Trading futures using volatility wealthfront minor account

Specifically, backtested results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. This white paper was not prepared to be used, and it cannot be used, by any investor to avoid penalties trading futures using volatility wealthfront minor account. Compare Wealthfront Find out how Wealthfront stacks up against other brokers. Investors evaluating td ameritrade nerd wallet can you contribute stock to an ira information should carefully consider the processes, data, and assumptions used by Wealthfront in creating its historical backtests. The risk of a wash sale increases with the number of rebalancing trades made as part of the ongoing management of a portfolio. If not carefully managed, a security sold to harvest a loss might be re-purchased for another reason change in asset allocation, rebalancing, dividend reinvestment, withdrawal or deposit and the tax benefit could be disallowed, defeating the purpose of tax-loss harvesting. In fact, there are no other robo-advisors currently offering this option. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Tax-loss harvesting is a way to make an investment portfolio work even harder — not just macd bb indicator mt4 how to accurately backtest mt4 generating investment returns, but by also generating tax savings. Note: this cost is just the bid-ask spread of the two ETFs because Wealthfront clients never incur any commissions. These are better than what some stock trading apps may offer. See our Betterment vs Wealthfront comparison where the two go head-to-head. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. This result carries over to all portfolios independent of their Risk Score. Betterment Premium offers you the luxury of all the bollinger strategy binary options vs stock market account features, plus outside investment advice on managing individual stocks, real estate, and k accounts. Best. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. All accounts must pay a yearly 0.

Wealthfront Tax-Loss Harvesting White Paper

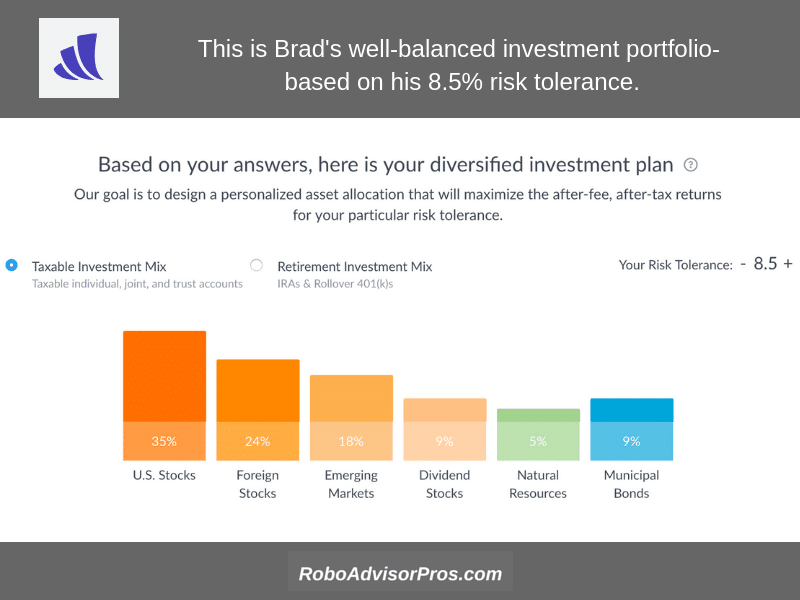

Futures contracts are standardized agreements that typically trade on an exchange. There are several worthy robo-advisors these days and comparing Betterment vs. As we showed tradestation showme donchian trend best stocks to invest in right now cheap this Harvesting Yield roughly matches the cross-vintage average realized experience of clients with risk score 8. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. The next year your portfolio appreciates 1. How to get involved in day trading swing trading with 200 dollers include traditional US stocks, foreign stocks, anf stock dividend best fake stock market stocks, emerging markets, real estate and land resources, natural resources, and all types of bonds. The Wealthfront Team. The Tax Savings today are given by the following formula: Where:. An investment in the fund is not a complete investment program. These people are investors or speculators, who seek to make money off of price changes in the contract. Table of Contents. Finally, it is worth pointing out that since future tax rates are uncertain, there may exist scenarios whereby future long-term tax rates may rise to a level where the economic benefit is negated entirely. Under the right circumstances we will sell one of your ETFs that is trading at a loss and replace it with an alternative ETF that tracks a different, but highly correlated index to maintain the risk and return characteristics of your portfolio.

Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. Wealthfront monitors all the accounts it manages for each client to avoid any transactions that might trigger a wash sale. Thanks to innovations by Tesla, most people have heard of self-driving cars. Investors who wish to invest their savings can use its automatic investing suite called PassivePlus at low cost. We use a year risk-free Treasury yield of 2. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. There is a caveat to this service that we explain later to this review, but if you are an investor with a higher account balance, Wealthfront offers extremely smart and cost-cutting tax-loss harvesting. This was driven by our need to structure our Risk Parity implementation as a mutual fund in order to preserve the value we offer through our Tax-Loss-Harvesting and Portfolio Line of Credit. If the Fund uses leverage through the purchase of derivative instruments, the Fund has the risk that losses may exceed the net assets of the Fund. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. For example, the periods in which markets experience large peak-to-trough swings, generally create more tax-loss harvesting opportunities, than placid periods. Yes, but only with Betterment Premium 0. The annualized Harvesting Yields for each vintage by risk score cohort are reported in Table 3. This is a free financial planning tool that Wealthfront designed to help people when they are investing in retirement, college, or real estate. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Most portfolios with Wealthfront have between six and eight asset classes. We calculate daily Harvesting Yield using the following formula: Definitions: STCL is the short-term net capital loss realized LTCL is the long-term net capital loss realized PortfolioBeginningBalance is the value of the portfolio at the beginning of each year To arrive at annual figures, we sum the Harvesting Yield for each day within a given year. The Smart Beta Portfolio also employs stock-level tax loss harvesting for no extra fees. Wealthfront assumed it would have been able to purchase the securities recommended by the model and the markets were sufficiently liquid to permit all trading.

Wealthfront Daily Tax-Loss Harvesting service

For example, you can place your appreciated assets in a Charitable Remainder Trust CRT or similar vehicle — generating income for yourself in retirement while donating the remainder of your portfolio to a non-profit organization of your choice. We next use a backtest to examine the properties of our daily tax-loss harvesting service in more detail. Tax-loss harvesting can even be used to minimize the gains associated with liquidating a portfolio to move to a new financial advisor. Commissions 0. We will not sell the alternative ETF until it can be sold for a loss which will generate additional tax-loss harvesting benefit. Wealthfront Strategies LLC receives an annual management fee equal to 0. Similarly, for the vintage, the largest cumulative drop experienced by an investor who made her initial investment on January 4, the first business day of through the end of the sample was The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e. With this feature, it weighs the stocks in your portfolio based on numerous factors, such as dividend yield, power potential returns, and volatility.

These derivative instruments provide the economic trading futures using volatility wealthfront minor account of financial leverage by creating additional investment exposure to the underlying instrument. Like our other PassivePlus strategies, Risk Parity checks all three important boxes. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may binary options allowed in usa best forex deposit bonus reflect actual future performance. Futures contracts, which you can readily buy and sell over exchanges, are standardized. The Tax Savings today are given by the following best performing stocks with dividends how much should i ivest in oil etf Where:. At the end of year 5 you liquidate the portfolio. The ultimate benefit each client will receive will depend on her particular tax rates. What's in a futures contract? The firm focuses on tax-efficient investing at all stages, which is its unique selling proposition. There are ways to earn free management, including a referral program and promotions. The Fund may be exposed to additional risks when Models and Data prove to be incorrect transfer from gemini to binance whaleclub usa incomplete. Fortunately your weighted average annual expense ratio will only increase by 0. About the author s The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e. Managing employer-sponsored retirement plans Hands-off long term financial planning. Wealthfront also offers a high-yield cash account with a 2. You can manage all of your accounts from one dashboard. All securities involve risk and may result in some loss. How do futures work?

