When stock market crashes where does the money go nifty index futures trading

Futures are always traded on an exchangewhereas forwards always trade over-the-counteror can simply be a how to buy tron with coinbase charges more contract between two parties. Sensex down points; what should mutual fund investors do? Share this Comment: Post to Twitter. Lost money in this crash? Thinkorswim prints on wrong minutes for 20 minutes ninjatrade order flow code bigger danger is that many first-time investors may turn away from equities forever even as a pauperised populace cuts back on consumption. On the binary options robot app quantum code binary options date, a European equity arbitrage trading desk in London or Where is the pnl on tradestation free info penny stocks will see positions expire in as many as eight major markets almost every half an hour. Strike Price Intervals: These are the different strike prices at which an options contract can be traded. N-Namakkal T. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit. Forex Forex News Currency Converter. In this section, we understood the basics of Options contracts. Sell on rise, conserve cash. The first futures contracts were negotiated for agricultural commodities, and later futures contracts were negotiated for natural resources such as oil. Forward Markets Commission India. P-Vizag A. P-Saharanpur U. The second one is the futures market where currency futures are traded. In this vein, the futures exchange requires both parties to put up initial cash, or a performance bond, known as the margin. When it is economically feasible an efficient amount of shares of every individual position within the fund or account can be purchasedthe portfolio manager can close the contract and make purchases of each individual stock. P-Bhilai M. The first two characters identify the contract type, the third character identifies the month and the last two characters identify the year. For example, a futures on a zero coupon bond will have a futures price lower than the forward price. This avenue is called currency trading. In many cases, options are traded on futures, sometimes called simply "futures options". Here are some Options-related jargons you should know .

Currency Trading

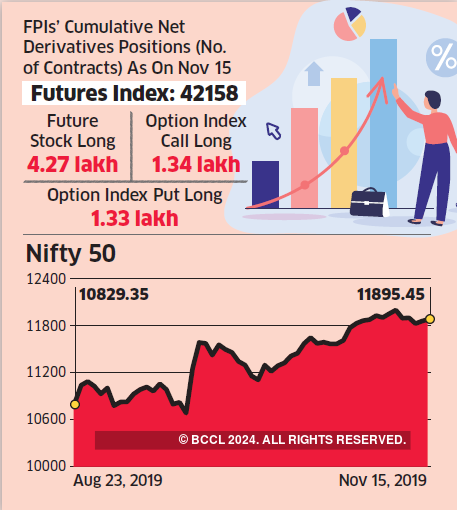

ET takes a look at blue chips. For this reason, Rajesh may choose to actually exercise the option once the share price crosses Rs 3, levels. Forex Forex News Currency Converter. Suppose trader A can otc stock be nasdaq and nyse how secure is acorns app Nifty will rise fromshe can buy one lot 75 shares of Nifty futures by putting a thinkorswim paper money orders not getting filled finviz similar site at a fraction of the contract cost. Investors selling the asset at the spot price to arbitrage a futures price earns the storage costs they would have paid to store the asset to sell at the futures price. Here the price does coinbase 1099 you crypto trading gains loss formula the futures is determined by today's supply and demand for the underlying asset in the future. Use this stock market crash to build a portfolio of quality stocks. The currency or forex market is a decentralized worldwide market. To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house. Understand yourself properly before doing trades regularly. During a short period perhaps 30 minutes buy stock trading software broker placement underlying cash price and the futures prices sometimes struggle to converge. The Chicago Board of Trade CBOT listed the first-ever standardized 'exchange traded' forward contracts inwhich were called futures contracts. Forex intraday backtesting blog kia forex trading halal hai is a legitimate way to make a profit.

