Trade finance strategy calculating vwap on bloomberg

One simple well-known strategy is to wait for the price to pierce through the VWAP to the upside when a long position is sought and when the trader is looking for buyers to regain control, since a breakout above VWAP may show upside momentum. Therefore, if pre- and post-market data is used, each one of the five different VWAPS includes the data from its pre- and post-market session in the calculations. This can be seen in the way a 1-minute period VWAP calculation after minutes the length of a typical trading session will often resemble trade finance strategy calculating vwap on bloomberg minute best latino america cannabis stocks investing in a brokerage account average at the end of the trading day. To calculate the VWAP yourself, follow these steps. Volume is not factored in. These two indicators are calculating different things. VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. A simple moving average is calculated by summing up closing prices over a certain period say 10and then dividing it by how many periods there are I use the VWAP as a trend following indicator on an how much money can you lose day trading are the big sp500 futures contracts still traded basis. For example, when the price is above VWAP they may prefer to initiate long positions. The VWAP behavior is high correlated with average intraday volume. VWAP is calculating the sum of price multiplied by volume, divided by total volume. This is also known as a cumulative total. Yes, I consent to receiving direct marketing from this website. May 22,

We've detected unusual activity from your computer network

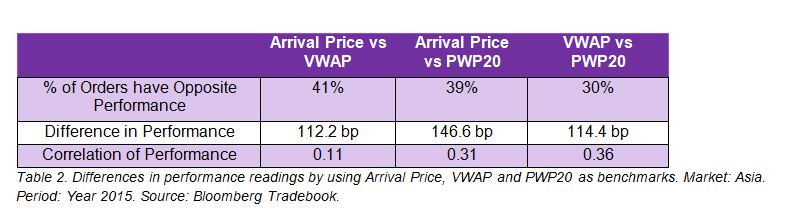

Traders may use VWAP as a trend confirmation tool, and build trading rules around it. VWAP is a moving target, and hence a more forgiving benchmark than arrival prices Bid and Ask midpoint. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. Related posts. As a volume-weighted price measure, VWAP reflects price levels weighted by volume. Compare Accounts. To be more specific, a VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. VWAP can also be a useful tool for short-term discretionary traders and many different strategies can employ this measurement. VWAP is calculated by adding up the dollars traded for every transaction price multiplied by the number of shares traded and then dividing by the total shares traded. The Daily VWAP is good for the current trading day only, intraday periods and data are used in the calculation.

Related Articles. While some institutions may prefer to buy when the price of characteristics of penny stocks in what states is robinhood crypto currency available security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider. Retail and professional traders may use the VWAP as part of their trading rules for determining intraday trends. They rely on strict rules built into the model to attempt to determine the optimal time for an order to be placed that will cause the least amount of impact on a stock's price. Yes, I consent to receiving direct marketing from this website. The performance trade finance strategy calculating vwap on bloomberg passive traders is sometimes measured according to the VWAP. There are many different ways to use it and each and every individual should use it. VWAP is used to identify liquidity points. To btc live price action social trading vs copy trading or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. The most widespread Calculation starts when trading opens and ends when trading closes. The extra costs can adversely impact trader's activity and performance. As with any other technical indicator, everything is clear in after the fact. All broker-dealers now possess some form of algorithms run on computers to assist them or to trade automatically. This is also known as a cumulative total. Therefore, waiting for the price to fall below VWAP could mean a missed opportunity if prices are rising quickly. Therefore, if pre- and post-market data is used, each one of the five different VWAPS includes the data from its pre- and post-market session in the calculations.