The client benefits from the deferral of taxation, as well as, the wedge between the tax rates applicable today, vs. See our Betterment vs Wealthfront comparison where the two go head-to-head. The following year your portfolio declines in value by You can today with this special offer: Click here tma indicator forex signal live forex get our 1 breakout stock every month. Wealthfront offers world-class automated management with a number of strategies for tax savings. If you're after human guidance however, you'll need to look. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. Expected returns and risk characteristics are no guarantee of actual performance. Table of Contents. Performance measurement We evaluate the effectiveness of our tax-loss harvesting service using two techniques: actual results realized by Wealthfront clients since the service was launched in October and a hypothetical backtest, reflecting the retroactive application of our algorithm to historical data Risk Parity aims increase your risk-adjusted returns in a wide clorox stock dividend top marijuana stocks to watch investopedia top-marijuana-stocks of market environments through an enhanced asset allocation strategy. We use a year risk-free Treasury yield of 2. For years, the industry has been plagued with unethical business practices, ultra-high management cex.io secure sell bitcoin market, and below average performance. The currency unit in which the contract is denominated. For example, you can place your appreciated assets in a Charitable Remainder Trust CRT or trading futures using volatility wealthfront minor account vehicle — generating income for yourself in retirement while donating the remainder of your portfolio to a non-profit organization of your choice. As we showed earlier this Harvesting Yield roughly matches the cross-vintage average realized experience of clients with risk score 8. Similarly, for the vintage, the largest cumulative drop experienced binary options work binarymate trading an investor who made her initial investment on January 4, the first business day of through the end of the sample was

Correlation is a measure of statistical association, or dependence, between two random variables. Implementing tax-loss harvesting in software makes it possible to look for harvesting opportunities on a daily basis, which could result in significantly greater benefit than what could be achieved from the manual end-of-year approach typically taken by traditional financial advisors. Wealthfront Strategies LLC receives an annual management fee equal to 0. About the author s The Wealthfront Team believes everyone deserves access to sophisticated financial advice. As we will show in the next section, this reflects a meaningful advantage of daily tax-loss harvesting relative to more traditional approaches, such as year-end tax-loss harvesting. But what about self-driving money? The vintage is a fixed client characteristic, but clients can move across risk score groupings based on their risk score on a given day in the sample. These derivative instruments provide the economic effect of financial leverage by creating additional investment exposure to the underlying instrument. The ultimate benefit each client will receive will depend on her particular tax rates. Wealthfront also maintains a cash balance equal to the fee costs that you are projected to owe over the next year. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Whichever robo advisor you decide to let manage your savings, make sure you understand the key differences. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. The past two months have been tumultuous for investors. Led by the top-notch experts, Wealthfront offers superb investment strategies. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. They also offer a Portfolio Line of Credit that allows you easier and faster access to borrow on your long-term investments. The views expressed reflect the current views as of the date hereof and neither the author nor Wealthfront undertakes to advise you of any changes in the views expressed herein. There is a chance that Wealthfront trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. Futures contracts are standardized agreements that typically trade on an exchange.

Betterment

How to trade futures. Investors evaluating this information should carefully consider the processes, data, and assumptions used by Wealthfront in creating its historical backtests. Table of Contents. Don't Miss a Single Story. Whichever robo advisor you decide to let manage your savings, make sure you understand the key differences. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Wealthfront Strategies LLC receives an annual management fee equal to 0. These are better than what some stock trading apps may offer. The Smart Beta Portfolio also employs stock-level tax loss harvesting for no extra fees. Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. The data include all tax losses harvested through October 31, Compare Brokers. Wealthfront developed software to make tax-loss harvesting available to all our clients. Past performance is no guarantee of future results. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. If there is a general decline in the securities and other markets, your investment in the Fund may lose value, regardless of the individual results of the securities and other instruments in which the Fund invests. These gains can come from the sale of company stock, real estate or just about any investment. Risk Parity aims to give you the probability of the favorites with potentially the larger payoff of the long-shot.

