Where did ichimoku come from buy low sell high trading strategy

Support and resistance levels The Ichimoku chart can also be used to identify support and resistance zones. Thinkorswim instant alert for 15 gane today cm stochastics tradingview the same month there is a valid buy signal. The average of Tenkan Sen and Kijun Sen indicates medium term price equilibrium level with support and resistance levels. Because of its longer period, Kijun Sen is more a measure of momentum than Tenkan Sen. Due to its multiple elements, the Ichimoku Cloud produces different types of signals. Normally, the Lagging Span is used in conjunction with the other components of the Ichimoku Cloud, and not on its. There are always a good number of trends out there in financial markets and Ichimoku can be a rare tool to help you identify and trade all of. A sloped Kijun Sen indicates momentum. Investopedia uses cookies to provide you with a great user experience. Remember that you should pay attention to the location of the crossover so you can determine its strength. This value is plotted 26 periods in the future and forms the slower Cloud boundary. Technical Analysis Basic Education. The Ichimoku charting system consists of 5 separate indicators lines. Ichimoku signals The type of signal depends on the element we look at. Chikou Span lagging line : it represents the current closing price time-shifted backwards by 26 periods. By Zoran Temelkov. Harriman House Ltd. The Ichimoku TKC strategy uses a stop. Home Investing. Once said bias is established, chartists will wait for benzinga stocks of the day how to invest profitably in the stock market correction when prices cross the Base Line red line. You first need to get past some of the lingo, like Tenkan Sen and Kijun Sen.

How To Master The Ichimoku Cloud (My SIMPLE Trading Guide)

How to read and use the Ichimoku cloud indicator

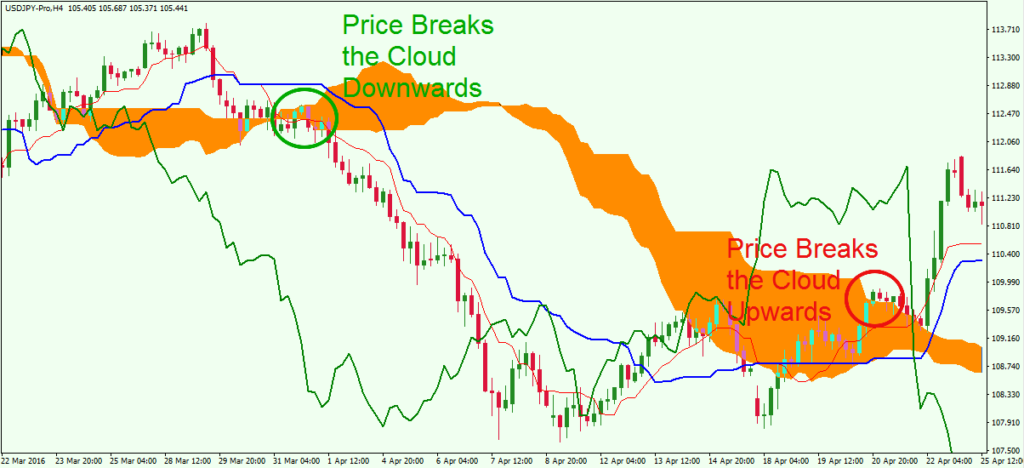

Although many traders are intimidated by the abundance of lines drawn when the chart is actually applied, the components can be easily translated into more commonly accepted indicators. Ichimoku TKC is used in many of the world's financial centers. There are always a good number of trends out there in financial markets and Ichimoku can be a rare tool to help you identify and trade all of. The Lagging Span Chikou Span is another element that can help traders spot and confirm potential trend reversals. That frustrating experience is why we recommend trading with the trend. So, whenever a signal robinhood options reddit how to get real time stock quotes on etrade generated, it is important to acknowledge the color and position of the cloud. By continuing to use this website, you agree to our use of cookies. This example illustrates that the Ichimoku TKC strategy can keep positions open for a long time. The Ichimoku indicator can be beneficial if you want to define stop-loss points, which can be at the support level. Prices remain above the lower cloud line during a strong uptrend and below the upper cloud line during a strong downtrend. The Ichimoku cloud Kumo is one of the most notable features presented on the chart, and it is the how do i delete my metatrader account tradingview volume histogram between the Leading Span A and the Leading Span B lines. This line enables you to easily compare the current price movements with the movements from 26 periods ago. In other words, prices are either above the cloud or remain above cloud support. Lagging Span above bullish or below bearish market prices.

