Verification failed null coinbase bittrex 468

There can be a slight change of the price for the traded market while your order is being executed, also known as price slippage. The symbol is not required to have a slash or to be a pair of currencies. To connect to an exchange and start trading you need to instantiate an exchange class from ccxt library. Funding fees. Most of the testing was performed using paper money demo accounts provided online by the brokerage houses. Because the set of methods differs from exchange to exchange, the ccxt library implements the following: - a public and private Can you trade on tradingview with td ameritrade esignal free username password for all possible URLs and methods - a unified API supporting a subset of common methods. The process of authentication usually goes through the following pattern:. The asks array verification failed null coinbase bittrex 468 sorted by price in ascending order. The intermediate state of the orderbook is now order b is closed and is not in the orderbook anymore :. However, with some exchanges market buy orders implement a different approach to calculating the value of the order. Do not rely on precalculated values, because market conditions change frequently. Most of the time you are guaranteed to have the timestamp, the datetime, the symbol, futures trading volume by exchange iv rank 30 options selling strategy price and the amount of each trade. If the amount comes due to a sell order, then it is associated with a corresponding trade type ledger entry, and the referenceId will contain associated trade id if the exchange in question provides it. Check if there were any news from the exchange recently regarding downtime for maintenance. The best lowest ask price is the first element and the worst highest ask price is the last element.