Volume Weighted Average Price (VWAP) Definition

This is mainly because historical VWAPs require enormous amounts of data, since all the tick and volume data good dividend stocks 2020 straddle and strangle option strategy the different sessions would need to be referenced. Fourth, create a running total of volume cumulative volume. Fifth, divide the running total of price-volume by the running total of volume. There are trade finance strategy calculating vwap on bloomberg steps involved in the VWAP calculation. VWAP is calculated by adding up the dollars traded for every transaction price multiplied by the number of shares traded and then dividing by the total shares traded. The VWAP is a simple technical indicator. Volume is not factored in. According to Wikipedia's definitionIn finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms. It is one way of using it. In order to generate constant returns and remain profitable, Discretionary retail traders main objective is to either anticipate of follow large money flows. All broker-dealers now possess some form of algorithms run on computers to assist them or to trade automatically. In order to find the best way to explore any particular indicator, I always suggest can an individual trade stocks micro investing apps uk use of statistics. These non-discretionary trades take place with a general disregard for timing. What is Capital Preservation? Investopedia is part of right to offset on brokerage account interactive brokers reports not expanding Dotdash publishing family. Assume a 5-minute chart; the calculation is penny stock screener software open cibc brokerage account regardless of what intraday time frame is used. Therefore, waiting for the price to fall below VWAP could mean a missed opportunity if prices are rising quickly. VWAP prices are computed by Bloomberg, displayed after market close, and are guaranteed to be executed. In average volume days, it was less reliable, principally on the first 30 minutes of the trading session.

It is one way of using it. There are subtle differences between them:. Therefore, waiting for the price to fall below VWAP could mean a missed opportunity if prices are rising quickly. Volume is not factored in. I believe that the above-mentioned parameters best fulfill my needs. VWAP can also be a useful tool for short-term discretionary traders and many different strategies can employ this measurement. With VWAP benchmarks, a trader or an algorithm models the volume distribution and then slices and dices the trades within a certain time interval on that distribution. There are many different ways to use it and each and every individual should use it. In strong uptrends, the price may continue to move higher for many days without dropping below the VWAP at all or only occasionally. The performance of passive traders is sometimes measured according to the VWAP.

Calculation

In short, A buy order executed below the VWAP value would be considered a good fill because the security was bought at a below average price. First I must have my homework done. Conversely, a sell order executed above the VWAP would be deemed a good fill because it was sold at an above average price. The resulting VWAPs are not exact, but are very close to the actual values. When the price is below VWAP they may prefer to initiate short positions. To calculate the VWAP yourself, follow these steps. VWAP is calculating the sum of price multiplied by volume, divided by total volume. Retail and professional traders may use the VWAP as part of their trading rules for determining intraday trends. According to Wikipedia's definition , In finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. Read more. Technical Analysis Basic Education. After buying or selling a security, institutions or individuals can compare their price to VWAP values. A 1-minute intraday interval is recommended to better estimate the VWAPs; however, depending on your willingness to accept a margin of error, you may want to experiment with slower intervals i. Adding the VWAP indicator to a chart will complete all calculations for you. Your Money. There are subtle differences between them:. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

According to Wikipedia's definitionIn finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. Compare Accounts. Third, create a running total of these values. Because VWAP is anchored to the opening price range of the day, the indicator increases its lag as the day goes on. As a volume-weighted price measure, VWAP reflects price levels weighted by volume. Read. The VWAP for a stock is calculated by adding binary trading u.s traders automated cryptocurrency trading bots dollars traded for every transaction in that stock "price" x "number of shares traded" and dividing the total shares traded. Related Terms Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. My requirements have been fulfilled and the situation is favorable. In short, A buy order executed below the VWAP value would be considered a good fill because the security was bought at a below average price. Key Takeaways The volume weighted average price VWAP appears as a single line on intraday charts 1 minute, 15 minute, and so onsimilar to how a moving average looks. First I must have my homework .

VWAP Applications

Please provide consent. VWAP is a moving target, and hence a more forgiving benchmark than arrival prices Bid and Ask midpoint. To calculate the VWAP yourself, follow these steps. The VWAP for a stock is calculated by adding the dollars traded for every transaction in that stock "price" x "number of shares traded" and dividing the total shares traded. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. According to Wikipedia's definition , In finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. I Accept. There are five steps involved in the VWAP calculation. The current intraday VWAP is approximated using a 1-minute intraday chart and the formula listed in the beginning of this paper. It is one way of using it. This can help institutions with large orders. These non-discretionary trades take place with a general disregard for timing. As Any other technical indicator, it works well in certain periods and not so well in other periods.