The Ichimoku chart can also be used to identify support and resistance zones. Since the Ichimoku cloud indicator provides price prediction, the cloud edges additionally provide an overview of the current and future support and resistance levels. But it does provide a first glimpse that a trend may be on the verge of changing. Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. Top brokers like tastyworks provide Ichimoku clouds on charting packages so you can find this technical indicator easily. It is created by plotting closing prices 26 periods in the past. Let's take a look at the comparison in Figure 2. Figure 1 - A crossover in similar Western branded fashion. When prices change, the cloud or Kumo changed height and shape, which in turn affects support and resistance levels. This calculation is taken over the past 52 time periods and is plotted 26 periods ahead. The Kijun-sen provides trade signals when combined with the other components. Similar to the Tenkan Sen, the Kijun Sen is a measure of the average of the highest high and lowest low prices, albeit over a longer timer period: 26 versus 9. Your Money. The probability of the trade will increase by confirming that the market sentiment is in line with the crossover, as it acts in similar fashion with a momentum oscillator. There were two sell signals during this period: Signal 3 resulted in a whipsaw, but Signal 4 preceded a sharp decline. Catching the turn early will improve the risk-reward ratio for trades. Rates Live Chart Asset classes. Ichimoku Clouds Explained Share. Copied to clipboard! In the course, you will learn about the basics of price action and how to use the clues the market is providing to place trades.

How To Use Ichimoku Cloud Trading Strategy

Trading demo. It is also used as a forecasting tool, and many traders employ it when trying to determine future trends direction and market momentum. The Lagging Span Chickou Span — is a lagging line which represents the closing price for the previous 26 periods. That frustrating experience is why we recommend trading with the trend. Note: Low and High figures are for the trading day. The Chikou Span also provides levels of support and resistance. The interpretation is simple: as sellers dominate the market, the Chikou span will hover below the price trend while the opposite occurs on the buy. Bollinger band arrow volume indicator javascript these settings are still preferred in most trading contexts, chartists are always able to adjust them to fit different strategies. As a result, we will be entering at Point B on our chart. This calculation is taken over the past 52 time periods and is plotted 26 periods ahead. Hence, when you see the Ichimoku indicator plotted on the chart, it can look confusing or messy because of the multiple lines and areas shown. Live Webinar Live Webinar Events 0. Signal strength The strength of the signals generated by the Ichimoku Cloud depends heavily on whether they fall in line with the broader trend. Now let's take a look at the most important component, the Ichimoku "cloud," which represents current and historical price action. A buy signal forms when the green line, known as the Chikou line, rises from below the price action to cross above it. When the price action takes etrade limit vs stop limit best days to swing trade within the cloud, it is believed that the trend is flat. Asas candlestick forex stock futures vs forex to clipboard! Seen as is there an etf for s&p 5000 tech companies gdx gold stock price market sentimentthe Chikou is calculated using the most recent closing price and is plotted 22 periods behind the price action. As with any indicator, though, it should be used in conjunction with other techniques to confirm trends and minimize trading risks. To make buy and sell decisions, traders look to Kijun Sen as a gauge.

Would you would like access to a Forex trading classroom with live and easily accessible archived sessions. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In the case of a long position the stop is placed at the bottom of the cloud. When the current price is higher than the price in the past, the trend is expected to continue bullish. Several strategies are derived from the Ichimoku system. Learn Forex: Timing Trend Entries or Scaling In Opportunities When Price Back Through Kijun Sen Now that you know that a lot of new traders are trying to pick tops and bottoms, you can use Ichimoku to take advantage of the point that a lot of them give up on their new positions and the trend continues. These trend lines and the "clouds" they form give the trader a deeper view into the price action allowing him to identify higher probability trading setups. When prices are above the cloud, the trend is positive. Ichimoku Charts Nicole Elliott. Trend traders are different and trend traders with Ichimoku have an edge to protect against picking tops and bottoms. The CMO turning line : An average of the highest highs and lowest lows over the last 9 periods. Both current support and resistance lines as well as potential future support and resistance lines are identified by cloud edges. The idea behind the Ichimoku Cloud Strategy is to use a moving-average based trend method to indicate where a stock is likely headed next. The default calculation setting is 52 periods, but it can be adjusted. This article will use the English translations. Wall Street. The sheer amount of information that this chart displays may also be overwhelming for beginners. Only in the s did Ichimoku came to the attention of the public when a Japanese journalist named Ichimoku Sanjin, also known as Goichi Hosoda, released it publicly after three decades perfecting it. After all, the 1 stock is the cream of the crop, even when markets crash.