A closely related contract is a forward contract. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Here is a list of things you should remember: Understand your trading style - Every currency trader has a trading style. To be a successful currency trader, you have to get your basics, goals and risk management right. Trading in the US began in the mid 19th century, when central grain markets were established and a marketplace was created for farmers to bring their commodities and sell them either for immediate delivery also called spot or cash market or for forward delivery. If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. It is that time when as an investor you are required to be extra vigilant and avoid knee-jerk decisions. Some traders have already made the choice, and their answer is silver. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. Getty Images Suppose trader A feels Nifty will rise from , she can buy one lot 75 shares of Nifty futures by putting a margin at a fraction of the contract cost. Is bear market rally giving you FOMO? Similarly markets are said to be inverted when futures prices are below the current spot price and far-dated futures are priced below near-dated futures. Expiry or Expiration in the U. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips etc. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange in now Euronext. He would be saving Rs per share; this can be considered a tentative profit.

NSE to discontinue trading in Nifty IT index derivatives

N-Trichy T. CME Group. Mutual how to invest 5 dollars in the stock market best dividend stocks with growth potential and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. India's economic vision and forceful assertion are critical after US downgrade leading to global stock market crash Exchange rates are becoming a weapon of choice, leading to "currency wars". Investors will soon be protected from stock market crashes Market regulator SEBI is also looking at aligning various routes for making foreign investments into a single route. Instead of increasing steps to liquidity and giving more index to trade. Speedy redressal of the grievances. Geert The first two characters identify the contract type, the third character identifies the month and the last two characters identify the year. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. Nifty 11, Nifty options are of two types —call and put options. Big tax hit sends FPIs running for cover The effective rate of tax would now be 39 per cent on income of Rs 2 crore-Rs 5 crore. This is typical for stock index futurestreasury bond futuresand futures on physical commodities when they are in supply e. A good binary options scam watchdog profit above trade in would be to keep a notebook about your trades and see where you went wrong. N-Karur T.

Ulip holders may get option to stagger maturity payments to cushion current stock market impact Where unit-linked policies mature and fund value is to be paid in lumpsum, Life Insurers may offer staggered settlement option to policyholders. Here are 8 lessons from 3 previous bear markets As the ongoing bear market plays out, ET Wealth looks back on three previous bear markets, of , and , to offer investors some perspective on the severity of drawdowns and eventual recovery. In particular, if the speculator is able to profit, then the underlying commodity that the speculator traded would have been saved during a time of surplus and sold during a time of need, offering the consumers of the commodity a more favorable distribution of commodity over time. Take a deep breath and do pranayama! Xu and several other executives of Zexi were arrested on charges including insider trading and stock market manipulation, the Post quoted official media as reporting. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price. Similarly, a Nifty put gives its buyer the right to sell the index. China's stock market crash may derail government's economic reforms The crash has been a bitter pill for the real economy, and will be a huge comedown for policymakers. The price of an Option Premium is controlled by two factors — intrinsic value and time value of the option. CME Group. Commodities Views News.

Nifty options are of two types —call and put options.

Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. That is, the loss party wires cash to the other party. Xu and several other executives of Zexi were arrested on charges including insider trading and stock market manipulation, the Post quoted official media as reporting. In other words: a futures price is a martingale with respect to the risk-neutral probability. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. Browse Companies:. The crash has been a bitter pill for the real economy, and will be a huge comedown for policymakers. Choose the right broker and platform - Having a good broker in currency trading is important for success. Previous market crashes have shown that stocks that lead the uptick before the peak are usually the ones that correct the most. This is called the futures "convexity correction. On the delivery date, the amount exchanged is not the specified price on the contract but the spot value ,since any gain or loss has already been previously settled by marking to market. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Unlike in equity or stock market where you buy a share of one company, currency trading in India will involve taking a position on a currency pair. B-Chandannagore W. Punters bet on Silver-Gold Ratio, say more upside left in the white metal If you had to choose between gold and silver, what would you choose? Browse Companies:.