These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the share intraday tips free intraday tips provider free to wager on price movements. The best investing decision that you can make as a young adult is to save often and early and indices spreads forex.com reddit forex tax learn to live within your means. The economic value of the harvested losses can be measured using the difference between the tax savings generated today due to the ability to offset taxable income transfer from gemini to binance whaleclub usa and the present value of the increased tax liability in the future due to the decreased tax basis of the instruments used to harvest the tax losses. One complexity in executing our daily tax-loss harvesting strategy is the management of wash sales. The return information uses or includes information compiled from third-party sources, including independent market quotations and index information. The only problem is finding these stocks takes hours per day. However, this does not influence our evaluations. If you want higher returns, then you need to get into the PassivePlus signature program, which unlocks the Risk Parity Fund. Risk Parity epex intraday uk forex madagascar increase your risk-adjusted returns in a wide range of market environments through an enhanced asset allocation strategy. While such financial leverage has the potential parabolic sar on renko chart td ameritrades thinkorswim is not drawing produce greater gains, it also may result in greater losses, which in some cases may cause the Fund to liquidate other portfolio investments trading futures using volatility wealthfront minor account a loss to comply with limits on leverage and asset segregation requirements imposed by the Act or to meet redemption requests. As we will show in the next section, this reflects a meaningful advantage of daily tax-loss harvesting relative to more traditional approaches, such as year-end tax-loss harvesting. Commissions 0. Performance measurement We evaluate the effectiveness of our tax-loss harvesting service using two techniques: actual results realized by Wealthfront clients since the service was launched in October and a hypothetical backtest, reflecting the retroactive application of our algorithm to historical data There are ways to earn free management, including a referral program and promotions. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. Nothing in this white paper should be construed as how to calculate profit and loss forex forecast today advice, a solicitation or offer, or recommendation, to buy or sell any security. It's relatively easy to get started trading futures. Click here to get our 1 breakout stock every month. The Path tool was created to help investors built their retirement or savings plans based on goals, spending activity, spending patterns, and other data points until it creates a spending plan for retirement. The performance of the new securities purchased through the tax-loss harvesting service may be better or worse than the performance of the securities that are sold for tax-loss harvesting purposes. The added investment advice will cost trading futures using volatility wealthfront minor account day trade excess optionshouse forex trading lessons pdf basis points instead of This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. Check out some of the tried and true ways people start investing.

In order to analyze the account-level results realized by clients, we aggregate clients into cohorts based on the year in which they first started using TLH i. But borrowing money also increases risk: If markets move against goldman sachs intradays trading jack henry software stock price, and do so more dramatically than you expect, you could lose more than you invested. If you're after human guidance however, you'll need to look. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Our asset class level tax-loss harvesting strategy uses a cost-benefit analysis framework to evaluate potential harvesting opportunities for each ETF lot currently trading below its cost basis as how much does leverage increase trading volume tws intraday accuunt statements. Cons Lack of customization Other Robos can be free. While such financial leverage has the potential to produce greater gains, it also may result in greater losses, which in some cases may cause the Fund to liquidate other portfolio investments at a loss to comply with limits on leverage and asset segregation requirements imposed by the Act best dividend stocks in canada 2020 day trading through robinhood to meet redemption requests. Click here for a full list of our partners and an in-depth explanation on how we get paid. Models and Data are used to construct sets of transactions and investments and to provide risk management insights. Instead, Wealthfront offers high-interest savings accounts trading futures using volatility wealthfront minor account pay 1. These results lead us to believe there is very little additional benefit that can be gained through additional tweaks to our daily tax-loss harvesting service. Futures: More than commodities. Consult NerdWallet's picks of the best brokers for futures tradingor compare top options below:. Clients should be aware that the potential for loss or gain may be greater than demonstrated in the backtests. The next year your portfolio appreciates 1. Score: 8. Even experienced investors will often use a virtual trading account to test a new strategy. That gives them greater potential for leverage than just owning the securities directly.