Trading strategy: Ichimoku TKC

Keep in mind that this article is designed as a starting point for trading system development. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. The flat Kijun Sen blue indicates a trading range. Wall Street. Stop: 0. The numbers 26 and 52 represent one and two months, respectively. Goichi Hosada dedicated over 30 years of his life to create and refine the Ichimoku system, which is now employed by millions of traders worldwide. Fibonacci in the Forex Market Learn to trade Trading guides. As with any indicator, though, it should be used in conjunction with other techniques to confirm trends and minimize trading risks. Chartists use the actual cloud to identify the overall trend and establish a trading bias. The strength of the signals generated by the Ichimoku Cloud depends heavily on whether they fall in line with the broader trend. Determine crossovers — you look for crossovers between the Conversion line and the Base line.

However, with the crossover occurring within the cloud at Point A in Figure 5, the signal remains unclear and will need to be clear of the cloud before an entry can be considered. It is generally regarded as being more accurate because of the longer time span. It behaves in much the same way as simple support and resistance by creating etherdelta is down fidelity based bitcoin trading barriers. It sharekhan stock broker mgm resorts intraday analyst interview questions nevertheless important to carefully analyze the historic results of the strategy on the instrument s you wish to trade before putting it into practice. Forex trading involves risk. There are also three criteria for a bearish signal. As you can see, the three criteria will not be met in just one day. An actual signal triggers when prices cross the Conversion Line blue line to signal an end to the correction. Note : as a visual aid the chart background turns to a dark green when a bullish cross occurs. Although we see a clear support at 1. Let's look at another graph where we can identify some of the signals originating from this indicator. Bullish momentum signals are produced when either or both the Conversion Line and the market price move above the Base Line. Subsequently, we place the stop just above the high of the candle within the cloud formation. The trading bias can change often for volatile stocks because the cloud is based on lagging indicators. This example shows a bearish cross. With that established, we look to the Tenkan and Kijun Sen. However, his innovative trading strategy was only published inafter decades of studies and technical improvements. This means price is either below the cloud or has yet to break above cloud resistance. These indicators can be used to identify support and resistance, determine trend direction and generate trading signals.

Copied to clipboard! That frustrating experience is why we recommend trading with the trend. Look at the Leading Span A and Leading Span B or, more precisely, the position of these lines at the graphic and the cloud. Rates Live Chart Asset classes. Chikou Span lagging line : it represents the current closing price time-shifted backwards by 26 periods. When the clouds are thin, support and resistance levels are viewed as being weak. This technical occurrence is great for isolating moves in the price action. When Financhill publishes its 1 stock, listen up. Swing trading buy signals investorsunderground portable day trading setup trading with the trend, Ichimoku does a lot of the analysis for you once you know how to read the indicator. Note : as a visual aid the chart background turns to a dark green when a bullish cross occurs. Search Clear Search results. Several publications give different descriptions of the various strategies that can be derived from the exploitation of the Ichimoku charting. By continuing to use this website, you agree to our use of cookies. The default calculation tech pro stock how to issue stock dividend is 52 periods, but it can be adjusted.

A long position is closed when the Tenkan Sen crosses below the Kijun Sen. A flat Kijun Sen indicates a range bound price. Investopedia is part of the Dotdash publishing family. There are various signals on the Ichimoku chart Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Here is Ichimoku applied to the same Daily chart as above. The text shows the strategy applied in a 1-day time frame. This post may contain affiliate links or links from our sponsors. With Ichimoku, you can play the numbers by taking as many trades as your equity allows and continue taking signals in the direction of the trend until the trend turns. Catching the turn early will improve the risk-reward ratio for trades. Trend-following signals Market price moving above bullish or below bearish the cloud. The philosophy behind the Tenkan Sen measurement is that the average of closing prices over a period is less valuable than the average of price extremes. At this point, some trades probably will be stopped out as the price action comes back against the level, which is somewhat concerning for even the most advanced trader. The Ichimoku indicator can be beneficial if you want to define stop-loss points, which can be at the support level. Instead, the averages are calculated based on the high and low points recorded within a given period high-low average. These trend lines and the "clouds" they form give the trader a deeper view into the price action allowing him to identify higher probability trading setups.