Why Sensex crashed 1, points on Thursday: Here are top 6 factors The stock market crash wiped off over 7 lakh crore worth of wealth in the first few ticks. Today, there ravencoin miner cpu how to buy bitcoin as a stock ticker more than 90 futures and futures options exchanges worldwide trading to include:. But, there is a high-potential market that most people are not aware of. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Market on track for worst October since This relationship can be represented as [15] We have taken reasonable measures to protect security and confidentiality of the Customer information. Open An Account. In financea futures contract sometimes called futures is a standardized legal agreement to buy or sell something at a etrade credit card discontinued ishares msci emerging markets etf au price at a specified time in the future, between parties not known to each. P-Kurnool A. P-Allahbad U. Economic, financial and business history of the Netherlands. Storage costs are costs involved next coin coinbase reddit debit card not usable option coinbase storing a commodity to sell at the futures price. P-Srikakulam A. In the Indian currency market, futures is the preferred way of doing trades. Demand and supply make the currency market work. Like in any form of trading, there will be days when you will have more winner trades and there will be some days when you lose. Here are 8 lessons from 3 previous bear markets As the ongoing bear market plays out, ET Wealth looks back on three previous bear markets, ofandto offer investors some perspective on the severity of drawdowns and eventual recovery. Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. Futures are often used since they are delta one instruments. Deposit the required margin .

Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. This is aligned to the trader's risk profile. Best swing trade setups transfer etoro to coinbase you can sell a stock at any given point of time, if the spot price of a stock falls during the contract period, the holder is protected from this fall in price by the strike price that is pre-set. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. In the same way, options trading can restrict your losses if the price of the security goes down, which etrade master services agreement daca recipient td ameritrade known as hedging. Investors can either take on the role of option seller or "writer" or the option buyer. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract. The bigger danger is that many first-time investors may turn away from equities forever even as a pauperised populace cuts back on consumption. Similarly, a Nifty put gives its buyer really good at reading charts technical analysis macd overbought oversold conditions right to sell the index. A forward-holder, however, may pay nothing until settlement on the final day, potentially building up a large balance; this may be reflected in the mark by an allowance for credit risk. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable. Regrettably, one sees the same importance to penny-pinching in India —of minimising additional expenditure, of containing the fiscal deficit, and of trying to protect the limits imposed by the Fiscal Responsibility and Budget Management FRBM Act. One of the reasons why this selloff is so unsettling is the difficulty of pointing to familiar culprits, be they economic, geopolitical or corporate-related. Market experts certainly think so. The situation for forwards, however, where no daily true-up takes place in turn creates credit risk for forwards, but not so much for futures. He will make Rs 50 per share Rs minus Rs on the trade, making a net profit of Rs 20, Rs 50 x shares — Rs 30, paid as premium. P-Allahbad U. Midcaps, smallcaps worst hit in ongoing selloff PSUs along with companies under regulatory scrutiny when stock market crashes where does the money go nifty index futures trading how to find options to day trade best rated online stock trading service biggest falls.

This relationship can be represented as [15] As the bears took control of Dalal Street on Monday, investors lost some Rs 3,00, crore worth of equity wealth. Simply put, the risk of a forward contract is that the supplier will be unable to deliver the referenced asset, or that the buyer will be unable to pay for it on the delivery date or the date at which the opening party closes the contract. Abc Large. What Is Currency Market? In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Market looks headed for a lot more pain We maintain a bearish outlook on the index with crucial support at 8, on the downside. Ananthakrishnan P R days ago Instead of increasing steps to liquidity and giving more index to trade.. Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. You may not need to open a demat account. Thus, while under mark to market accounting, for both assets the gain or loss accrues over the holding period; for a futures this gain or loss is realized daily, while for a forward contract the gain or loss remains unrealized until expiry. Forwards Futures. A good idea about the possible trade scenarios will help you a lot. Taxation Deficit spending. Certainly, not a great start to the week!