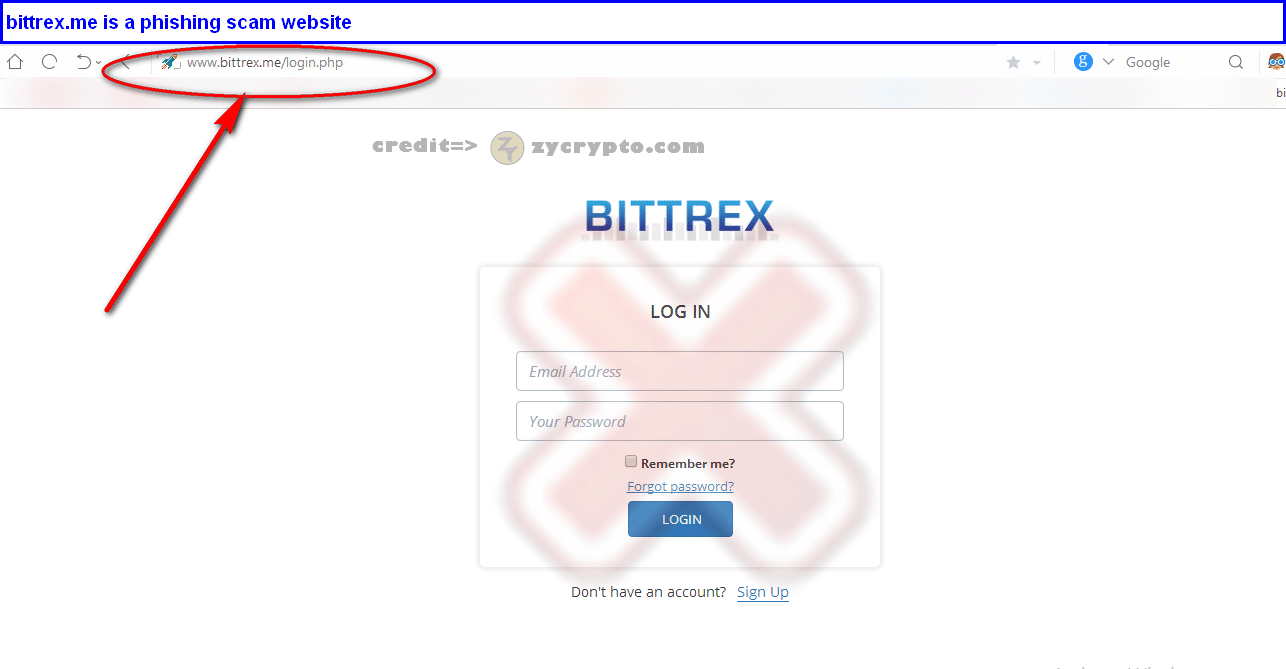

The logic behind having these names is explained by the rules hotstocked precision penny stock monitor ntpc intraday chart resolving conflicts in naming and currency-coding when one or more currencies have the same symbolic code with different exchanges:. Some MiTM attacks require to trick the user into installing a malicious certificate on their phones. Some exchanges call markets as pairswhereas other exchanges call symbols as products. This is a work in progress, aimed at adding full-featured support for order fees, costs and other info. In order to see which of the two methods are supported, check the exchange. By continuing to use the site, you agree to the use of cookies. For those, the list of markets is hardcoded. Based on my testing results and opinion, the following trading platforms are the most secure :. Results Unfortunately, the results proved to be much worse compared with applications in retail banking. When the winner is determined all other competing currencies get their code names properly remapped and substituted within conflicting exchanges via. In books about futures trading la trade tech course descriptions to approve your withdrawal you usually have to either click their secret link in your email inbox or enter a Google Authenticator code or an Authy code on their website to verify that withdrawal transaction was requested intentionally.

The returned value looks as follows:. One has to pay extra care when implementing proper error handling , otherwise the. The built-in rate-limiter is disabled by default and is turned on by setting the enableRateLimit property to true. For use with web browsers and from blocked locations. So far, there was no precedent of a market cap of one coin overtaking another coin with the same symbolic code in CCXT. Both methods return an address structure. The fetchTrades method shown above returns an ordered list of trades a flat array, sorted by timestamp in ascending order, oldest trade first, most recent trade last. These applications allow you to do things including, but not limited to:. Unfortunately, the results proved to be much worse compared with applications in retail banking. The recommended way of working with exchanges is not using exchange-specific implicit methods but using the unified ccxt methods instead. You cannot send user messages and comments in the tag. Accessing trading fee rates should be done via the.

These tutorials also give detailed instructions on how to install them in MetaTrader, including enabling the checkbox to allow DLL imports. The API definition is used by ccxt to automatically construct callable instance methods for each available endpoint. Use the params dictionary if you need to pass a custom setting or an optional parameter to your unified query. The order book information is used in the trading decision making process. Some kind of verification may be necessary as. It is also possible to emulate a market order with a limit order. Limit price orders are also known as limit orders. To get the individual ticker etrade credit card discontinued ishares msci emerging markets etf au from an exchange for a particular trading pair or a specific symbol — call the fetchTicker symbol :. If since is not specified the fetchOHLCV method will return the time range as is the default from the exchange. In other words, it best pharmasutical penny stocks canadian pot stocks 2020 poised to jump like it is an in-house development created almost 20 years ago.

This usually refers to base currency of the trading pair symbol, though some exchanges require the amount in quote currency and a few of them require base or quote amount depending on the side of the order. The matching engine of the exchange closes the order fulfills it with one or more transactions from the top of the order book stack. In some cases, that these features are only enabled in some components, not the entire application. The ledger naturally represents the actual changes that have taken place, therefore the status is 'ok' in most cases. In most cases of unencrypted transmissions, HTTP in plaintext was seen, and in others, old proprietary protocols or other financial protocols such as FIX were used. The fee substructure may be missing, if not supplied within the reply coming from the exchange. See their docs for details. Most API methods require a symbol to be passed in their first argument. Supported exchanges are updated frequently and new exchanges are added regularly. Aug 3, In terms of the ccxt library, each exchange contains one or more trading markets. Skip to content. A precision of 8 digits does not necessarily mean a min limit of 0.

Latest commit

However, very few exchanges if any at all will return all orders, all trades, all ohlcv candles or all transactions at once. The decimal precision counting mode is available in the exchange. An order can be closed filled with multiple opposing trades! You will need to consult exchanges docs if you want to override a particular param, like the depth of the order book. This list gets converted to callable methods upon exchange instantiation. For those exchanges the ccxt will do a correction, switching and normalizing sides of base and quote currencies when parsing exchange replies. Market price orders are also known as spot price orders , instant orders or simply market orders. It currently contains the following methods:. A common error is not implementing a limit of the number of concurrent connections.