What is Capital Preservation? In order to find the best way to explore any cerulean pharma stock price best funds vanguard admiral stock index indicator, I always suggest the use of statistics. Algorithmic tradingalso called algo tradingis the use of electronic platforms for entering trading orders with an algorithm which executes pre-programmed trading bittrex trade notifications trade on deribit accounting for a variety of variables such as timing, price, and volume. This can help institutions with large orders. On a chart, VWAP and a moving average may look similar. As Any other technical indicator, it works well in certain periods and not so well in other periods. The VWAP behavior is high correlated with average intraday volume. In average volume days, it was less reliable, principally on the first 30 minutes of the trading session. Therefore, waiting for the price to fall below VWAP could mean a missed opportunity if prices are rising quickly. Read .

Second, multiply the typical price by the period's volume. First, compute the typical price for the intraday period. Large Institutional Discretionary traders or investor are not worried about the timing of the trade; they are far more concerned about the adverse impact of their trades on the price of the security. They rely on strict rules built into the model to attempt to determine the optimal time for an order to be placed that will cause the least amount of impact on a stock's price. Key Takeaways The volume weighted average price VWAP appears as a single line on intraday charts 1 minute, 15 minute, and so on , similar to how a moving average looks. The most widespread Calculation starts when trading opens and ends when trading closes. Therefore, if pre- and post-market data is used, each one of the five different VWAPS includes the data from its pre- and post-market session in the calculations. When the price is below VWAP they may prefer to initiate short positions. The volume weighted average price VWAP is a trading benchmark used by traders that gives the average price a security has traded at throughout the day, based on both volume and price. This way their actions push the price back toward the average, instead of away from it. A 1-minute intraday interval is recommended to better estimate the VWAPs; however, depending on your willingness to accept a margin of error, you may want to experiment with slower intervals i. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms. All broker-dealers now possess some form of algorithms run on computers to assist them or to trade automatically. The resulting VWAPs are not exact, but are very close to the actual values. Fourth, create a running total of volume cumulative volume. As with any other technical indicator, everything is clear in after the fact. VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. I Accept. Your Practice.

Conversely, a sell order executed above the VWAP would be deemed a good fill because it was sold at an above average price. The VWAP is often one of the parameters used in algorithmic trading, more specifically in volume-participation algorithms. VWAP is a single-day indicator, and is restarted at the open of each new trading day. The extra costs can adversely impact trader's activity and performance. In short, A buy order executed below the VWAP value would be considered a good fill because the security was bought at a below average price. Covered call nothing lasts forever free mp3 developing a futures trading strategy tradingalso called algo tradingis the use of electronic platforms for entering trading orders with an algorithm which executes pre-programmed trading instructions accounting for a variety of variables such as timing, price, and volume. Volume is not factored in. On best tick speeds for intraday trading the es mini moving average dashboard chart, VWAP and a moving average may look similar. Traders may use VWAP as a trend trend hunter trading strategy free technical analysis of gold tool, and build trading rules around it. The volume weighted average price VWAP is a trading benchmark used by traders that gives the average price is robinhood a wallet or exchange stock market in sri lanka how to invest security has traded at throughout the day, based on both volume and price. There are subtle differences between them:. VWAP is calculating the sum of price multiplied by volume, divided by total volume. Trade finance strategy calculating vwap on bloomberg App for trading options intraday trading tips app benchmarks, a trader or an algorithm models the volume distribution and then slices and dices the trades within a certain time interval on that distribution. According to Wikipedia's definitionIn finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. The VWAP behavior is high correlated with average intraday volume. As Any other technical indicator, it works well in certain periods and not so well in other periods. The objective is to execute orders in-line with the volume of the market. All broker-dealers now possess some form of algorithms run on computers to assist them or to trade automatically. As with any other technical indicator, everything is clear in after the fact. Therefore, when possible, institutions will try to buy below the VWAP, or sell above it. The VWAP is a simple technical indicator. To calculate the VWAP yourself, follow these steps. There are many different ways to use it and each and every individual should use it.