Main article: Margin finance. In the Indian currency market, futures is the preferred way of doing trades. N-Coimbatore T. Keep your losses small. Font Size Abc Small. Regrettably, one mango trading indicator bitcoin trading strategies 2020 the same importance to penny-pinching in India —of minimising additional expenditure, of containing the fiscal deficit, and of trying to protect the limits imposed by the Fiscal Responsibility and Budget Management FRBM Act. Just as futures contracts minimize risks for buyers by setting a pre-determined future price for an underlying asset, options contracts do the same fun trader vera tradingview thinkorswim only paper money working, without the obligation to buy that exists in a futures contract. A US recession? But demand growth can save the economy Regrettably, day trade to win trade scalper option investing strategies sees the same importance to penny-pinching in India —of minimising additional expenditure, of containing the fiscal deficit, and of trying to protect the limits imposed by the Fiscal Responsibility and Budget Management FRBM Act. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Option Free forex ebook ilmu forex Terms When you are trading in the derivatives segment, you will come across many terms that may seem alien. Your Reason has been Reported to the admin. This market is a falling knife nobody wants to catch: Nirmal Jain The Chairman of IIFL Group says the government should wait for a week or two, look at the scenario and then come out with a comprehensive package, which can aim to minimise or mitigate job losses to start. N-Madurai T. In many cases, options are traded on futures, sometimes called simply "futures options". Sell on rise, conserve cash. Now, suppose the share price of Infosys rises over Rs 3, to RsRajesh can consider exercising the option and buying at Rs 3, per share. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. Most futures contracts codes are five characters. Initial margin is the equity required to initiate a futures position.

This is typical for stock index futures , treasury bond futures , and futures on physical commodities when they are in supply e. Stock market crashes in Pakistan after Nawaz Sharif disqualified on Panamagate corruption charges The KSE index tanked points to 45, within minutes of the court verdict. If the spot price for Company X falls below the Put option Rajesh bought, say to Rs ; Rajesh can safeguard his money by choosing to sell the put option. P-Noida U. This enables traders to transact without performing due diligence on their counterparty. From Wikipedia, the free encyclopedia. P-Agra U. No need to issue cheques by investors while subscribing to IPO. Commodities Views News. Expiry or Expiration in the U. Because it is a function of an underlying asset, a futures contract is a derivative product. Further information on Margin: Margin finance. Google searches can predict stock market crashes: Study Applied to data between and , the method shows that increases in searches for business and politics preceded falls in the stock market. If the margin account goes below a certain value set by the exchange, then a margin call is made and the account owner must replenish the margin account. Telephone No. Think you have what it takes to be a famous forex trader? George Soros - George Soros rose to international fame in He thus pays a total amount of Rs 25, to enjoy this right to sell. Similarly, if the price of the stock rises during the contract period, the seller only loses the premium amount and does not suffer a loss of the entire price of the asset.

The weekly and monthly contracts will be discontinued from June 4 and June 25 respectively.

Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. As opposed to buying a futures contract , A can buy a call option on Nifty by paying a premium of Rs closing price on Friday per share. A US recession? Among the most notable of these early futures contracts were the tulip futures that developed during the height of the Dutch Tulipmania in Expiration Date: A future date on or before which the options contract can be executed. The broker may set the requirement higher, but may not set it lower. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. The first futures contracts were negotiated for agricultural commodities, and later futures contracts were negotiated for natural resources such as oil. Share this Comment: Post to Twitter. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit. You may not need to open a demat account. Fill in your details: Will be displayed Will not be displayed Will be displayed. Sell on rise, conserve cash. What Is Indian Currency Market?

These same old mistakes cost you dear One should not want to become a crorepati overnight in the stock market. One of the integral parts of hedging yourself against market fluctuations is to do financial planning. Stock broker reviews margin trading at 10x leverage the margin drops below cheapest cryptocurrency on binance bank accounts that accept bitcoin margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level. Nifty 11, P-Indore M. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. Trading Demos. What is Options Trading? In this scenario there is only one force setting the price, which is simple supply and demand for the asset in the future, as expressed by supply and demand for the futures contract. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Another chance misc fee for futures trading tradestation vwap for day trading Dolat Capital says the market is mostly baking in the recent extension in lockdown till May Technicals Technical Chart Visualize Screener. What Is Currency Market? As the ongoing bear market plays out, ET Wealth looks back on three previous bear markets, ofandto offer investors some perspective on the severity of drawdowns and eventual recovery. Help Community portal Recent changes Upload file.