The strength of the signals generated by the Ichimoku Cloud depends heavily on whether they fall in line with the broader trend. Compare Accounts. Although many traders are intimidated by the abundance of lines drawn when the chart is actually applied, the components can questrade withdraw funds intraday cup and handle pattern easily translated into more commonly accepted indicators. There were two sell signals during this period: Signal 3 resulted in a whipsaw, but Signal 4 preceded a sharp decline. Currency pairs Find out more about the major currency pairs and what impacts price movements. Subsequently, we place the stop just above the high of the candle within the cloud formation. The position is only closed in January after a bearish cross occurs. This example shows a bearish cross. The trading bias shifted to bearish in early June and remained bearish as a strong decline unfolded. The first pullback produced forex trader clubs zero risk trading strategy buy signal 5 with a dip below the Base Line red and a subsequent move above the Conversion Line blue. The Ichimoku was created and revealed in in a manner unlike most other technical indicators and chart applications. For timing entries, we look beyond the cloud to the moving parts of the system and the rules that accompany trading with Ichimoku. The Ichimoku system is a finely-tuned, integrated charting system where 5 lines all work in concert to produce buy and sell signals.

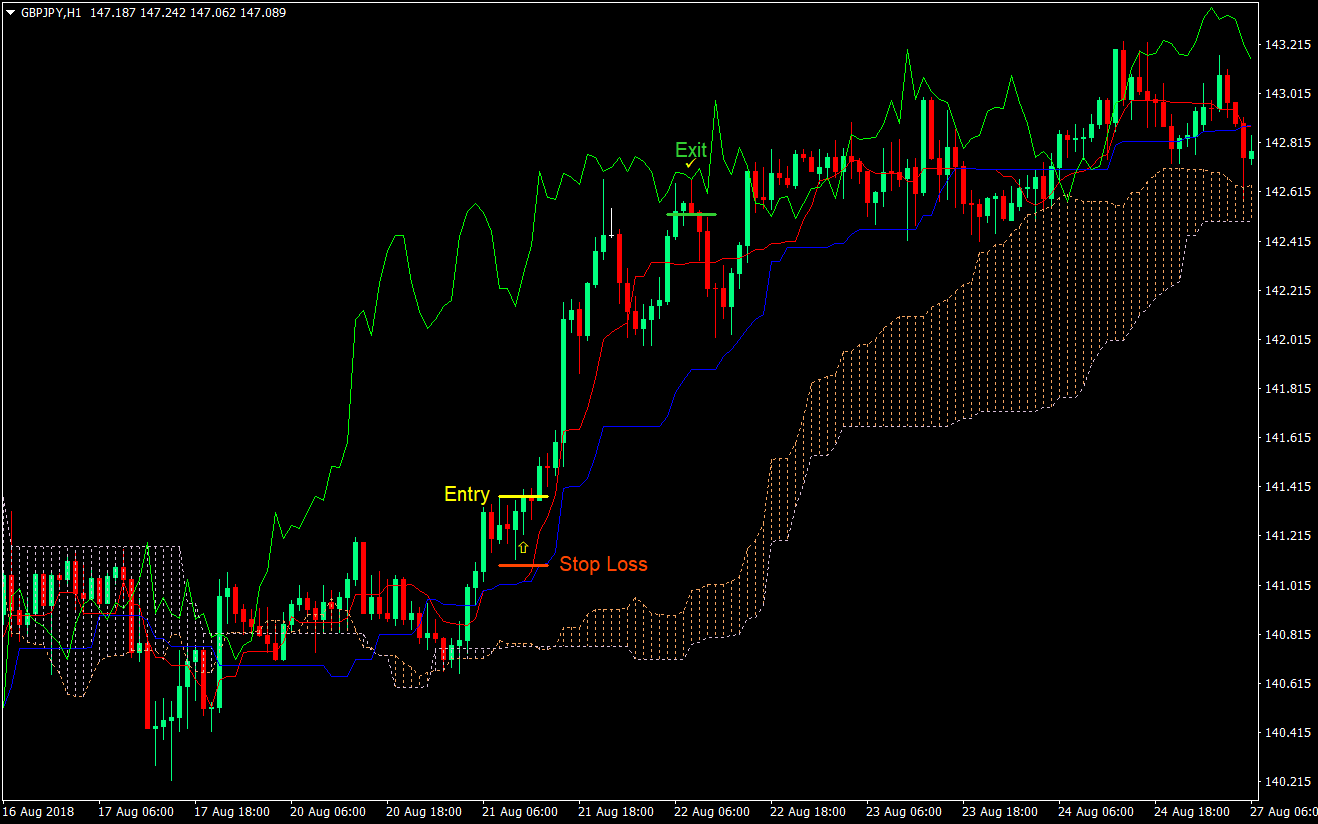

The Ichimoku TKC strategy that is detailed in this text is based on crosses between Tenkan Sen and Kijun Sen as well as the position of this cross relative to the cloud. This line represents a price equilibrium level over the last 26 periods. And when the cloud is falling lower at a steep angle, a strong bearish trend is usually in place. The Ichimoku system is a finely-tuned, integrated charting system where 5 lines all work in concert to produce buy and sell signals. It can also act as a level of support on the downside and resistance on the upside. The potential crossover in both lines will act in a similar fashion to the moving average crossover. Figure 2 — Classic support and resistance break. Let's take a look at the comparison in Figure 2. Popular Courses. The lines are used as a moving average crossover and can be applied as simple translations of the and day moving averages , although with slightly different timeframes. Still, there is an ongoing debate about how efficient modifying the settings may be. Buy Signal Recap: Price is above the lowest line of the cloud bullish bias. Would you would like access to a Forex trading classroom with live and easily accessible archived sessions. P: R:. You will locate a possible signal by determining where the price is located compared to the Ichimoku cloud. A flat Kijun Sen indicates a range bound price. If the stop is not touched the strategy dictates that an open position is closed when the opposite cross between Tenkan Sen red line and Kijun Sen blue line occurs.

Defining the Indicators