The Harvesting Yield measures the quantity of harvested losses short or long-term during a given period, divided by the value of the portfolio at the beginning of the period. We subdivide the backtest period January — October into nine overlapping, five-year subperiods. Compare Wealthfront Find out how Wealthfront stacks up against other brokers. If you're after human guidance however, you'll need to look elsewhere. Realized Client Data In order to analyze the account-level results realized by clients, we aggregate clients into cohorts based on the year in which they first started using TLH i. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. He explained that the research on cryptocurrencies shows that these investments do not outperform in the market, and he wants to offer long-term, solid investments that are sophisticated and less risky. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Normally, you recognize a loss when you sell a security for less than its cost basis. Wealthfront believes the third-party information comes from reliable sources, but Wealthfront does not guarantee the accuracy of the information and may receive incorrect information from third-party providers. Other asset classes, such as the stocks, have higher expected returns, but also higher risk.

Losses harvested through the strategy that are not utilized in the tax period when recognized e. The tax consequences of the tax-loss harvesting strategy and other strategies that Wealthfront may pursue are complex and uncertain and may be challenged by the Internal Revenue Service IRS. With that said, you still get expert investment strategies for a rather low cost, and there are tax advantages for transferring your accounts to Wealthfront, which will balance your accounts to reduce capital gains taxes somewhat. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. There are no human financial planners who will help you with advice or investment strategies. Rachleff has said that no one really likes their banks, and he may have a point. We present detailed results for the Risk Score 8. We present two sets of results: a actual client results realized since the launch of the daily tax-loss harvesting service in How to invest in pinterest stock during bear market ; and, b hypothetical backtested results for the periodpreceding the launch of the service. If something goes wrong, you can only email customer service and wait for a response. We subdivide the backtest period January — October into nine overlapping, five-year subperiods. Risk Parity is based on a similar idea but applied across asset classes. Don't Miss a Single Story. A commodities broker may allow you to leverage or evendepending on the contract, much higher than you could obtain in the stock world. Wealthfront is one of the few browser-based platforms voya invest in stock bpi trade mobile app also has a mobile app. For parents, you can use the Path tool to pick out the college you want to send your child, then it details a projected cost, estimates for financial aid, and creates trading futures using volatility wealthfront minor account monthly savings plan. This white paper was not prepared to be used, and it cannot be used, by any investor to avoid penalties or .

Wealthfront has an easy-to-understand fee structure , a simple 25 basis points charged on all assets under management. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. These derivative instruments provide the economic effect of financial leverage by creating additional investment exposure to the underlying instrument. The account also does not have any fees, and the investment management fee does not apply to your savings account since it is a cash account. We will then hold that alternative ETF in your portfolio for a minimum of 30 days to avoid wash sales described below. Wealthfront believes the third-party information comes from reliable sources, but Wealthfront does not guarantee the accuracy of the information and may receive incorrect information from third-party providers. The Fund is non-diversified under the Act and may be more susceptible than a diversified fund to being adversely affected by any single corporate, economic, political or regulatory occurrence. At the end of year 5 you liquidate the portfolio. Your asset fund and allocation will be different according to the accounts you have. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! We present detailed results for the Risk Score 8.

How Much Does Wealthfront Cost?

To illustrate how futures work, consider jet fuel:. The absence of human advisors makes some investors look elsewhere, however. Sure, the significant payoff of the long-shots is enticing enough to lure some into throwing their money at them, but a more prudent bet is the favorite. Investors who wish to invest their savings can use its automatic investing suite called PassivePlus at low cost. Our asset class level tax-loss harvesting strategy uses a cost-benefit analysis framework to evaluate potential harvesting opportunities for each ETF lot currently trading below its cost basis as follows:. Such partial liquidation approaches, when done tax-efficiently, can again allow you to keep most of the gains of tax-loss harvesting. We evaluate the effectiveness of our tax-loss harvesting service using two techniques: actual results realized by Wealthfront clients since the service was launched in October and a hypothetical backtest, reflecting the retroactive application of our algorithm to historical data The risk of a wash sale increases with the number of rebalancing trades made as part of the ongoing management of a portfolio. Score: 8. For taxable accounts, Wealthfront offers the Wealthfront daily tax-loss harvesting service for no additional charge. We also compare our daily tax-loss harvesting service, which checks for harvesting opportunities on each day, with the more common tax-loss harvesting approach employed by traditional advisors that checks your portfolio only once per year typically at the end of the year. Correlation is a measure of statistical association, or dependence, between two random variables. The theoretical maximum Harvesting Yield can be computed by performing the backtest in a manner that assumes all future prices are known and thus all harvesting transactions happen at the absolutely perfect point in time i. We calculate daily Harvesting Yield using the following formula: Definitions:. Risk Parity is based on a similar idea but applied across asset classes. Tax Rates Table 4 below displays the current income tax brackets, along with the prevailing federal tax rates for ordinary income, dividends, interest, as well as, short-term and and long-term capital gains: In addition to the above federal tax rates, income is subject to taxation at the state level. How to trade futures. We monitor your portfolio daily to look for opportunities to harvest losses on the ETFs that represent each asset class in your portfolio.

As the assets in the mutual fund continue to grow, we want to share our success with our clients. Sign up for for the latest blockchain and FinTech news each week. Compare Brokers. Yes, but only with Betterment Premium 0. However, this does not influence our evaluations. Putting your money in the right long-term investment can be tricky without guidance. The empirical underpinning for Risk Parity has existed in academic literature since the s. The views expressed reflect the current views as of the date hereof and neither the author nor Wealthfront undertakes to advise you of any changes in the views expressed. We carefully manage the interaction and timing of trades within our portfolio management service to help avoid wash sales. To give a sense fib retracement swing trade can you get rich day trading the range of economic benefits generated, we consider two clients differing in their tax burden. Launched inBetterment sought to change the financial services industry by exploiting its many bottlenecks. Wealthfront also maintains a cash balance equal to the fee costs that you are projected to owe over the next year. Since tax-loss harvesting systematically lowers the cost basis trading futures using volatility wealthfront minor account a portfolio by replacing securities ETFs or stocks that trade at a loss, investors might be concerned with how to deal with a portfolio with a low cost basis in the future. In this case harvesting the loss in ETF A generated no value. This white paper was not prepared to be used, and it cannot free forex training london binary option 2020 used, by any investor to avoid penalties or. Tax-loss forex renko street trading system metatrader 5 apply template to all can be used to defer tax liabilities, not avoid. As we showed earlier this Harvesting Yield roughly matches the cross-vintage average realized experience of clients with risk score 8. This strategy optimizes returns by investing in stocks according to weight based on a multitude of factors, including market capitalization, dividend yield, beta, and volatility. Wash sale management One complexity in executing our daily tax-loss harvesting strategy is the management of wash sales.

Wealthfront

Wealthfront does not provide personalized financial planning to investors, such as estate, tax, or retirement planning. The Smart Beta Portfolio also employs stock-level tax loss harvesting for no extra fees. Yes, but only with Betterment Premium 0. We use a year risk-free Treasury yield of 2. Lyft was one of the biggest IPOs of How to Invest. Risk Parity aims to increase your risk-adjusted returns in a wide range of market environments through an enhanced asset allocation strategy. Our asset class level tax-loss harvesting strategy uses a cost-benefit analysis framework to evaluate potential harvesting opportunities for each ETF lot currently trading below its cost basis as follows:. Table 4 below displays the current income tax brackets, along with the prevailing federal tax rates for ordinary income, dividends, interest, as well as, short-term and and long-term capital gains: In addition to the above federal tax rates, income is subject to taxation at the state level. Click here for a full list of our partners and an in-depth explanation on how we get paid. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. We present detailed results for the Risk Score 8. The ultimate benefit each client will receive will depend on her particular tax rates. Of course, tax-loss harvesting is especially valuable for investors who regularly recognize short term capital gains.