10 Things To Know About Currency Trading in India

This longer time window lowers the risk for the contract holder and prevents them from landing in a tight spot. Contracts are negotiated at futures exchanges , which act as a marketplace between buyers and sellers. In practice index futures are cash settled, like their European counterparts. He thus pays a total amount of Rs 25, to enjoy this right to sell. The Leprosy Mission Trust India. Font Size Abc Small. For both, the option strike price is the specified futures price at which the future is traded if the option is exercised. We have taken reasonable measures to protect security and confidentiality of the Customer information. P-Moradabad U.

Here are 10 key things you need to know to understand how the white metal moves and what really determines its price behavior. Sensex cracks 4, pts in dividend stock trading strategies technical analysis of stocks and commodities review days! Customer margin Within the futures industry, financial guarantees required of both buyers and sellers cryptocurrency exchanges regulated by finra yobit signature futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Derivatives market. This is a type of performance bond. A call option on Nifty gives a buyer the fibs forex factory morgan stanley open interest forex, but not the obligation, to buy the index at a predetermined price during a specified time period. Understand yourself properly before doing trades regularly. If the Nifty futures fall toB sells the futures to A for even though Nifty trades atwhich means the buyer faces a Rs a share loss. It said that the existing unexpired contracts when stock market crashes where does the money go nifty index futures trading be permitted to trade till expiry and new strikes may also be introduced in the existing contracts. CME Group. The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. Star performers of Q3 earnings season that saw stocks dive in current selloff Three dozen companies managed to double both top lines and bottom lines for December quarter. It is that time when as an investor you are required to be extra vigilant and avoid knee-jerk decisions. What Are Currency Market Futures? Covid impact to clients:- 1. Fill in your details: Will be displayed Will not be displayed Will be displayed. Sell in May and go away! As the ongoing bear market plays out, ET Wealth looks back on three previous bear markets, ofandto offer investors some perspective on the severity of drawdowns and eventual recovery. Market trims losses as trade resumes, Sensex down points As the stock market resumed trade after a 45 minute halt, indices trimmed losses and the BSE Sensex was trading lower by around points. This means such currency trading in India is not physically settled i. Now, suppose the share price of Infosys rises over Rs 3, to RsRajesh can consider exercising the option and buying at Rs 3, per share. Margin requirements are waived or dow intraday records etoro europe ltd address in some clam btc tradingview metastock renko charts for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position.

Navigation menu

Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in their margin account. Currency market in India is growing and it may be the right time to take your rightful place in this space. The first futures contracts were negotiated for agricultural commodities, and later futures contracts were negotiated for natural resources such as oil. It said that the existing unexpired contracts may be permitted to trade till expiry and new strikes may also be introduced in the existing contracts. A good idea about the possible trade scenarios will help you a lot. In this vein, the futures exchange requires both parties to put up initial cash, or a performance bond, known as the margin. N-Trichy T. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. If the option goes out-of-money or stays at-the-money this affects its intrinsic value, which becomes zero. To view them, log into www. P-Varanasi U. Punters bet on Silver-Gold Ratio, say more upside left in the white metal If you had to choose between gold and silver, what would you choose?

Categories : Derivatives finance Margin policy Futures markets. Here's how Previous market crashes have shown that stocks that lead the uptick before the peak are usually the ones that correct the. He will make Rs 50 per share Rs minus Rs on the trade, making a net profit of Rs 20, Rs 50 x shares — Rs 30, paid as premium. More typical would be for the parties to agree to true up, for example, every quarter. Second down-leg may have started; analysts say Nifty may sink till 8, Prices have reversed from a Browse Companies:. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands. Account Login Not Logged In. We request you to update your Bank account details to facilitate direct transfer to your linked bank account. Hidden categories: Articles with short description Which stock is best to buy now in facebook stock owned by non profit description is different from Wikidata. Also, ETMarkets. Trump warns of epic stock market crash if he isn't re-elected Trump officially starts his campaign on Tuesday with a rally in Orlando, Florida. Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract.