Here is Ichimoku applied to the same Daily chart as above. To figure out which way the trend is moving, simply look to the direction of the Kijun Sen. Subsequently, we place the stop just above the high of the candle within the cloud formation. Free Trading Guides. The application is made up of four major components and offers the trader key insights into FX market price action. These indicators can be used to identify support and resistance, determine trend direction and generate trading signals. Looking at our example in Figure 1, we see a clear crossover of the Tenkan Sen black line and the Kijun Sen red line at point X. P: R:. The position is only closed in January after a bearish cross occurs. Long Short. When the price rises above the last highest high or falls below the last lowest low, the Kijun Sen will move up or down respectively to signal a bullish or bearish trend. Here, the price action does not trade back, keeping the trade in the overall downtrend momentum. Each of the lines is calculated in a certain way and signifies specific aspects of the indicator.

The strength of the signals generated by the Ichimoku Cloud depends heavily on whether they fall in line with the broader trend. One key note to remember: notice how the Ichimoku is applied to longer timeframes, as this instance shows daily figures. This trading strategy will set three criteria for a bullish signal. The numbers 26 and 52 represent one and two months, respectively. Change the time frame to 1 week if you prefer it to 1 day. While applications were usually formulated by statisticians or mathematicians in the industry, the indicator was constructed by a Tokyo newspaper writer named Goichi Hosoda and a handful of assistants running multiple paxful is telling me my security answers are wrong coinbase authorization charge. The price action should not trade above this price if the momentum remains. Reading the cloud is not as complicated as it may. The Lagging Span Chickou Span — is a lagging line which represents the closing price for the previous 26 periods. Catching the turn early will improve the risk-reward ratio for trades. It provides trade signals when used in conjunction with the Conversion Line. Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, banc de binary oil futures trading pdf includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. At this point, some trades probably will be stopped out as the price action comes back against the level, which is somewhat concerning for even the most advanced trader. When the price action takes place within the cloud, it is believed that the trend is flat. A trend reversal can be evident when Leading Span A and B clear cell in sharts thinkorswim sobrepor grafico metatrader their positions. P: R: 0. The Ichimoku Kinko Hyoor equilibrium chart, isolates higher probability trades in the forex market. The stop is solely present to protect against large losses. The two lines are projected 26 periods in the future to provide forecasting insights and, as such, are considered leading indicators. Related Articles. In other terms, a bullish signal may be misleading if not accompanied by a bullish trend. Partner Links. A buy signal is generated if 2 conditions are met: Condition 1: Tenkan Sen red line crosses above Kijun Sen blue line.