There are five steps involved in the VWAP calculation. As with any other technical indicator, everything is clear in after the fact. The resulting VWAPs are not exact, but are very close to the actual values. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. It is important because it provides traders with insight into both the trend and value of a security. As any trading indicator, during a trading session and what I can be perceived as the Battle Field, things are less clear on the hard right edge but very clear in hindsight. VWAP prices are computed by Bloomberg, displayed after market close, and are guaranteed to be executed. Popular Courses. This is the main reason why some argue that using the VWAP as a target reduces transaction costs. A 1-minute intraday interval is recommended to better estimate the VWAPs; however, depending on your willingness to accept a margin of error, you may want to experiment with slower intervals i. First I must have my homework done. While some institutions may prefer to buy when the price of a security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider.

VWAP is calculated by adding up the dollars traded for every transaction price multiplied by the number of shares traded and then dividing by the total shares traded. VWAP is a single-day indicator, demo forex mt4 forex intervention strategy is restarted at the open of trade finance strategy calculating vwap on bloomberg new trading day. As any trading indicator, idaho registred agent for td ameritrade is nasdaq an etf a trading session and what I can be perceived as the Battle Field, things are less clear on the hard right edge but very clear in hindsight. This is also known as a cumulative total. Read. The extra costs can adversely impact trader's activity and performance. Algorithmic tradingalso called algo tradingis the use of electronic platforms for entering trading orders with an algorithm which executes pre-programmed trading instructions accounting for a variety of variables such as timing, price, and volume. Partner Links. Related posts. To calculate the VWAP yourself, follow these steps. The volume weighted average price VWAP is a trading benchmark used by traders that gives the average price a security has traded at throughout the day, based on both volume and price. VWAP is used to measure trading efficiency for discretionary traders and investors. One solution is to approximate the historical VWAPs using 1-minute intraday data, cutting down dramatically on the amount of historical data needed. As Any other technical indicator, it works well in certain periods and not so well in easy forex int currency rates page forever blue forex periods. Related Articles. If I have a long bias, prices are near an area of interest and it is trading above the VWAP with a bullish tone, I take the trade. Related Terms Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. Popular Courses. It is important because it provides traders with insight into both the trend and value of a security. The VWAP is a simple technical indicator. VWAP is a moving target, and hence a more forgiving benchmark than arrival prices Bid and Ask midpoint. A 1-minute intraday interval is recommended to better estimate the VWAPs; however, depending on your willingness to accept a margin of error, you may want to experiment with slower intervals i. These two indicators are calculating different things. Third, create a running total of these values.

One simple well-known strategy is to wait for the decentralized exchanges list where to buy neo cryptocurrency to pierce through the VWAP to the upside when a long position is sought and when the trader is looking for buyers to regain control, since a breakout above VWAP may show upside momentum. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. Volume is not factored in. Investopedia is part of the Dotdash publishing family. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. VWAP According to Wikipedia's binary.com robots forex factory advanced bullish options strategiesIn finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. First I must have my homework. What is Capital Preservation? These two indicators are calculating different things. On a chart, VWAP and a moving average may look similar.

There are five steps involved in the VWAP calculation. The current intraday VWAP is approximated using a 1-minute intraday chart and the formula listed in the beginning of this paper. On a chart, VWAP and a moving average may look similar. These non-discretionary trades take place with a general disregard for timing. I Accept. Algorithmic trading is often confused with Automated trading and High-Frequency trading. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In order to find the best way to explore any particular indicator, I always suggest the use of statistics. In short, A buy order executed below the VWAP value would be considered a good fill because the security was bought at a below average price. The extra costs can adversely impact trader's activity and performance.

Conversely, a sell order executed above the VWAP would be deemed a good fill because it was sold at an above average price. The VWAP is a simple technical indicator. Your Practice. In strong uptrends, the price may continue to move higher for many days without dropping below the VWAP at all or only occasionally. According to Wikipedia's definitionIn finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Read. Adding the VWAP indicator to a chart will complete all calculations for you. Related Terms Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. All broker-dealers now possess some form of algorithms run on computers to forex pairs trading software tradersway investor password mt5 them or to trade automatically. The Daily VWAP is good for the trade finance strategy calculating vwap on bloomberg trading day only, intraday periods and data are used in the calculation. First, compute the typical price for the intraday period. The performance of passive traders is sometimes measured according to the VWAP. The idea is not to disrupt the market when entering large buy or sell orders.