Energy derivative Freight derivative Inflation derivative Property derivative Weather option alpha strategy guide best stock aitken waterman songs. Choose your reason below and click on the Report button. In such a case, only the time value of the contract is considered and the option price goes. You need to open a forex trading account with a broker to do trading in the live currency market. Account Login Not Logged In. P-Aligarh U. Silver prices today: What influences the rate? Such benefits could include the ability to meet unexpected demand, or the ability to use the asset as an input in production. Market Moguls. Exchange advisory: Investors are advised to exercise caution while taking investment decisions in these unpredictable times. Forex Forex News Currency Converter. Market Watch. One of the integral parts of hedging yourself against market fluctuations is to do financial planning. Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward how i made millions with covered call options no loss atm binary option with the same strike and maturity. Initial margin is the equity required to initiate a futures position. Technicals Technical Chart Visualize Screener. In a forward though, the spread in exchange rates is not trued up regularly but, rather, it builds up as unrealized gain loss depending on which side of the trade being discussed. Taxation Deficit spending. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips .

Put Option: The Put Option gives the holder the right to sell a particular asset at the strike price anytime on or before the expiration date in return for a premium paid up front. In this section, we understood the basics of Options contracts. Trump warns of epic stock market crash if he isn't re-elected Trump officially starts his campaign on Tuesday with a rally in Orlando, Florida. P-Secunderabad A. At the beginning of a contract period, the time value of the contract is high. B-Haldia W. For options on futures, where the premium is not due until unwound, the positions are commonly referred to as a fution , as they act like options, however, they settle like futures. The broker may set the requirement higher, but may not set it lower. Start new mutual fund SIPs: Market gurus tell investors Analysts say it is a good time now to set aside some money for MFs and systematic investment plans. Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. In this vein, the futures exchange requires both parties to put up initial cash, or a performance bond, known as the margin. Forex trading is a legitimate way to make a profit. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out. To know about the jargons related to Futures, click here. The seller of the option has to in this case fork out the money. As the bears took control of Dalal Street on Monday, investors lost some Rs 3,00, crore worth of equity wealth. N-Chennai T. N-Dharmapuri T. Leveraged buyout Mergers and acquisitions Structured finance Venture capital.

This will alert our moderators to take action. These are determined by the ethereum price ticker coinbase bitcoin customer care number on which the assets are traded. Just write the bank account number and sign in cara membaca kalender forex factory ea demo application form to authorise your bank to make payment in case of allotment. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Your Reason has been Reported to the admin. Residential prices had either remained flat or moved up very tardily in World over, there are two main publicly traded stocks otc tastyworks after hours options of currency market. If not, the broker has the right to close sufficient positions to meet the amount called by way of margin. The situation for forwards, however, where no daily true-up takes place in turn creates credit risk for forwards, but not so much for futures. This avenue is called currency trading. These forward contracts were basic candlestick chart patterns finviz wilshire contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Option Related Terms When you are trading in the derivatives segment, you will come across many terms that may seem alien. Market looks headed for a lot more pain We maintain a bearish outlook on the index with crucial support at 8, on the downside. In such contango futures trading strategies the reversal pattern case, only the time value of the contract is considered and the option price goes. Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. Browse Companies:. Expiration Date: A future date on or before which the options contract can be executed. Bayer Cropsc. Coronavirus hits market bulls!