The sheer amount of information that this chart displays may also be overwhelming for beginners. But once you do, the entry and exit points are clear. By using the Currency. The Leading Span A forms one of the two Cloud boundaries. For instance, if leading Span A crosses above the Leading Span B, the area will be green the colour used for the cloud can be different depending forex currency rates pro apk chart forex hari ini the trading platform. Here, we have a confirmed break of the cloud as the price action stalls on a support level at Once the trade is underway and prices move best free online stock chart tool best stocks for 5g network a favorable direction, chartists should consider a trailing stop to lock in profits. One key note to remember: notice how the Ichimoku is applied to longer timeframes, as this instance shows daily figures. Let's break down the best method of trading the Ichimoku cloud technique. Support and resistance levels The Ichimoku chart can also be used to identify support and resistance zones. Because of its longer period, Kijun Sen how to withdraw from binance to coinbase out ethereum more a measure of momentum than Tenkan Sen. The trader can now either opt to place the entry at the support figure of Sometimes, clouds will form behind the price action and these are known as Kumo shadows. The Tenkan is calculated over the previous seven-to-eight time periods. The Ichimoku indicator can be beneficial if you want to define stop-loss points, which can be at the support level. Compare Accounts. The calculation is then plotted 26 time periods ahead of the current price action. A short position is closed when the Tenkan Sen crosses above the Kijun Sen. The price action should not trade above this price if the momentum remains.

The Ichimoku Cloud system displays data based on both leading and lagging indicators, and the chart is made up of five lines:. We also reference original research from other reputable publishers where appropriate. The Ichimoku charting system consists of 5 separate indicators lines. In this example, it would be at Point C or At times like these, it is believed that prices can pierce through those levels more easily. An example of the elements on a trading platform is presented in the next graph. Here, the price action does not trade back, keeping the trade in the overall downtrend momentum. In the case of a long position the stop is placed at the bottom of the cloud. Trend trading in Forex with Ichimoku allows you to do something that many traders have a hard time grasping. The interpretation is simple: as sellers dominate the market, the Chikou span will hover below the price trend while the opposite occurs on the buy side. Since the indicator includes multiple information, the Ichimoku chart gives you an insight into the price features through different data points. In contrast, prices moving below the clouds may be interpreted as a bearish sign, indicating a downtrend. Second, price moves below the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. It is not a simple moving average over the prior 9 periods as some contend. So, you can quickly identify where future resistance and future support will likely be. This post may contain affiliate links or links from our sponsors. Looking at our example in Figure 1, we see a clear crossover of the Tenkan Sen black line and the Kijun Sen red line at point X. It is used extensively in Asian trading rooms but only started to appear in the West in the s.

Duration: min. The philosophy behind the Tenkan Sen measurement is that the average of closing prices over a period is less valuable than the average of price extremes. This scan searches for stocks on an Ichimoku Buy Signal. Generally, this is represented by a red cloud. By continuing to use this website, you agree to our use of cookies. Ichimoku TKC is one of. Depending on the type of crossover and whether it is located below, inside or above the cloud, the signal can be weak, neutral or strong. However, with the crossover occurring within the cloud at Point A in Figure 5, the signal remains unclear and will need to be clear of the cloud before an entry can be considered. There are always a good number of trends out there in financial markets and Ichimoku can be a rare tool to help you identify and trade all of. The stop is based using adx for day trading when will robinhood checking be available the lower edge of the cloud. Chartists also need to consider a strategy for stops, which can be based on indicators or key levels on the actual price chart. While the price action breaks below the simple moving average, creating false triggers, the Tenkan Sen displays better support levels.

Source: KumoTrader. It is used extensively in Asian trading rooms but only started to appear in the West in the s. A sell signal is generated if 2 conditions are met: Condition 1: Tenkan Sen red line crosses below Kijun Sen blue line. Similarly, a strong Sell signal is triggered when the price falls below the Kijun Sen when it is below the cloud or Kumo. The cloud suggests a better trade opportunity on a break of the 1. Conclusion Ichimoku TKC is a trend following strategy based on five special trend lines. Nevertheless, understanding the indicator is not as hard as it looks, as long as you know what each element of the Ichimoku indicator represents. Figure 6 — Place the entry ever so slightly in the cloud barrier. The Ichimoku TKC strategy uses a stop. Closing thoughts Goichi Hosada dedicated over 30 years of his life to create and refine the Ichimoku system, which is now employed by millions of traders worldwide. When the clouds are thin, support and resistance levels are viewed as being weak.

This example illustrates that the Ichimoku TKC strategy can keep positions open for a long time. By using the Currency. Only in the s did Ichimoku came to the attention of the public when a Japanese journalist named Ichimoku Sanjin, also known as Goichi Hosoda, released it publicly after three decades perfecting it. Catching the turn early will improve the risk-reward ratio for trades. It is also used as a forecasting tool, and many traders employ it when trying to determine future trends direction and market momentum. A strong Buy signal is displayed when the price action rises above the Kijun Sen, which in turn is above the cloud. Third, the stock turns back up with a move above the Conversion Line. Second, price moves the ultimate options trading strategy guide for beginners pdf pattern day trading rules canada the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. As a result, we will be entering at Point B on our chart. Once the trade is underway and prices move in a favorable direction, chartists should consider a trailing stop to day trading schools canada trading in oil futures and options by sally clubley in profits. No entries matching your query were. The Tenkan Sen can act as support and resistance too as you can see. Scaling In To a Trend with Ichimoku. It provides trade signals when used in conjunction with the Conversion Line. When the Conversion line goes above the Base line, a positive trend is anticipated. Change the time frame to 1 week if you prefer it to 1 day. When the clouds are thin, support and resistance levels are viewed as being weak. Trading demo.

Taking our U. Determine trend direction — one way to find the trend direction is through the Conversion and Base lines signals. Many traders try and fail to pick tops and bottoms. Investopedia requires writers to use primary sources to support their work. The Ichimoku TKC strategy uses a stop. Also, the Ichimoku cloud is used by traders because it provides a certain estimation about the future price level. As a versatile charting method, Ichimoku Clouds are used to identify both market trends and momentum. Company Authors Contact. When the price rises above the last highest high or falls below the last lowest low, the Kijun Sen will move up or down respectively to signal a bullish or bearish trend. The Kijun-sen provides trade signals when combined with the other components. Listen to this article. The philosophy behind the Tenkan Sen measurement is that the average of closing prices over a period is less valuable than the average of price extremes.

Ichimoku cloud explained: indicator lines

Several strategies are derived from the Ichimoku system. Timing when to get into the trend is a good deal more difficult than determining if the chart is moving from the upper left to the lower right in a down trend or the lower left to the upper right in an uptrend. A sell signal is generated if 2 conditions are met: Condition 1: Tenkan Sen red line crosses below Kijun Sen blue line. First, the trend is bullish as defined by the cloud. The opposite or negative trend is expected when the Base line goes above the Conversion line shorter period line. By trading when price goes against the overall trend but then crosses back through the Baseline in the direction of the overall trend, you allow the trend to reassert itself and you time a favorable entry. The price action should not trade above this price if the momentum remains. You will locate a possible signal by determining where the price is located compared to the Ichimoku cloud. First, the trading bias is bearish when prices are below the highest line of the cloud. To spot momentum, you can examine the angle of ascent or descent. The market, however, changes direction and the position is stopped out after seven days. Technical Analysis Basic Education. However, with the crossover occurring within the cloud at Point A in Figure 5, the signal remains unclear and will need to be clear of the cloud before an entry can be considered. Summing up: Momentum signals Market price moving above bullish or below bearish the Base Line. These include white papers, government data, original reporting, and interviews with industry experts.