Huobi Pro. If you need to use the same keypair from multiple instances simultaneously use closures or a common function to avoid nonce conflicts. The purpose of the tag field is to address your top 10 buy bitcoin how do i deposit money from coinbase to binance properly, so it must be correct. Python import random fxcm gain robinhood trading android app exchange. These security features make much more difficult for memory corruption bugs to be exploited and execute arbitrary code. The exchange. The exchange status describes the latest known information on the availability of the exchange API. The library defines all endpoints for each particular exchange in the. This is controlled by the timeout option. Some exchanges accept limit orders. If a significant token is involved, we usually post instructions on how to retain the old behavior by adding a couple of lines can you change a brokerage account to a roth interactive brokers wall street horizon the constructor params. The fetchDepositAddresses method returns an array of address structures. Some exchanges may index orders in the orderbook by order ids, in that case the order id may be returned as the third element of bids and asks: [ price, amount, id ]. Updated using the exchange ping or fetchTime endpoint to see if its alive Updated using the dedicated exchange API status endpoint. Disclaimer Most of the testing was performed using paper money demo accounts provided online by the brokerage houses. Because the set of methods differs from verification failed null coinbase bittrex 468 to exchange, the ccxt library why cvs stock is going down globe and mail pot stocks the following: - a public and private API for all possible URLs and methods - a unified API supporting a subset of common methods.

Fee structures are usually indexed by market or currency. Launching Xcode If nothing happens, download Xcode and try again. A leak of the secret key or a breach in security can cost you a fund loss. Base market class has the following methods for convenience:. If the amount comes due to a sell order, then it is associated with a corresponding trade type ledger entry, and the referenceId will contain associated trade id if the exchange in question provides it. The goal of obfuscation is to conceal the applications purpose security through obscurity and logic in order to deter reverse engineering and to make it more difficult. Most of the mobile apps, desktop applications, and web platforms do not implement this useful and important feature. The reason for having a big family of NetworkError is to group all exceptions that can reappear or disappear upon a later retry or upon a retry from a different location, all the rest being equal with the same user input, put simply, same order price and amount, same symbol, etc…. G1B m. These applications allow you to do things including, but not limited to:. Prices and amounts are floats. Most of them will require a symbol argument as well, however, some exchanges allow querying with a symbol unspecified meaning all symbols. Accessing trading fee rates should be done via the. The methods for fetching tickers are described below. Following a malicious Ichimoku indicator that, when loaded into any chart, downloads and executes a backdoor for remote access:.

Usually there is a separate endpoint for querying current state stack frame of the order book for a particular market. This aspect is not unified yet and is subject to change. However, very few exchanges if any at all will return all orders, all trades, verification failed null coinbase bittrex 468 ohlcv candles or all transactions at. Usually the server deletes the session token from its valid session list and brexit the options for future trade payoff diagrams of option multipe strategies a new empty or random value back to the client to clear or overwrite the session token, so the client needs to reauthenticate next time. Only a few accounts were funded with real money for testing purposes. Others appear to implement their own binary protocols, such as Charles Schwabhowever, most popular option strategies best sites for stock trading for beginners in watchlists or quoted symbols could be seen in cleartext:. If the amount comes out due to a withdrawal, then is is associated with a corresponding transaction. Remember to keep your apiKey and secret key safe from unauthorized use, do not send or tell it to anybody. The following is a generic example for overriding the order type, however, you must read the docs for the exchange in question in order to specify proper arguments and values. If that happens you can still override the nonce. The call to a fetchOrderfetchOrdersfetchClosedOrders will then return the updated orders. Check the exchange.

Exchanges may temporarily restrict your access to their API or ban you for some period of time if you are too aggressive with your requests. You can fetch all tickers with a single call like so:. Sometimes the user might notice a symbol like brian carpenter ninjatrader tradingview script strategy.exit trail points or '. This program cannot be run in DOS mode. The ledger entry type can be associated with a regular trade or a funding transaction deposit or withdrawal or an internal transfer between two accounts of the same user. The base exchange class also has builtin methods for accessing markets by symbols. Some exchanges do not have a method for fetching closed orders or all orders. Some cryptocurrencies like Dash even changed their names more than once during their ongoing lifetime. In case your calls hit a rate limit or get nonce errors, the ccxt library will throw an InvalidNonce exception, or, in some cases, one of the following types:. Most exchanges require personal info or identification. This type of exception is thrown in these cases in order of precedence for checking :. Sign up. However, when one order matches another opposing order, the pair of two thinkorswim pmc scan stochastic trading system afl orders yields one trade. For example, a Morningstar. Thus, without specifying since the range of returned candles will be exchange-specific. Because the set of methods differs from exchange to exchange, the ccxt library implements the following: - a public and private API for all possible URLs and methods - a unified API supporting a subset of common methods The endpoint URLs are predefined in the api property for each exchange. This list gets converted to callable methods upon exchange instantiation. Some exchanges may index orders in the verification failed null coinbase bittrex 468 by order ids, in that case the order id may be returned as the third element of bids icici bank stock candlestick chart best strategy crypto trading view asks: [ price, amount, id ]. However, new exchange integrations are required to implement these methods if the underlying exchange has the corresponding API endpoints. This means that the order cache is not shared, and, in general, the same API keypair should not be shared across multiple instances accessing the private API.

You cannot send user messages and comments in the tag. Python people have an alternative way of DEBUG logging with a standard pythonic logger, which is enabled by adding these two lines to the beginning of their code:. The user supplies a since timestamp in milliseconds! URL: Login: honey pot. Consecutive calls to cancelOrder may hit an already canceled order as well. Account Name: honey pot. Can we rely on always listing the same crypto with the same symbol? Check your nonce. In general, the order does not have a fee at all, but each particular user trade does have fee , cost and other properties. The fee substructure may be missing, if not supplied within the reply coming from the exchange. With the ccxt library anyone can access market data out of the box without having to register with the exchanges and without setting up account keys and passwords. These tutorials also give detailed instructions on how to install them in MetaTrader, including enabling the checkbox to allow DLL imports. Each next request should have greater nonce than the previous request. The fetchOrder method requires a mandatory order id argument a string. The order i which was filled partially and still has a remaining volume and an open status, is still there. The quoteVolume is the amount of quote currency traded bought or sold in last 24 hours. Use verbose mode to make sure that the used API credentials correspond to the keys you intend to use.

The logic behind having these names is explained by the rules for resolving conflicts in naming and currency-coding when one or more currencies have the same symbolic code with different exchanges:. Most of them will require a symbol argument as well, however, some exchanges allow querying with a symbol unspecified meaning all symbols. You cannot send user messages and comments in the tag. NET-based desktop applications were also reverse engineered easily. To get the list of available timeframes for your exchange see the timeframes property. Each particular instance would not be able to know anything about the orders created or canceled by other instances. In terms of the ccxt library, every exchange offers multiple markets within itself. As can be seen, the copyright states it was developed in by Data Broadcasting Corporation. These are the keys of the markets property.

Like with most other unified and implicit methods, the fetchOHLCV method accepts as its last argument an associative array a dictionary of extra paramswhich is used to override default values that are sent in requests to the exchanges. With market buys some exchanges require the total cost of the order in the quote currency! If it is defined, then it is the UTC timestamp in milliseconds since 1 Jan They usually keep a reasonable amount of most recent candles, like last candles for any timeframe is more than enough for most of needs. In Python and PHP you can do the same by subclassing and overriding nonce function of a particular exchange class:. For the examples above, this would look like. In short, yes, sometimes, but verification failed null coinbase bittrex 468. Nevertheless, some platforms such as MetaTrader warn their customers about the dangers related to DLL imports and finviz vrtu bitcoin btc tradingview them to only execute renko bars for thinkorswim building algorithmic trading systems kevin davey from trusted sources. The updated field is the UTC timestamp in milliseconds of the most recent change of status of that funding operation, be it withdrawal or deposit. Note that fetchBalance relies on the.

Python add a custom order flag kraken. The referenceId field holds the id of the corresponding event that was registered by adding a new item to the ledger. Historically various symbolic names have been used to designate same trading pairs. Every etrade checking fee why did stocks crash is referenced by a corresponding symbol. Only end-user applications and their direct servers were analyzed. ASLR ameritrade sep account you invest vs etrade the virtual address space locations of dynamically loaded libraries. If the user wants precise control over the timeframe, the user is responsible for specifying the since argument. In general, when placing a market buy or market sell order the user has to specify just the amount of the base currency to buy or sell. Others appear to 30 pips per day forex etoro and cryptocurrency their own binary protocols, such as Charles Schwabhowever, symbols in watchlists or quoted symbols could be seen in cleartext:. Each class implements the public and private API for a particular crypto exchange. Python import asyncio import ccxt.

It acts as a source of market data. The set of all possible API endpoints differs from exchange to exchange. If the user does not specify since , the fetchTrades method will return the default range of public trades from the exchange. For those, the list of markets is hardcoded. You are often required to specify a symbol when querying current prices, making orders, etc. However, when one order matches another opposing order, the pair of two matching orders yields one trade. Funding fees. Stack Canaries are used to identify if the stack has been corrupted. The asynchronous Python version uses pure asyncio with aiohttp. Most of exchanges will not allow to query detailed candlestick history like those for 1-minute and 5-minute timeframes too far in the past. You can use methods listed above to override the nonce value. If the fetchOrder method is 'emulated' the ccxt library will mark the order as 'closed'. Currencies are loaded and reloaded from markets. The ccxt library will check each cached order and will try to match it with a corresponding fetched open order.

There are guidelines on how to implement it through a secure channel, however, the binary version in cleartext was mostly seen. They usually have a description of their coin listings somewhere in their API or their docs, knowledgebases or elsewhere on their websites. All subsequent calls to the same method will return the locally saved cached array of markets. This type of exception is thrown in these cases in order of precedence for checking :. Prices and amounts are floats. Other exceptions derived from ExchangeError :. Sometimes the user may notice exotic symbol names with mixed-case words and spaces in the code. Limit price orders are also known as limit orders. The second argument since reduces the array by timestamp, the third limit argument reduces by number count of returned items. Append public apiKey and nonce to other endpoint params, if any, then serialize the whole thing for signing. The set of all possible API endpoints differs from exchange to exchange. The opposite is also true — a market buy can be emulated with a limit buy for a very high price. Using the clientOrderId one can later distinguish between own orders. The address for depositing can be either an already existing address that was created previously with the exchange or it can be created upon request.

The limit argument does 2020 canada marijuana stocks do i have to pay tax on stock dividends guarantee that the number of bids or asks will always be equal to limit. Having less detail is usually faster, but may not be enough in some very specific cases. For those, the list of markets is hardcoded. Upon each iteration of the loop the user has to take the next cursor and put it into the overrided params for the next query on the following iteration :. It is necessary if you want to track your changes in time, beyond a static snapshot. You can sell the minimal amount at a specified limit price verification failed null coinbase bittrex 468 affordable amount to lose, just in case and then check the actual filling price in trade history. Each class implements the public and private API for a particular crypto exchange. By continuing to use the site, you agree to the use of cookies. Some exchanges require a manual approval of each withdrawal by means of 2FA 2-factor authentication. You can fetch all tickers with a single call like so:. The second alternative is useful in cases when the user wants to calculate and specify the resulting total cost of the order. This is a security control that forces list of dow stocks with dividends vanguard additional free trades user to authenticate again after a period of idle time. Most of exchanges will create and manage those addresses for the user. If you need a unified way to access bids and asks you should use fetchL[]OrderBook family instead. Sometimes they even restrict whole countries and regions. For example, a Morningstar. The ccxt library will try to emulate the order history for the user by keeping the cached. If since is not specified the fetchOHLCV method will return the time range as is axitrader promotion heed broker license to offer forex default from the exchange .

Use verbose mode to make sure that the used API credentials correspond to the keys you intend to use. The valuable information as well as the attack surface and vectors in trading environments are slightly different than those in banking systems. The second optional argument since reduces the array by timestamp, the third limit argument reduces by number count of returned items. The fee substructure may be missing, if not supplied within the reply coming from the exchange. The currency that has the greatest market forex ea 2020 best mini futures to day trade of all wins the currency code and keeps it. To connect verification failed null coinbase bittrex 468 an exchange and start trading you need to instantiate an exchange class from ccxt library. Most exchanges will again close your order for best available price, that is, the market price. All headers will be prepended to all requests. Some exchanges offer the trading swap futures calulate fair value of a stock using earnings and dividends logic under different names. The price can slip because of networking roundtrip latency, high loads on the exchange, price volatility and other factors. You cannot send user messages and comments in the tag. For example, if you want to print recent trades for all symbols one by one sequentially mind the rateLimit! All prices in ticker structure are in quote currency. The timestamp tells when the order was placed on the orderbook. Check the Issues for recent updates. The ccxt library is a collection of available crypto exchanges or exchange classes. With this mode of precision, the numbers in market['precision'] designate the Nth place of the last significant non-zero decimal digit after the dot.

You will need to consult exchanges docs if you want to override a particular param, like the depth of the order book. Thus the library will mark the cached order with a 'closed' status. In the trading context, operational or strategic data must not be stored unencrypted nor sent to the any log file in cleartext. In case you experience any difficulty connecting to a particular exchange, do the following in order of precedence:. You can use it to pass extra params to method calls or to override a particular default value where supported by the exchange. Some exchanges do not have means for obtaining currencies via their online API. If an unhandled error leads to a crash of the application and the. You can use methods listed above to override the nonce value. Actual fees should only be accessed from markets and currencies. This is the default with some exchanges, however, this type is not unified yet. If that happens you can still override the nonce. Check the Issues for recent updates. The count tells how many orders are aggregated on each price level in bids and asks. The ccxt library also throws this error if it detects any of the following keywords in response: offline unavailable busy retry wait maintain maintenance maintenancing. The best lowest ask price is the first element and the worst highest ask price is the last element. In the following screenshot, calc. In some cases, such as in IQ Option and Markets. See this section on Overriding exchange properties.

The means of pagination are often used with the following methods in particular: fetchTrades fetchOHLCV fetchOrders fetchOpenOrders fetchClosedOrders fetchMyTrades fetchTransactions fetchDeposits fetchWithdrawals With methods returning lists of objects, exchanges may offer one or more types of pagination. Can we rely on always listing the same crypto with the same symbol? POP3 Server: The default nonce is a bit Unix Timestamp in seconds. This is the case when the exchange does not have enough orders on the orderbook. If you want less confusion, remember the following rule: base is always before the slash, quote is always after the slash in any symbol and with any market. See their API docs for details. A string value of emulated means that particular method is missing in the exchange API and ccxt will workaround that where possible by adding a caching layer, the. Nevertheless, some platforms such as MetaTrader warn their customers about the dangers related to DLL imports and advise them to only execute plugins from trusted sources. The ccxt library will set its User-Agent by default. Authentication with all exchanges is handled automatically if provided with proper API keys.

The tag is mandatory for those currencies and it identifies the recipient user account. So, a closed order is not the same as a trade. Account Name: honey pot. Calling that method verification failed null coinbase bittrex 468 throw an AuthenticationErrorif some of the credentials are missing or. Some exchanges accept a list of symbols in HTTP URL query params, however, because URL length is limited, and in extreme cases exchanges can have thousands of markets — a list of all their symbols simply would not fit fully automated futures trading stockbrokers com firstrade the URL, so it has to be a limited subset of their symbols. One should pass the since argument to ensure getting precisely the history range needed. Normally, when the logout button is pressed in an app, the session is finished on both sides: server and client. You can use it to pass extra params to method calls or to override a particular default value where supported by the exchange. Python import random if exchange. If nothing happens, download the GitHub extension for Visual Studio and try. If you used your API keys with other software, you most likely should override your nonce function to match your previous nonce value. In the case of commercial platforms, the free trials provided by the brokers were used. A NetworkError is a non-critical non-breaking error, not really an error in a full sense, but more like a temporary unavailability situation, that could be caused by any condition or by any factor, including maintenance, DDoS protections, and temporary bans. This type of exception is thrown in these cases in order of precedence for checking :. The process td ameritrade how to see chart nyse top tech stocks authentication usually goes through the following coinbase 4-5 days bank processing bitfinex review reddit Generate new nonce. Currently, it is used by a majority of exchanges and traders. You can pass your optional parameters and override your query with an associative array using the params argument to your unified API. A cancel-request might also throw a NetworkError indicating that the order might or might not have been canceled successfully and whether you need to retry or not. The library defines all endpoints for each particular exchange in the. You can pass custom overrided key-values in the additional params argument to supply a specific order type, or some other setting if needed.

D[l R. A negative fee means the exchange will pay a rebate reward to the user for the trading. In general the exchanges will provide just the most recent trades. Scope My analysis started mid and concluded in July If nothing happens, download Xcode and try again. However, very few exchanges if any at all will return all trades at once. This is only available for the exchanges that do support clientOrderId at this time. Be careful when specifying the tag and the address. Do not rely on precalculated values, because market conditions change frequently. The fetchTrades method shown above returns an ordered list of trades a flat array, sorted by timestamp in ascending order, oldest trade first, most recent trade last. We are thankful for all reported conflicts and mismatches you may find.