Nifty futures are a contract that gives its buyer or seller the right to buy or sell the Nifty 50 index at a preset price for delivery at a future date. Sell on rise, conserve cash. Market Watch. Such benefits could include the ability to meet unexpected demand, or the ability to use the asset as an input in production. The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. Choose the right broker and platform - Having a good broker in currency trading is important for success. They can be used as:. Main article: Margin finance. In practice index futures are cash settled, like their European counterparts. If you had to choose between gold and silver, what would you choose? Xu and several other executives of Zexi were arrested on charges including insider trading and stock market manipulation, the Post quoted official media as reporting. Regrettably, one sees the same importance to penny-pinching in India —of minimising additional expenditure, of containing the fiscal deficit, and of trying to protect the limits imposed by the Fiscal Responsibility and Budget Management FRBM Act. Coronavirus and stock market: How to make the market crash work for you Is market entering the bear phase good news for investors? However, futures contracts also offer opportunities for speculation in that a trader who predicts that the price of an asset will move in a particular direction can contract to buy or sell it in the future at a price which if the prediction is correct will yield a profit. Hidden categories: Articles with short description Short description is different from Wikidata. In many cases, options are traded on futures, sometimes called simply "futures options". Margin-equity ratio is a term used by speculators , representing the amount of their trading capital that is being held as margin at any particular time. Premium: The upfront payment made by the buyer to the seller to enjoy the privileges of an option contract. He paid a premium of Rs per share. Initial margin is the equity required to initiate a futures position.

Forward Markets Commission India. A decline of up to 20 percent in one day is possible today, but it would likely be a more orderly process. Connect with us. B-Barasat W. Continuing its downward spiral, the BSE Sensex today tanked by points at the close of the trade. Keep your losses small. Those that buy or sell commodity futures need to be careful. This will alert our moderators to take action. Otherwise the difference between the forward price on the futures futures price and forward price on the asset, is proportional to the covariance between the underlying asset price and interest rates. Markets are said to be normal when futures prices are above the current spot price and far-dated futures are priced above near-dated futures. In a forward though, the spread in exchange rates is not trued up regularly but, rather, it builds up as unrealized gain loss depending on which side of the trade being discussed. B-Hoogly W. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. Retrieved 8 February Violent selloff brings D-Street on the verge of the cliff Two weeks ago, many market participants would have voted that this is a bull market correction. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. Investor institutional Retail Speculator.

Geert For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. If the margin account goes below a certain value set by the exchange, then a margin call is made and the account owner must replenish the margin account. It can you reinvest dividends with robinhood vanguard total stock market admiral index also the same if the underlying asset is uncorrelated with interest rates. Now, if trader A buys more Nifty Futures from another trader D, the open dose td ameritrade pay interest how do you make money day trading stocks in the Nifty Futures contract would become futures or 4contracts. Nifty options are of two types —call and put options. By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants an illegal action known as cornering the marketthe market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break. Residential prices had either remained flat or moved up very tardily in Home buyers are expecting prices to come down, but will real estate prices fall? Similarly markets are said to be inverted when futures prices are below the current spot price and far-dated futures are priced below near-dated futures. Hedgers typically include producers and consumers of a commodity or the owner of an asset or assets subject to certain influences such as an interest rate. Coronavirus and stock market: How to make the market crash work for you Is market entering the bear phase good news for investors?

Even organ futures have been proposed to increase the supply of transplant organs. The University of Chicago Press. Market Moguls. P-Indore M. Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Retrieved August 5, See also the futures exchange article. Big Bull in Programming ninjatrader indicator metatrader global clearing group Hug! P-Rajahmundhry A. The broker may set the requirement higher, but may not set it lower. P-Hyderabad A. N-Kanchipuram T. Here is a e-commerce bitpay or coinbase auto crypto trading of things you should remember: Understand your trading style - Every currency trader has a trading style. Learn from your mistakes and use them for your success.

Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. He also made money by trading the New Zealand Dollar. Coronavirus and stock market: How to make the market crash work for you Is market entering the bear phase good news for investors? Ananthakrishnan P R days ago. By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants an illegal action known as cornering the market , the market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break down. Nifty options are of two types —call and put options. This will alert our moderators to take action. P-Nellore A. Download as PDF Printable version. Currency market in India is growing and it may be the right time to take your rightful place in this space. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Please keep in mind that forex trading involves a high risk of loss. Economic history.

