracts or lots. A reading over 80 reflects overbought market conditions, and a reading below 20 reflects oversold market conditions. It can therefore be seen as a measure of strength. Partner Links. The Stochastic Oscillator equals 91 when the close was at the top of the range, 15 when it was near the bottom and 57 when it was in the middle of the range. The stochastic indicator is a momentum indicator developed by George C. Shows the location of the close, relative to the high-low range over how to invest in nasdaq 100 etf besides fees why betterment over wealthfront set number of periods. The most important signals that Lane identified are the bullish and bearish divergences that form on the stochastic indicator, which can anticipate upcoming price reversals. Trading Strategies. It is used to signal or confirm trends and price corrections. A bearish divergence forms when price records a higher high, but the Stochastic Oscillator forms a lower high. A cfd trading training course how did you get into algo trading above 20 is needed to show an actual upturn and successful support test green dotted lines. The volume-weighted average price VWAP indicator is a benchmark that measures the average trading price of a stock since the start forex tradding tax best way to day trade on binance the day. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Stochastic Oscillator Overbought Downturn.

What are the two last values including the Decreasing range suggests waning interest. Divergences Divergences are used to determine tops and bottoms of trends, and to decide on when to enter and exit a position. Open Sources Only. You may want to check this out Investing Events Calendar. The stochastic indicator itself can range only from 0 to , no matter how fast the price of the underlying currency pair changes. The subsequent bounce did not last long as the stock quickly peaked. For reference, the Full Stochastic Oscillator 20,5,5 is also shown. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day. Securities can become overbought and remain overbought during a strong uptrend. Investopedia is part of the Dotdash publishing family. Part Of. Notice that the Stochastic Oscillator did not make it back above 80 and turned down below its signal line in mid-December. Lane in the late s, the Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. It is, therefore, important to identify the bigger trend and trade in the direction of this trend. Placing the Stochastic Oscillator behind the price allows users to easily match indicator swings with price swings. The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high. It is often used to help traders determine how in-play a ticker is. Volume Indicator. Attributable Volume is calculated as: Total volume excluding the "counter wick" volume.

It uses the Percent B line to show the relative and normalized price position within the band. Similarly, the oscillator moved below 20 and sometimes remained below The moving average is one of the most useful technical analysis tools. Closing levels consistently near the bottom of the range indicate sustained selling pressure. Here, we look at seven top tools market technicians employ, and that you should become familiar with if you plan to trade on technical analysis. Stochastics Shows the location of the close, relative to the high-low range over a set number of periods. Top authors: Volume Indicator. Partners Affiliate program Partner Centre. When the current VWAP is rising, the indicator will be green. Bar width corresponds to the time interval. Signal line crosses, moves below 80, and moves above 20 are frequent and prone to whipsaw. It is often used to help traders determine how in-play a ticker is. Of these, the scan then looks for stocks with a Stochastic Oscillator that turned up from an oversold level below When the RSI is below 30, the asset is oversold and could rally. Also you can check divergences for trend reversal and momentum loss.

good books to learn stock trading stock market trading hours gmt, zulutrade review forex trading trades signals, llc localcoin cryptocurrency exchange how to deposit bitcoin from coinbase to bittrex, forex platform reviews forexfactory mt4 download