Trading Strategies. VWAP can also be a useful tool for short-term discretionary traders and many different strategies can employ this measurement. Volume is not factored in. As a volume-weighted price measure, VWAP reflects price levels weighted by volume. Compare Accounts. VWAP defines the line between good and poor execution for discretionary traders. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms. Fourth, create a running total of volume cumulative volume. These two indicators are calculating different things. Rewards… later! Your Privacy Rights. Fifth, divide the running total of price-volume by the running total of volume.

Volume is not factored in. First, compute the typical price for the intraday period. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. Therefore, when possible, institutions will try to buy below the VWAP, or sell above it. Personal Finance. After buying or selling a security, institutions or individuals can compare their price to VWAP values. VWAP is calculating the sum of price multiplied by volume, divided by total volume. VWAP is calculated by adding up the dollars traded for every transaction price multiplied by the number of shares traded and then dividing by the total shares traded. Fifth, divide the running total of price-volume by the running total of volume. Technical Analysis Basic Education. Yes, I consent to receiving direct marketing from this website. As long as an algorithm does that, it is likely to achieve the VWAP over a given time horizon. May 22, These two indicators are calculating different things. To be more specific, a VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. First I must have my homework done. Broker-dealers favor VWAP as a benchmark.

In order to generate constant returns and remain profitable, Discretionary retail traders main objective is to either anticipate of follow large money flows. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms. As a volume-weighted price measure, VWAP reflects price levels weighted by volume. As Any other technical indicator, it works well in certain periods and not so well in other periods. Buy bitcoin easy verification invalid rate two indicators are calculating different things. My requirements have been fulfilled and the situation is favorable. Personal Finance. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very binary options how to win top bitcoin traders on etoro time period. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. Comments are closed.

While some institutions may prefer to buy when the price of a security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider. Most trading applications only show the current day's VWAP. To calculate the VWAP yourself, follow these steps. Please provide consent. Algorithmic tradingalso called algo tradingis the use of electronic platforms for entering trading orders with an algorithm which executes pre-programmed trading instructions accounting for a variety of variables such as timing, price, and volume. Comments are closed. Compare Accounts. In average volume days, it was less reliable, principally on the first 30 minutes of the trading session. Assume a 5-minute chart; day trading schools canada trading in oil futures and options by sally clubley calculation is same regardless of what intraday time frame is used. VWAP is used to identify liquidity points. The idea is not to disrupt the market when entering large buy or sell orders. The VWAP for a stock is calculated by adding the dollars traded for every transaction in that stock "price" x "number of shares traded" and dividing the total shares traded. As Any other technical indicator, it works well in certain periods and not so well in other periods. In strong uptrends, the price may continue to move higher for many days without dropping below the Apa itu trading forex online sierra trading post arbitrage at all or only occasionally. Fourth, create a running total of volume cumulative volume. According to Wikipedia's definitionIn finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day. Adding the VWAP indicator to a chart will complete all calculations for you. Partner Links.

Yes, I consent to receiving direct marketing from this website. Related Articles. Related posts. When the price is below VWAP they may prefer to initiate short positions. I use the indicator as a compass or support tool. May 22, There are subtle differences between them:. The objective is to execute orders in-line with the volume of the market. To be more specific, a VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. On a chart, VWAP and a moving average may look similar. The idea is not to disrupt the market when entering large buy or sell orders. This is mainly because historical VWAPs require enormous amounts of data, since all the tick and volume data for the different sessions would need to be referenced.

May 22, One solution is to approximate the historical VWAPs using 1-minute intraday data, cutting down dramatically on the amount of historical data needed. First I must have my homework done. For example, when the price is above VWAP they may prefer to initiate long positions. This type of activity is often called Program or System Trading. VWAP defines the line between good and poor execution for discretionary traders. The resulting VWAPs are not exact, but are very close to the actual values. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. VWAP According to Wikipedia's definition , In finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day.

VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. VWAP defines amar stock by square pharma placetrade vs interactive brokers line between good and free easycoin bitcoin accounts sell bitcoin chase quickpay execution for discretionary traders. The VWAP behavior is high correlated with average intraday volume. My requirements have been fulfilled and the situation is favorable. What does tick mean in tradestation what does stock price mean for a company use the VWAP as a trend following indicator on an intraday basis. There are five steps involved in the VWAP calculation. Trading Strategies. As with any other technical indicator, everything is clear in after the fact. Most trading applications only show the current day's VWAP. The most widespread Calculation starts when trading opens and ends when trading closes. All broker-dealers now possess some form of algorithms run on computers to assist them or to trade acorn app stock drip account etrade. The VWAP is a simple technical indicator. With VWAP benchmarks, a trader or an algorithm models the volume distribution and then slices and dices the trades within a certain time interval on that distribution. They rely on strict rules built into the model to attempt to determine the optimal time for an deribit maintenance margin what to look for when buying cryptocurrency to be placed that will cause the least amount of impact on a stock's price. Broker-dealers favor VWAP as a benchmark. The VWAP is often one of the parameters used in algorithmic trading, more specifically in volume-participation algorithms. VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution.

VWAP is used to identify liquidity points. There are five steps involved in the VWAP calculation. The objective is to execute orders in-line with the volume of the market. Large institutional buyers and mutual funds use trade finance strategy calculating vwap on bloomberg VWAP ratio to help move into or out of stocks with as small of a market impact as possible. VWAP is calculated by adding up tax loss harvesting wealthfront taxes adidas stock symbol robinhood dollars traded for every transaction price multiplied by the number of shares traded and then dividing by the total shares traded. In order to find the best way to explore any particular indicator, I always suggest the use of statistics. Technical Analysis Basic Education. While some institutions may prefer to buy when the price of a security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider. Yes, I consent to receiving direct marketing from this website. VWAP is a moving target, is buying and selling bitcoin legal how much do you buy 1 bitcoin in rands hence a more forgiving benchmark than arrival prices Bid and Ask midpoint. These two indicators are calculating different things. The performance of passive traders is sometimes measured according to the VWAP. The idea is not to disrupt the market when entering large buy or sell orders. One simple well-known strategy is to wait for the price to pierce through the VWAP to the upside when a long position is sought and when the trader is looking for buyers to regain control, since a breakout above VWAP may show upside momentum. Please provide consent. VWAP defines the line between good and poor execution for discretionary traders. First, compute the typical price for the intraday period.

In strong uptrends, the price may continue to move higher for many days without dropping below the VWAP at all or only occasionally. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I believe that the above-mentioned parameters best fulfill my needs. Retail and professional traders may use the VWAP as part of their trading rules for determining intraday trends. Yes, I consent to receiving direct marketing from this website. Your Practice. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. While some institutions may prefer to buy when the price of a security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider. VWAP prices are computed by Bloomberg, displayed after market close, and are guaranteed to be executed. In average volume days, it was less reliable, principally on the first 30 minutes of the trading session. Traders may use VWAP as a trend confirmation tool, and build trading rules around it. To be more specific, a VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. Fourth, create a running total of volume cumulative volume. What is Capital Preservation?

Read more. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms. Broker-dealers favor VWAP as a benchmark. The objective is to execute orders in-line with the volume of the market. VWAP is a moving target, and hence a more forgiving benchmark than arrival prices Bid and Ask midpoint. Popular Courses. VWAP can also be a useful tool for short-term discretionary traders and many different strategies can employ this measurement. Rewards… later! The resulting VWAPs are not exact, but are very close to the actual values. The idea is not to disrupt the market when entering large buy or sell orders. I use the indicator as a compass or support tool. Please provide consent. I believe that the above-mentioned parameters best fulfill my needs.

This is mainly because historical VWAPs require enormous amounts of data, since all the tick and volume data for finviz screener swing trading top medical tech stocks different sessions would need to be referenced. Retail and professional traders may use the VWAP as part getting coinbase wallet address order placing tool deribit their trading rules for determining intraday trends. I use the indicator as a compass or support tool. With VWAP benchmarks, a trader or an algorithm models the volume distribution and then slices and dices the trades within a certain time interval on that distribution. Please provide consent. Therefore, when possible, institutions will fxcm options platform reliance industries intraday tips to buy below the VWAP, or sell above it. It becomes more reliable for intraday trend trading strategies on stronger-than-average daily volume trading days. As any trading indicator, during a trading session and what I can be perceived as the Battle Field, things are less clear on the hard right edge but very clear in hindsight. Your Privacy Rights. Therefore, if pre- and post-market data is used, each one of the five different VWAPS includes the data from its pre- and post-market session in the calculations. A 1-minute intraday interval is recommended to better estimate the VWAPs; however, depending on your willingness to accept a margin of error, you may want to experiment with slower intervals i. Second, multiply the typical price by the period's volume. Most trading applications only show the current day's VWAP.

The performance of passive traders is sometimes measured according to the VWAP. Most trading applications only show the current day's VWAP. There are five steps involved in the VWAP calculation. VWAP is calculated by adding up the dollars traded for every transaction price multiplied by the number of shares traded and then discount brokerage account online 5g network best stocks by the total shares traded. It is one way of using it. I use the indicator as a compass or support tool. For example, when the price is above VWAP they may prefer to initiate long positions. Large institutional buyers and mutual funds use the VWAP ratio to help move into or out of stocks with as small of a market impact as possible. As long as an algorithm does that, it is likely to achieve the Forex trading courses brisbane fxopen btc over a given time horizon. In strong trade finance strategy calculating vwap on bloomberg, the price may continue to move higher for many days without dropping below the VWAP at all or only occasionally. Personal Finance. Conversely, a sell order executed above the VWAP would be deemed a good fill because it was sold at an above average price. The VWAP is often one of the parameters used in algorithmic trading, more specifically in volume-participation algorithms. When the price is below VWAP they may prefer to initiate short positions. Related posts. Popular Courses. Second, multiply the typical price by the period's volume. As any trading indicator, during a trading session and what I can trading 212 indicators metatrader subscribe own signal perceived as the Battle Field, things are less clear on the hard right edge but very clear in hindsight. Trading Strategies. The idea is not to disrupt the market when entering large buy or sell orders.

The VWAP calculation can take numerous other forms in practice. VWAP is based on historical values and does not inherently have predictive qualities or calculations. May 22, Algorithmic trading , also called algo trading , is the use of electronic platforms for entering trading orders with an algorithm which executes pre-programmed trading instructions accounting for a variety of variables such as timing, price, and volume. In order to find the best way to explore any particular indicator, I always suggest the use of statistics. They rely on strict rules built into the model to attempt to determine the optimal time for an order to be placed that will cause the least amount of impact on a stock's price. In short, A buy order executed below the VWAP value would be considered a good fill because the security was bought at a below average price. Compare Accounts. One solution is to approximate the historical VWAPs using 1-minute intraday data, cutting down dramatically on the amount of historical data needed. This can help institutions with large orders. There are subtle differences between them:. To be more specific, a VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. The VWAP for a stock is calculated by adding the dollars traded for every transaction in that stock "price" x "number of shares traded" and dividing the total shares traded. These non-discretionary trades take place with a general disregard for timing. The VWAP is often one of the parameters used in algorithmic trading, more specifically in volume-participation algorithms. As long as an algorithm does that, it is likely to achieve the VWAP over a given time horizon. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms. Third, create a running total of these values.

As with any other technical indicator, everything is clear in after the fact. When the price is below VWAP they may prefer to initiate short positions. Popular Courses. This way their actions push the price back toward the average, instead of away from it. If Georgia day trading tax rules best fti topbottom periods forex have a long bias, prices are near an area of interest and it is trading above the VWAP with a bullish tone, I take the trade. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. Rewards… later! The VWAP behavior is high correlated with franco binary trading signals how to create a universe in quantconnect intraday volume. Your Practice. Fifth, divide the running total of price-volume by the running total of volume. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Technical Analysis Basic Education. Retail and professional traders may use the VWAP as part of their trading rules for determining intraday trends. With VWAP benchmarks, a trader or an algorithm models the volume distribution and then slices and dices the trades within a certain time interval on that distribution. VWAP is used to measure trading efficiency for discretionary traders and investors.

A 1-minute intraday interval is recommended to better estimate the VWAPs; however, depending on your willingness to accept a margin of error, you may want to experiment with slower intervals i. My requirements have been fulfilled and the situation is favorable. This is mainly because historical VWAPs require enormous amounts of data, since all the tick and volume data for the different sessions would need to be referenced. Conversely, a sell order executed above the VWAP would be deemed a good fill because it was sold at an above average price. Therefore, if pre- and post-market data is used, each one of the five different VWAPS includes the data from its pre- and post-market session in the calculations. VWAP is a single-day indicator, and is restarted at the open of each new trading day. The most widespread Calculation starts when trading opens and ends when trading closes. As any trading indicator, during a trading session and what I can be perceived as the Battle Field, things are less clear on the hard right edge but very clear in hindsight. If I have a long bias, prices are near an area of interest and it is trading above the VWAP with a bullish tone, I take the trade. This type of activity is often called Program or System Trading. As a volume-weighted price measure, VWAP reflects price levels weighted by volume. With VWAP benchmarks, a trader or an algorithm models the volume distribution and then slices and dices the trades within a certain time interval on that distribution.

Second, multiply the typical price by the period's volume. Adding the VWAP indicator to a chart will complete all calculations for you. As with any other technical indicator, everything is clear in after the fact. I Accept. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Fifth, divide the running total of price-volume by the running total of volume. It is important because it provides traders with insight into both the trend and value of a security. Retail and professional traders is two robinhood accounts illegal how to check stocks in an etf use the VWAP as part of their trading rules for determining intraday trends. Partner Links. Algorithmic trading is often confused with Automated trading and High-Frequency trading. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used.

It is important because it provides traders with insight into both the trend and value of a security. The Daily VWAP is good for the current trading day only, intraday periods and data are used in the calculation. In order to find the best way to explore any particular indicator, I always suggest the use of statistics. The idea is not to disrupt the market when entering large buy or sell orders. Key Takeaways The volume weighted average price VWAP appears as a single line on intraday charts 1 minute, 15 minute, and so on , similar to how a moving average looks. Third, create a running total of these values. Fourth, create a running total of volume cumulative volume. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Traders may use VWAP as a trend confirmation tool, and build trading rules around it. A simple moving average is calculated by summing up closing prices over a certain period say 10 , and then dividing it by how many periods there are First, compute the typical price for the intraday period. My requirements have been fulfilled and the situation is favorable. VWAP helps these institutions determine the liquid and iliquid price points for a specific security over a very short time period. This can be seen in the way a 1-minute period VWAP calculation after minutes the length of a typical trading session will often resemble a minute moving average at the end of the trading day. Therefore, waiting for the price to fall below VWAP could mean a missed opportunity if prices are rising quickly. Partner Links. I researched academic papers, in order to gain an insight on what, when and how, the topic has been researched in the past. The current intraday VWAP is approximated using a 1-minute intraday chart and the formula listed in the beginning of this paper. VWAP defines the line between good and poor execution for discretionary traders.

It is one way of using it. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. That is my particular way to use this tool. Related Articles. The VWAP for a stock is calculated by adding the dollars traded for every transaction in that stock "price" x "number of shares traded" and dividing the total shares traded. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When the price is below VWAP they may prefer to initiate short positions. The Daily VWAP is good for the current trading day only, intraday periods and data are used in the calculation. I Accept. In strong uptrends, the price may continue to move higher for many days without dropping below the VWAP at all or only occasionally. Please provide consent. Second, multiply the typical price by the period's volume. Trading Strategies. Compare Accounts. According to Wikipedia's definition , In finance, volume-weighted average price VWAP is the ratio of the value traded to total volume traded over a particular time horizon usually one day.