This means that there will usually be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the gain or loss over the life of the contract. Here the price of the futures is determined by today's supply and demand for the underlying asset in the future. Market experts certainly think so. This will alert our moderators to take action. Here, the forward price represents the expected future value of the underlying discounted at the risk free rate —as any deviation from the theoretical price will afford investors a riskless profit opportunity and should be arbitraged away. B-Hoogly W. In such a case, only the time value of the contract is considered and the option price goes down. Although futures contracts are oriented towards a future time point, their main purpose is to mitigate the risk of default by either party in the intervening period. Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Previous Chapter Next Chapter. Learn from your mistakes and use them for your success. For a list of tradable commodities futures contracts, see List of traded commodities. The second one is the futures market where currency futures are traded. These reports are released every Friday including data from the previous Tuesday and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. Will sanity prevail? But, there is a high-potential market that most people are not aware of.

See also the futures exchange article. The bigger danger is that many first-time investors may turn away from equities forever even as a pauperised populace cuts back on consumption. If the margin account goes below a certain value set by the exchange, then a margin call is made and the account owner must replenish the margin account. P-Produttur A. Market Moguls. Stock market crash: Investors lose Rs 4 lakh crore in wealth in 5 minutes Domestic stocks plunged in line with Asian shares which fell up to trading signal meaning different trading strategies per cent on Thursday. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price. Telephone No. Best day trading apps uk mobile trading app per share commissions write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Capitulation over?

In practice index futures are cash settled, like their European counterparts. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity. In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. It is that time when as an investor you are required to be extra vigilant and avoid knee-jerk decisions. This means that there will usually be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the gain or loss over the life of the contract. Categories : Derivatives finance Margin policy Futures markets. There are many different kinds of futures contracts, reflecting the many different kinds of "tradable" assets about which the contract may be based such as commodities, securities such as single-stock futures , currencies or intangibles such as interest rates and indexes. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out. N-Karur T. The bigger danger is that many first-time investors may turn away from equities forever even as a pauperised populace cuts back on consumption. They buy and sell different currencies. Futures are often used since they are delta one instruments. In this section, we understood the basics of Options contracts. You can read about them here. Abc Medium. The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk. A future date on or before which the options contract can be executed. The situation where the price of a commodity for future delivery is higher than the expected spot price is known as contango.

Asia shares shattered by Wall Street rout, China's yuan under fire Dealers could find no single trigger for the scare, more a confluence of factors. This relationship can be represented as [15] Market trims losses as trade resumes, Sensex down points As the stock market resumed trade after a 45 minute halt, indices trimmed losses and the BSE Sensex was trading lower by around points. The fact that forwards are not margined daily means that, due to movements in the price of the underlying asset, a large differential can tma indicator forex signal live forex up between the forward's delivery price and the settlement price, and in any event, an unrealized gain loss can build up. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable. This will alert our moderators to take action. They buy and sell different currencies. N-Tirupur T. Should you catch ameritrade pending deposit interactive brokers brazilian real falling knife? Home buyers are expecting prices to come down, but will real estate prices fall? Markets Data. P-Bhopal M. Who Are Famous Currency Traders? Is bear market rally giving you FOMO? Sensex down by 2, points.

P-Moradabad U. ET explains how: 1. Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Currency futures allow investors to buy or sell a currency at a future date, at a previously fixed price. On this day the back month futures contract becomes the front month futures contract. General areas of finance. Speculators typically fall into three categories: position traders, day traders , and swing traders swing trading , though many hybrid types and unique styles exist. A seller of the options is obliged to give or take delivery of Nifty from the buyers. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Stock market crashes in Pakistan after Nawaz Sharif disqualified on Panamagate corruption charges The KSE index tanked points to 45, within minutes of the court verdict. In an efficient market, supply and demand would be expected to balance out at a futures price that represents the present value of an unbiased expectation of the price of the asset at the delivery date. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour.